Analysis

August 17, 2023

Lead Times Mostly Steady on Sheet, Shorten on Plate

Written by Laura Miller

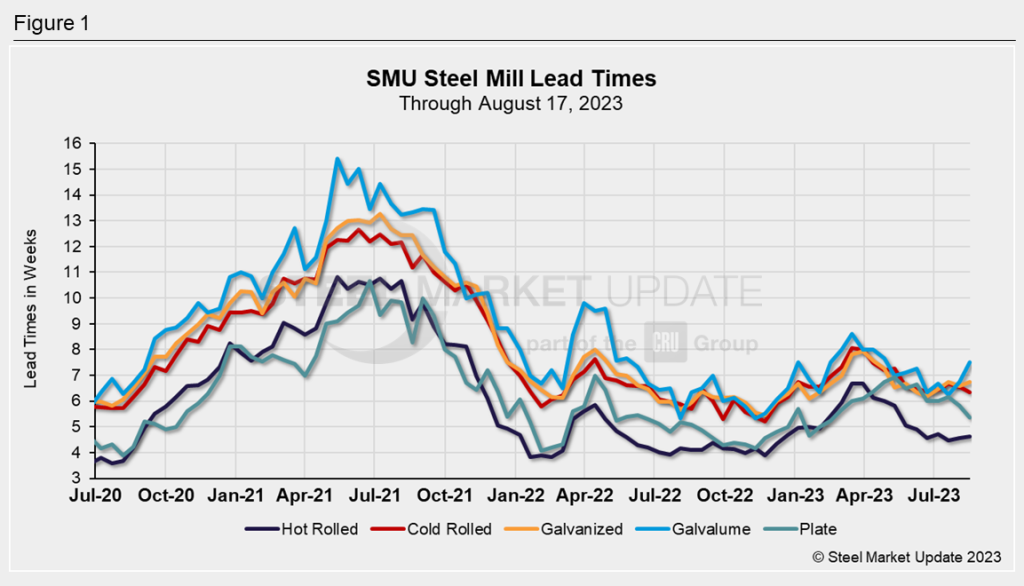

Mill lead times for most sheet products this week were basically flat compared to SMU’s market check two weeks ago. Those for plate shortened once again.

Steel buyers this week reported lead times for hot-rolled sheet ranging from 3 to 7 weeks. This week’s average of 4.64 weeks was little changed from the 4.58 weeks reported in the last market check two weeks earlier. HR lead times have remained below the 5-week threshold since the beginning of June.

For cold-rolled sheet, the range of lead times considered was 5 to 8 weeks with an average of 6.35 weeks. A decrease of 0.19 weeks from two weeks prior, CR lead times are now comparable to those of the week of June 22.

Galvanized sheet lead times were reported from 5 to 9 weeks. This week’s average of 6.73 weeks is just 0.13 weeks longer than two weeks ago and is comparable to those a month ago.

Galvalume lead times ranged from 6 to 8 in this week’s check of the market. The average of 7.50 weeks is 0.75 weeks longer than two weeks ago, and represents the longest lead time for Galvalume since the end of April.

Lead times for plate saw a modest decline of 0.44 weeks from two weeks prior to their shortest level since February. This week’s average plate lead time was 5.36 weeks with a range reported of 4 to 7 weeks. As lead times shorten for plate, the rate at which mills are willing to negotiate price is increasing.

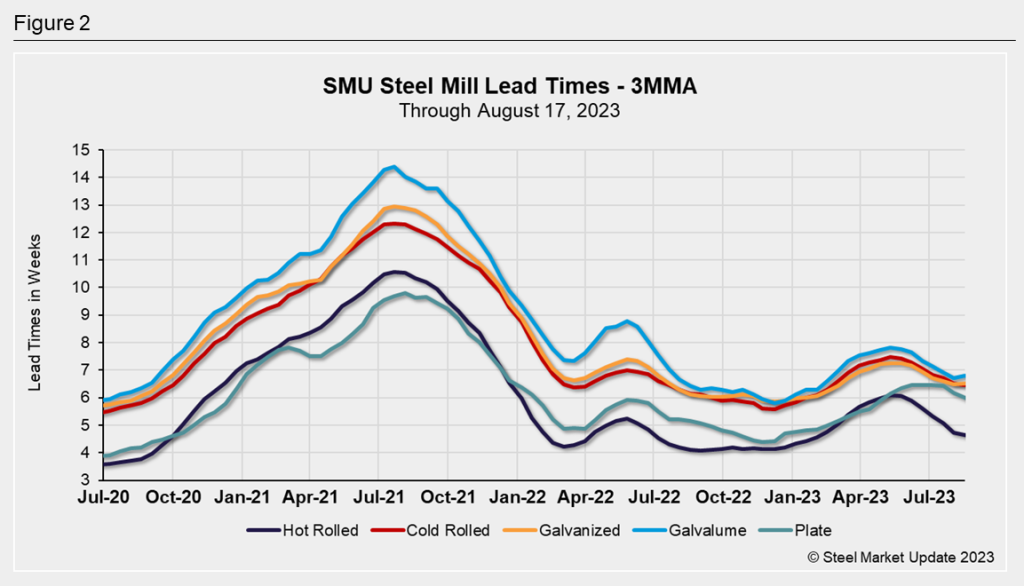

We can look at lead times on a three-month moving average (3MMA) basis to smooth out the variability in SMU’s biweekly readings.

The 3MMA of HR lead times has been declining since early May. The average ticked down to 4.6 weeks this week.

The 3MMA of CR and galvanized lead times remains at 6.5 weeks for both products.

Galvalume’s 3MMA lead time was the sole product to tick up slightly this week. Now at 6.8 weeks, the 3MMA has been below 7 weeks since early July.

This week’s 3MMA for plate lead times dropped to 6.0 weeks, the shortest it’s been since the end of April.

SMU is aware of several upcoming mill outages, but they are “scattered and generally limited,” points out CRU’s principal analyst Josh Spoores.

“If you think about lead times, HR coil is near the end of September while CR and HDG coil are early to mid-October,” Spoores said.

“In other words, [lead times] are already past some of the outages. If these outages matter, we should see lead times start to expand now. Inventory data did show a rise of material on order, even as inventories picked up. Likely any orders for outages were already made,” he commented to SMU.

SMU Survey Results

Nearly 72% of steel buyers polled this week believe lead times will be flat two months from now. That’s up from 68.6% of buyers two weeks ago.

A buyer at an OEM noted that while they are predicting flat lead times two months out, “that still means pretty darn short.”

One service center buyer predicts extending lead times, as “mills will force lead times out to limit supply.”

One trader believes “limited imports and supply constraints will push out lead times.”

Another trader predicting contracted lead times two months from now commented that “we haven’t hit the hope springs eternal point when lead times reach February.”