Plate

August 15, 2023

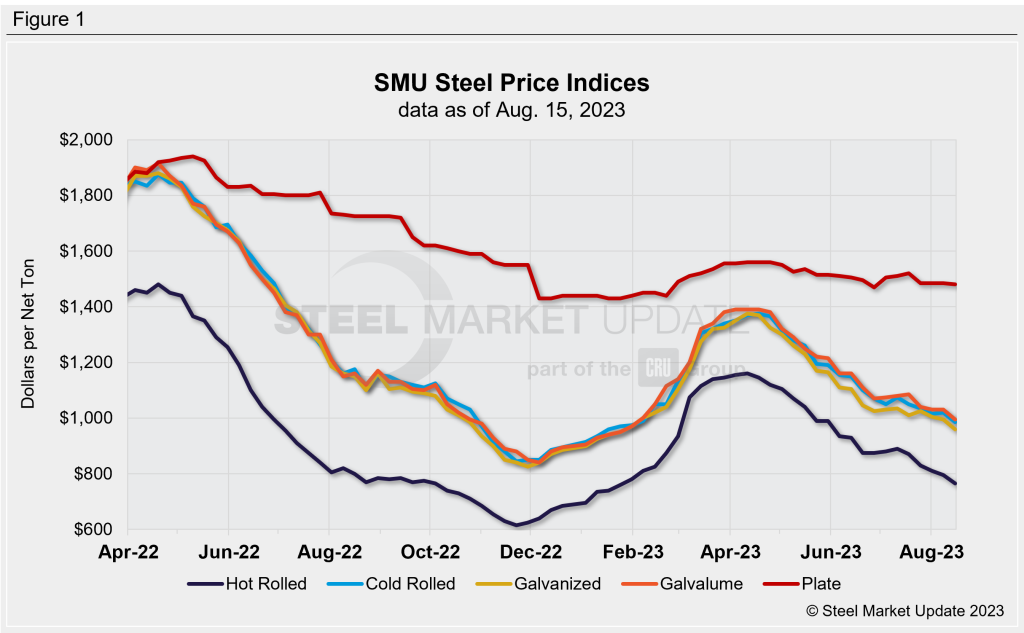

SMU Price Ranges: Sheet Price Slide Continues, Plate Steady

Written by David Schollaert & Michael Cowden

Sheet prices slipped again, continuing a trend of lower week-over-week tags that began in mid-July.

SMU’s average hot-rolled coil price now stands at $765 per ton ($38.25 per cwt), down $30 per ton from last week and down $125 per from a month ago.

HRC prices remain at levels last seen in late January before a series of near-weekly mill price hikes in February sent tags soaring to nearly $1,160 per ton in March.

Cold-rolled and coated prices fell roughly in tandem with HRC. Average base prices for cold-rolled, galvanized, and Galvalume have all dropped below $1,000 per ton over the last week.

Plate prices were little changed, down only $5 per ton.

When it comes to sheet, market participants described a tug-of-war between several big factors.

Weighing on sheet prices is the possibility of a United Auto Workers strike ahead of the union’s current labor contract with automakers expiring at 11:59 pm on Sept. 14 – about a month from now.

That has kept some buyers on the sidelines or buying only as needed. Also, our latest inventory data also shows that service center inventories have moved higher.

Supporting prices is a potential wave of fall maintenance outages.

Our sheet price momentum indicators continue to point lower. Our plate price momentum indicator remains at neutral.

Hot-Rolled Coil

The SMU price range is $730–800 per net ton ($36.50–40.00 per cwt), with an average of $765 per ton ($38.25 per cwt) FOB mill, east of the Rockies. The bottom end and the top end of our range were down $30 per ton vs. one week ago. Our overall average is also down $30 per ton WoW. Our price momentum indicator for hot-rolled coil is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Hot-Rolled Lead Times: 3–6 week

Cold-Rolled Coil

The SMU price range is $920–1,050 per net ton ($46.00–52.50 per cwt), with an average of $985 per ton ($49.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $60 per ton week-on-week (WoW), while the top end was down $10 per ton compared to a week ago. Our overall average is down $35 per ton WoW. Our price momentum indicator on cold-rolled coil is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Cold-Rolled Lead Times: 5–8 weeks

Galvanized Coil

The SMU price range is $920–1,000 per net ton ($46.00–50.00 per cwt), with an average of $960 per ton ($48.00 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $30 per ton vs. last week, while the top end of our range was also down $40 per ton vs. one week ago. Our overall average is $35 per ton lower vs. the prior week. Our price momentum indicator on galvanized steel is pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,017–1,097 per ton with an average of $1,057 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil

The SMU price range is $950–1,040 per net ton ($47.50–52.00 per cwt), with an average of $995 per ton ($49.75 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $50 per ton vs. last week, while the top end of the range was $20 per ton lower WoW. Our overall average was down $35 per ton compared to one week ago. Our price momentum indicator on Galvalume steel is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,244–1,334 per ton with an average of $1,289 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks

Plate

The SMU price range is $1,390–1,570 per net ton ($69.50–78.50 per cwt), with an average of $1,480 per ton ($74.00 per cwt) FOB mill. The lower end of our range was down $10 per ton compared to the week prior, while the top end of our range were unchanged vs. last week. Our overall average is down $5 per ton WoW. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 3–8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert