Mexico

July 25, 2023

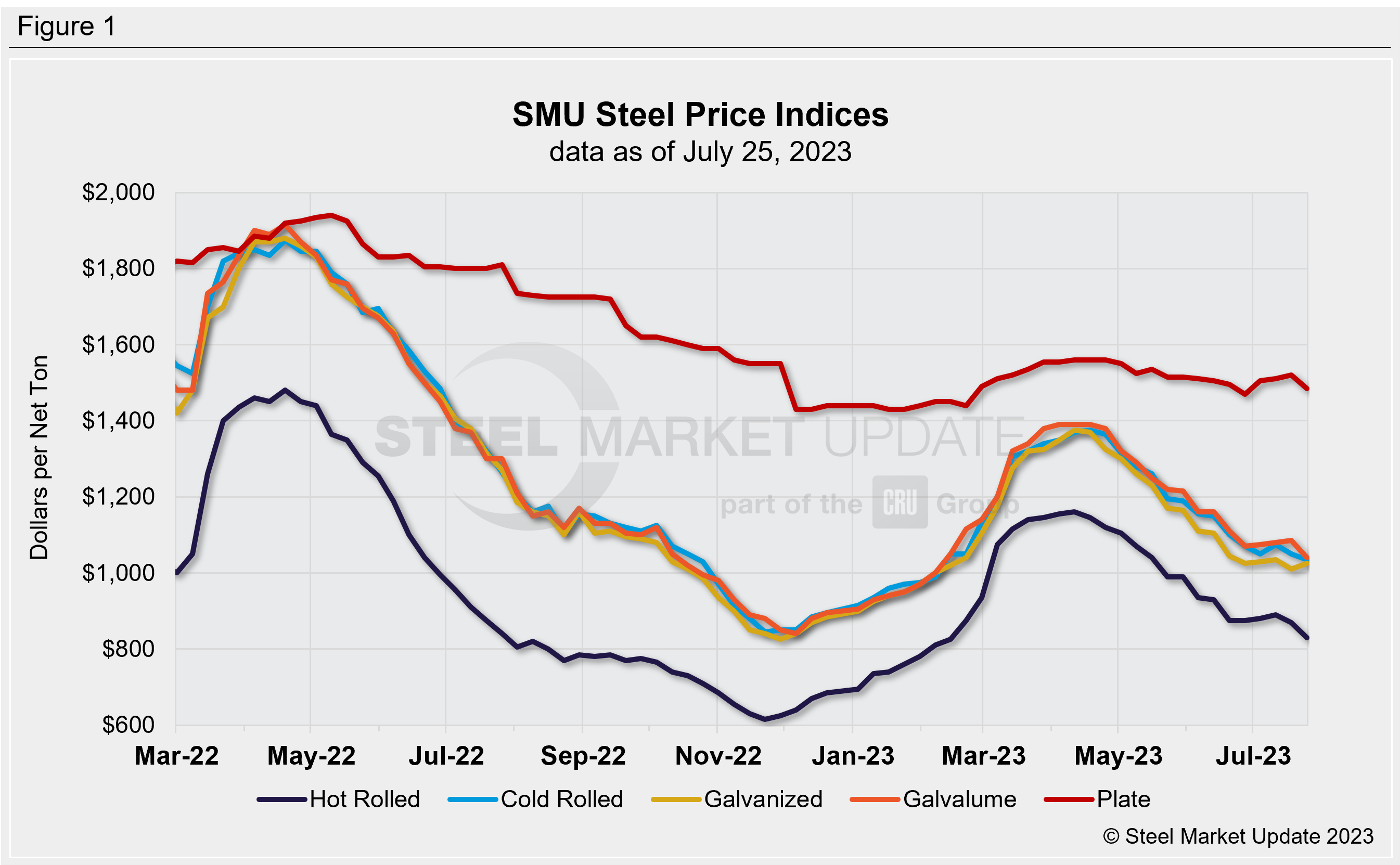

SMU Price Ranges: HRC Falls Again on Sub-$800 Deals

Written by Michael Cowden

Hot-rolled coil (HRC) prices fell for a second consecutive week as mills appear to have given up holding the line on $900 per ton ($45 per cwt) and amid discounting into the high $700s per ton.

SMU’s average HRC price now stands at $830 per ton, down $40 per ton from a week ago and marking the lowest point for hot band prices since early/mid-February.

Recall February saw a series of near-weekly sheet price hikes drive tags sharply higher. Those increases were supported in part by AHMSA stopping production and by a raft of spring maintenance outages among US mills.

Now, as far as we are aware, there is no raft of upcoming outages to ratchet back supplies. AHMSA being out is no longer a surprise. And the unplanned outage at SDI Sinton seems to have been shorter than some expected.

Prices for other products also fell. Cold rolled slipped $15 per ton, Galvalume dropped $45 per ton, and plate lost $30 per ton. Galvanized prices, in contrast, bucked the overall trend, rising by $15 per ton.

SMU has adjusted its sheet momentum indicators to lower on consecutive weekly declines and because of discounting among some mills. Our plate momentum indicator remains at neutral.

Hot-Rolled Coil: The SMU price range is $780–880 per net ton ($39.00–44.00 per cwt), with an average of $830 per ton ($41.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range fell $60 per ton vs. one week ago, while the top end was down $20 per ton week on week (WoW). Our overall average is down $40 per ton WoW. Our price momentum indicator for hot-rolled coil moved from neutral to lower, meaning SMU expects prices will decline more over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: The SMU price range is $970–1,100 per net ton ($48.50–55.00 per cwt), with an average of $1,035 per ton ($51.75 per cwt) FOB mill, east of the Rockies. The lower end of our range moved lower by $40 per ton WoW, while the top end was down $10 per ton compared to a week ago. Our overall average is down $25 per ton WoW. Our price momentum indicator on cold-rolled coil moved from neutral to lower, meaning SMU expects prices will decline more over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $1,000–1,050 per net ton ($50.000–52.50 per cwt), with an average of $1,025 per ton ($51.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $30 per ton vs. last week, while the top end of our range was unchanged vs. one week ago. Our overall average is up $15 per ton vs. the prior week. Our price momentum indicator on galvanized steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvanized .060” G90 Benchmark: SMU price range is $1,097–1,147 per ton with an average of $1,122 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–10 weeks

Galvalume Coil: The SMU price range is $1,020–1,160 per net ton ($51.00–53.00 per cwt), with an average of $1,040 per ton ($52.00 per cwt) FOB mill, east of the Rockies. The lower end of the range edged higher by $10 per ton vs. last week, while the top end moved down by $100 per ton WoW. Our overall average decreased by $45 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel moved from neutral to lower, meaning SMU expects prices will decline more over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,314–1,354 per ton with an average of $1,334 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks

Plate: The SMU price range is $1,400–1,570 per net ton ($70.00–78.50 per cwt), with an average of $1,485 per ton ($74.25 per cwt) FOB mill. The lower end of our range was down $70 per ton compared to the prior week, while the top end of our range was unchanged WoW. Our overall average was down $35 per ton vs. the prior week. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 4–9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com