Analysis

May 11, 2023

Final Thoughts

Written by Michael Cowden

I wrote on Tuesday that we’ve been seeing hot-rolled coil prices fall approximately $20-25 per ton per week since last month.

I’ve heard anecdotally from some of you that those declines are accelerating, and that they’ll only pick up speed as more mills open July books.

Others say that HRC prices could prove stickier than many buyers might assume. Some said that new capacity ramps continued to move slowly and others that a Q3 restart at AHMSA might not be a sure thing.

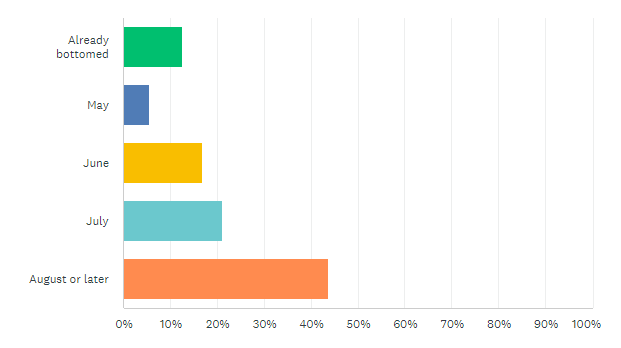

When, how quickly, and where might prices bottom? I don’t have a crystal ball, so I’ll share some preliminary results from our latest steel market survey. We’ll release final data and full survey results on Friday afternoon.

As it stands now, most survey respondents, nearly 65%, think prices will bottom in July, August, or later.

Here is what some of them had to say:

“We will see incremental decreases over the next 30-60 days and hit a low sometime in August.”

“It’ll be a pretty steady slide of $15-20/ton per week for a while. Maybe we bottom in the late summer?”

“The descent will begin in later July and continue through the end of November.”

“Futures are dragging downward, and there are no announcements from mills … to artificially boost prices.”

“I predict a long, slow ride down as the economy cools.”

“Most of the commodities have already started declining, and the steel market usually lags two months.”

“Offshore cost is 25% lower than domestic US, and demand is slowing with supply increasing.”

“There will be a slow and steady slide back to ‘normal’ pricing.”

In short, the consensus is that prices will continue to fall over the next two months. But a significant minority of survey respondents, about 20%, predict that prices have already bottomed or will so later this month.

Said one respondent in that camp: “Demand is picking up in a few key sectors of the industry. Even though scrap continues to drop, there is light at the end of the tunnel for price leveling.”

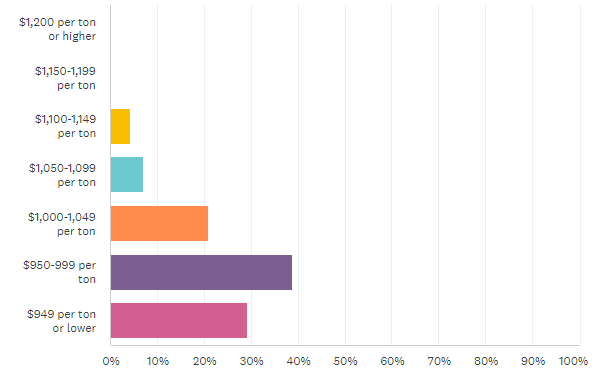

So where prices will bottom? Again, I don’t have a crystal ball, so I’m relying on the collective wisdom of our survey respondents.

We asked people where they thought hot-rolled coil prices would be two months from now. Preliminary results are below.

No one thinks $1,150-1,200 per ton is in the cards anymore for HRC. Nearly 40% think prices will fall to $950-990 per ton. (Recall that we’re at $1,070 per ton now.) Another ~30% think prices will go even lower than that.

Why do people think HRC prices will move below $1,000 per ton this summer?

“Raw materials costs will remain lower and drag down prices.”

“I just paid $900.”

“Lagging demand and supply improvements are leading to a lack of discipline.”

“Supply will be outpacing demand, and mills will be aggressive to get orders.”

“We’ll be sub-$1,000/ton in June and then maybe sub-$900/ton. We’re expecting steady drops heading into the summer.”

Some, however, said the decline in prices was not indicative of a decline in demand.

“Expect a slow, deflationary period. But industrial sector demand is supporting capacity.”

And, again, not everyone agrees that HRC prices will fall sharply lower:

“Prices will move lower slower than buyers are expecting.”

“I don’t feel the mills will give this market up so quickly.”

“Demand is good enough to keep prices from tanking. However, if the mills unleash output, the story will change.”

“End-user demand is fundamentally good, and inventories are not high.”

I’ll be curious to see how it all plays out over the next two months. In the meantime, thanks to all of you from all of us at SMU for your continued business.

SMU Community Chat

Don’t miss our next Community Chat with Flack Global Metals and Flack Metal Bank founder and CEO Jeremy Flack. It will be on Wednesday, May 17, at 11 am ET. You can find out more and register here.

PS – Want to participate in our survey? Contact us at info@steelmarketupdate.com. Don’t just read the data, see your company’s experience reflected in it!

By Michael Cowden, michael@steelmarketupdate.com