Prices

April 25, 2023

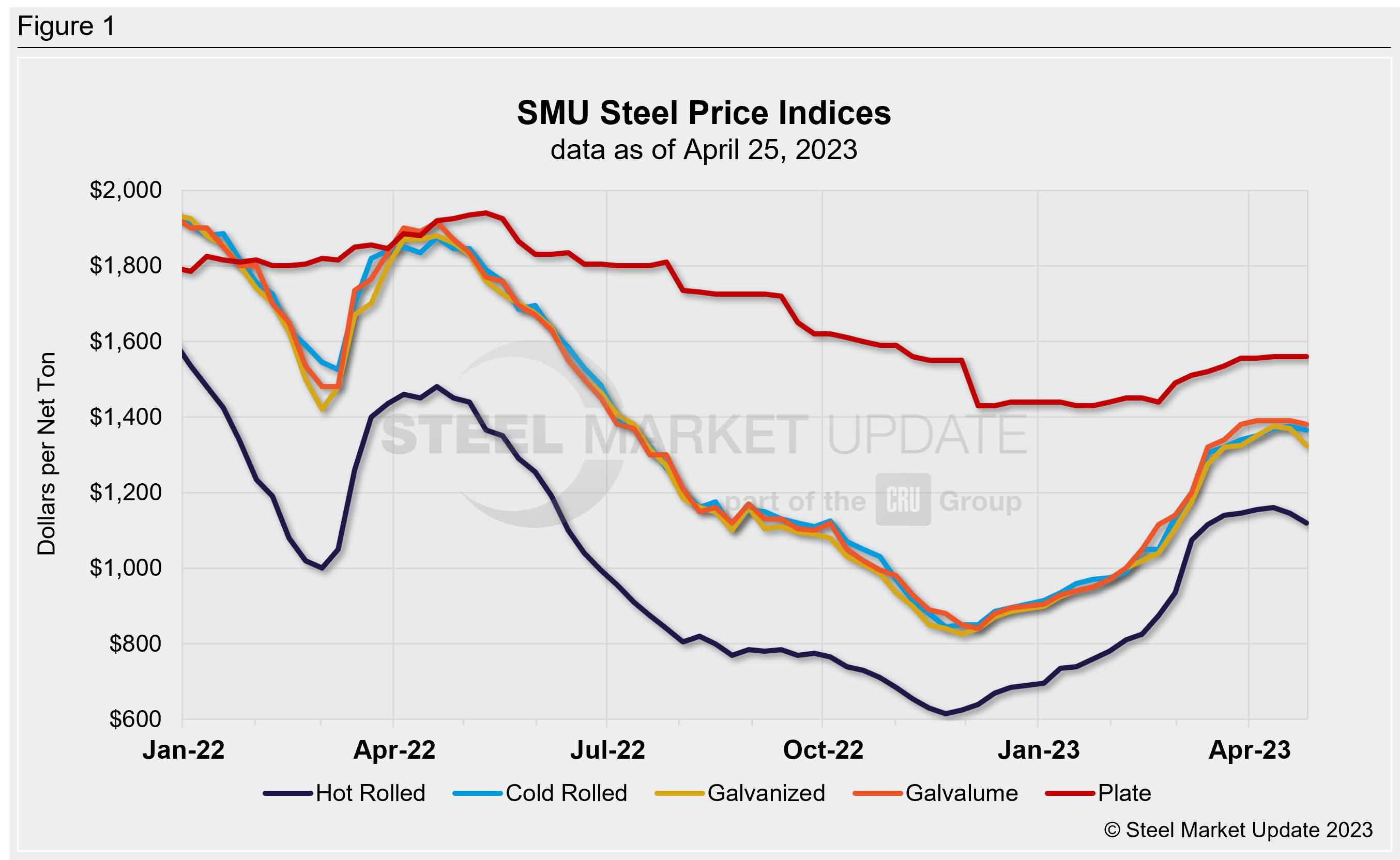

SMU Price Ranges: Sheet Price Slide Picks Up Steam

Written by Michael Cowden

Sheet prices fell across the board this week on the heels of shorter lead times, higher-than-anticipated inventory levels, and potential import competition.

Some market participants predicted that further declines would be “managed” by a more consolidated flat-rolled steel industry. Others said they feared that prices could come down quickly given how sharply they rose in the first quarter.

SMU hot-rolled coil price now stands at $1,120 per ton ($56 per cwt), down $25 per ton from $1,145 per ton last week and off $40 per ton from $1,160 per ton two weeks ago.

We haven’t recorded consecutive declines since before Thanksgiving, which was before the current price upcycle got underway.

Prices for value-added products also slipped with cold rolled down $10 per ton, galvanized down $45 per ton, and Galvalume down $10 per ton.

Plate bucked the trend and was flat as the market waited for the dust to settle on a $40-per-ton Nucor price hike last week.

SMU has adjusted its sheet price momentum indicators to downward from neutral. Our plate momentum indicators remain pointed upward. Note that plate inventories, unlike those for sheet, remain tight.

Hot-Rolled Coil: The SMU price range is $1,080–1,160 per net ton ($54.00–58.00/cwt), with an average of $1,120 per ton ($56.00/cwt) FOB mill, east of the Rockies. The bottom end of our range decreased by $20 per ton vs. one week ago, while the top end was down $30 per ton week on week (WoW). Our overall average is down $25 per ton WoW. Our price momentum indicator for hot-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Hot-Rolled Lead Times: 4–8 weeks

Cold-Rolled Coil: The SMU price range is $1,350–1,380 per net ton ($67.50–69.00/cwt), with an average of $1,365 per ton ($68.25/cwt) FOB mill, east of the Rockies. The lower end of our range was down by $10 per ton, while the top end also declined $10 per ton compared to a week ago. Our overall average is down $10 per ton WoW. Our price momentum indicator on cold-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Cold-Rolled Lead Times: 6–10 weeks

Galvanized Coil: The SMU price range is $1,290–1,360 per net ton ($64.50–68.00/cwt), with an average of $1,325 per ton ($66.25/cwt) FOB mill, east of the Rockies. The lower end of our range was down by $60 per ton WoW, while the top end was down $30 per ton vs. one week ago. Our overall average is down $45 per ton vs. the prior week. Our price momentum indicator on galvanized steel points downward, meaning we expect the market will be down over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,387–1,457 per ton with an average of $1,422 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–10 weeks

Galvalume Coil: The SMU price range is $1,360–1,400 per net ton ($68.00-70.00/cwt), with an average of $1,380 per ton ($69.00/cwt) FOB mill, east of the Rockies. The lower end of the range was up $20 per ton WoW, while the top end of the range was down $40 per ton vs. the week prior. Our overall average is down $10 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel now points downward, meaning we expect the market will be down over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,654–1,694 per ton with an average of $1,674 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8–10 weeks

Plate: The SMU price range is $1,530–1,590 per net ton ($76.50–79.50/cwt), with an average of $1,560 per ton ($78.00/cwt) FOB mill. The lower end of our range and the top end of our range were unchanged compared to the prior week. Our overall average, as a result, is sideways WoW. Our price momentum indicator on steel plate is still pointing higher, meaning we expect prices to increase over the next 30 days.

Plate Lead Times: 5–10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com