Prices

April 18, 2023

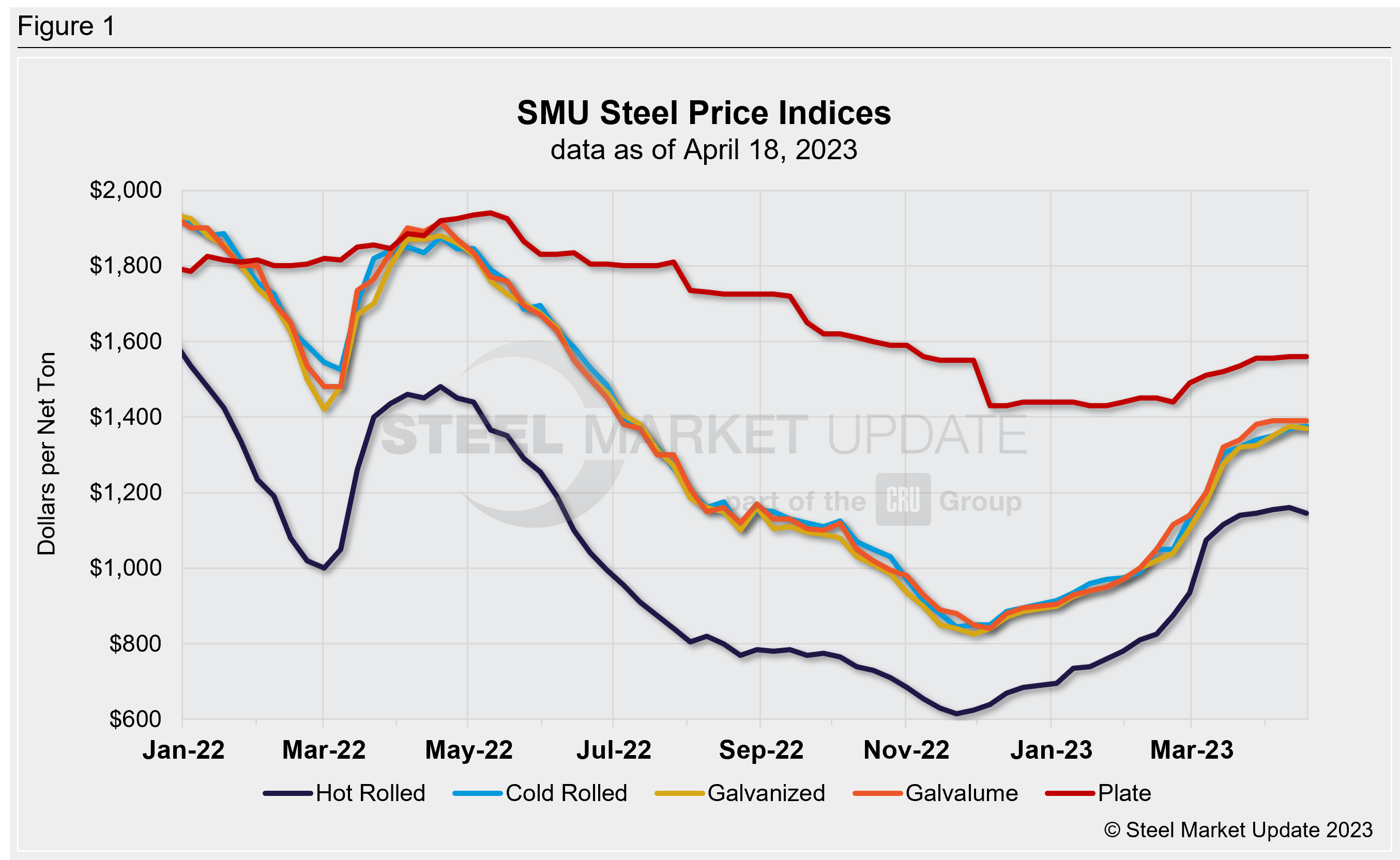

SMU Price Ranges: HRC Dips for the First Time Since November

Written by Michael Cowden

Hot-rolled coil prices edged downward for the first time since late November, according to SMU’s latest check of the market.

The dip in HRC prices comes after we saw lead times contract slightly, an uptick in the number of mills willing to negotiate lower prices, and a modest increase in sheet inventories.

SMU’s hot-rolled coil price now stands at $1,145 per ton ($57.25 per cwt), down $15 per ton from a week ago.

Prices for other products were mixed. Cold rolled was up $5 per ton, galvanized was down $5 per ton, and Galvalume was unchanged. Also unchanged were plate prices, although fundamentals for plate are stronger.

Market sentiment was also varied. Some sources jumped to sweeping conclusions – for example, that the sheet market might have entered a destocking period following a first-quarter restock.

Others noted that they had also seen prices moderate and lead times come in – but from very high levels. They stressed that business activity remained solid.

SMU has adjusted its sheet momentum indicators to neutral until the market establishes a clear direction up or down. Our plate momentum indicator remains pointed upward on longer lead times and tighter inventories.

Hot-Rolled Coil: The SMU price range is $1,100–1,190 per net ton ($55.00–59.50/cwt), with an average of $1,145 per ton ($58.00/cwt) FOB mill, east of the Rockies. The bottom end of our range decreased by $20 per ton vs. one week ago, while the top end was down $10 per ton week on week (WoW). Our overall average is down $15 per ton WoW. Our price momentum indicator for hot-rolled coil points to Neutral, meaning it is unclear wheather the market will be up or down over the next 30 days.

Hot-Rolled Lead Times: 4–8 weeks

Cold-Rolled Coil: The SMU price range is $1,360–1,390 per net ton ($68.00–69.50/cwt), with an average of $1,375 per ton ($68.75/cwt) FOB mill, east of the Rockies. The lower end of our range was up by $20 per ton, while the top end is down $10 per ton compared to a week ago. Our overall average is up just $5 per ton WoW. Our price momentum indicator on cold-rolled coil points to Neutral, meaning it is unclear wheather the market will be up or down over the next 30 days.

Cold-Rolled Lead Times: 6–10 weeks

Galvanized Coil: The SMU price range is $1,350–1,390 per net ton ($67.50–69.50/cwt), with an average of $1,370 per ton ($68.50/cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged WoW, while the top end was down $10 per ton vs. one week ago. Our overall average is down $5 per ton vs. the prior week. Our price momentum indicator on galvanized steel points to Neutral, meaning it is unclear wheather the market will be up or down over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,447–1,487 per ton with an average of $1,467 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–10 weeks

Galvalume Coil: The SMU price range is $1,340–1,440 per net ton ($67.00-72.00/cwt), with an average of $1,390 per ton ($69.50/cwt) FOB mill, east of the Rockies. The lower end and the top end of the range was unchanged vs. the week prior. Our overall average was, as a result, sideways when compared to one week ago. Our price momentum indicator on Galvalume steel now points to Neutral, meaning it is unclear wheather the market will be up or down over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,634–1,734 per ton with an average of $1,684 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8–10 weeks

Plate: The SMU price range is $1,530–1,590 per net ton ($76.50–79.50/cwt), with an average of $1,560 per ton ($78.00/cwt) FOB mill. The lower end of our range and the top end of our range were unchanged compared to the prior week. Our overall average, as a result, sideways WoW. Our price momentum indicator on steel plate is still pointing Higher, meaning we expect prices to increase over the next 30 days.

Plate Lead Times: 5–10 weeks

SMU Note: Below is a graphic showing our hot-rolled, cold-rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By David Schollaert, david@steelmarketupdate.com