Market Data

March 22, 2023

January Import Share of US Sheet and Plate Markets

Written by David Schollaert

Imported sheet and plate products’ arrival at US ports rose in January, leading their share of the US markets to recover, while domestic shipments varied during the month.

That’s according to a Steel Market Update’s analysis of import data from the US Commerce Department and domestic shipment figures from the American Iron and Steel Institute (AISI).

Imports’ share of US sheet and plate markets peaked nearly a year ago, with sheet reaching its highest level in the past four-plus years. The trend was driven by buyers seeking relief from soaring domestic steel prices. Imports have fluctuated since, especially given the price cut seen for domestic steel for much of the second half of 2022.

Imports’ share of total sheet shipments in the US was 14.2% in January, up from 12% in December, recovering for the first time in seven months. The rebound was driven by an increase of more than 29% in foreign sheet arrivals, though domestic sheet shipments edged up just 5% month on month (MoM). The market share of plate product imports also increased, up 1% to 21% from to 20% the month prior. This was led by a 3% increase in foreign plate products, while domestic shipments decreased 3.3%.

January’s sheet imports totaled 636,043 tons, up from 492,837 tons in December. Overall domestic sheet product shipments were up to 3.78 million tons from 3.59 million tons.

Overall sheet products (domestic shipments plus imports) totaled 4.42 million tons in January, up from 4.09 million tons in December.

Hot-rolled coil (HRC) imports rose 6.5% MoM in January, totaling 149,000 tons vs. 139,931 tons in December. Domestic shipments of HRC were up 6.3%, or 97,456 tons more, MoM. The details are below in Figure 1.

The import share of HRC rose marginally, up just 0.1 percentage point to 8.4% in January. This is still among one of the lowest totals over the past year, and well below the recent high of 15.3% set in October 2021. The slight gain was led largely by a similar increase in both the arrival of foreign material and domestic shipments in January. HRC apparent supply totaled 1.78 million tons in January, up from 1.68 million tons the month prior.

Cold-rolled coil (CRC) imports fell by more than 10% in January, while galvanized (hot dipped and electrolytic) surged, nearly doubling over the same period. Other metallic coat (OMC) jumped more than 55% MoM.

Plate products in January saw the second overall decrease in shipments in nearly a year as apparent supply edged down by 2.1% MoM. The decrease was driven by a decline of 3.3% in domestic plate shipments, while imports rebounded by 3% MoM. Despite the increase, plate imports were still among some of the lowest totals for the past 12 months at 154,123 tons.

All told, total plate shipments, including foreign and domestic, were 733,273 tons in January, down from 748,821 tons the month prior.

The import market share for plates in coil declined to 37% in January, a 2.5-percentage-point decrease MoM. The decline in market share was driven by an 11.7% increase in foreign product arrival, while domestic shipments also decreased by 1.7% over the same period. Total imports of plates in coil were 109,130 tons in January, down from December’s 123,530 tons.

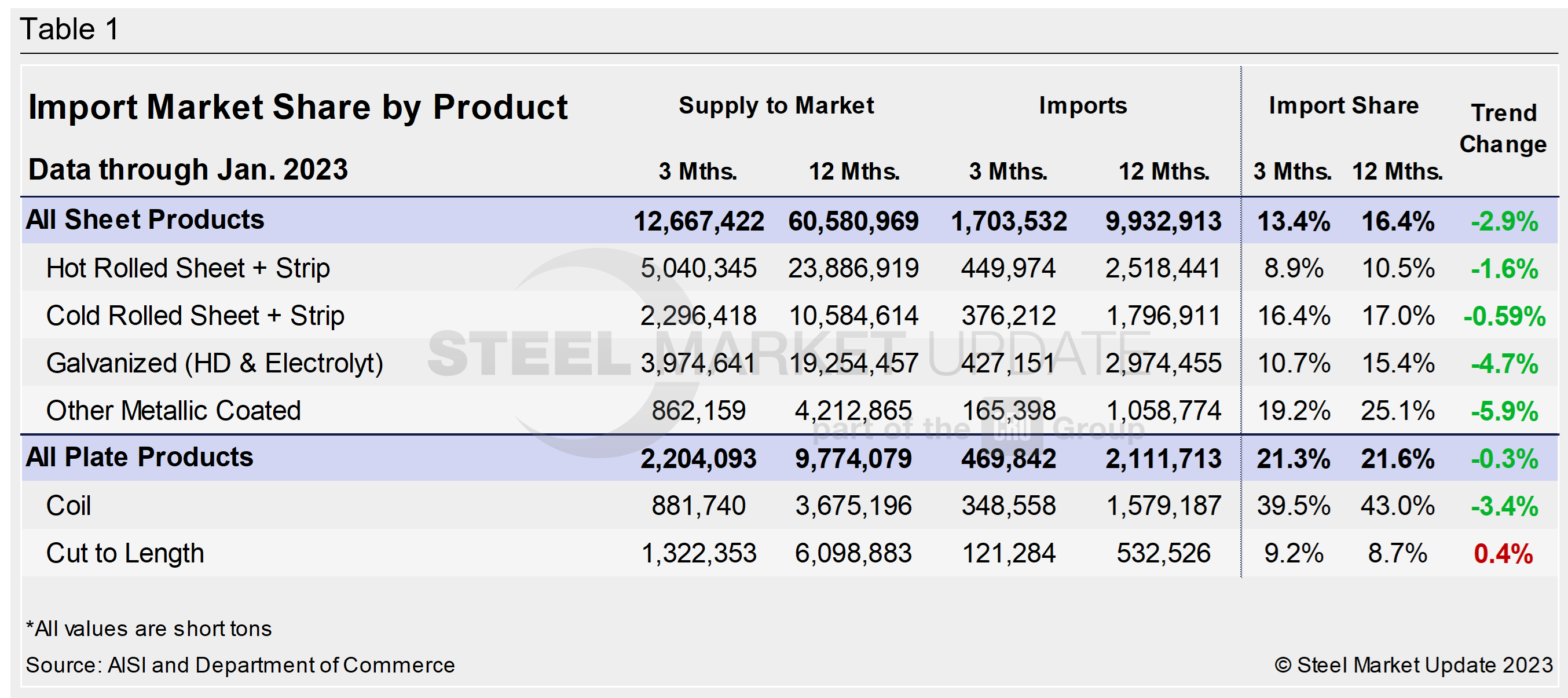

The table below displays the total supply to the market in the three months and 12 months through January 2023 for sheet and plate products and six subcategories. Supply to the market is the total of domestic mill shipments plus imports. It shows imports on the same three- and 12-month basis, and then calculates import market share for the two time periods for six products. Finally, it subtracts the 12-month share from the three-month share. Increasing import market share is in red. Decreasing import market share is in green.

The big picture: Imports’ share of US sheet and plate sales remain down through January. The big second-half jump in total imports in 2021 was the result of historically and disproportionately high domestic steel prices. The influx of foreign material has declined considerably on sharply lower domestic prices. We’ll keep an eye on whether imports surge in response to the current price cycle that has seen domestic prices jump at a torrid pace.

Except for cut-to-length plate, the remaining sheet and plate products have seen a trend shift, illustrating how import competition in January was no longer impacting domestic products in three months compared to 12 months.

The import market share of individual plate products and a breakdown of the market share for plates in coil are displayed together in Figure 2.

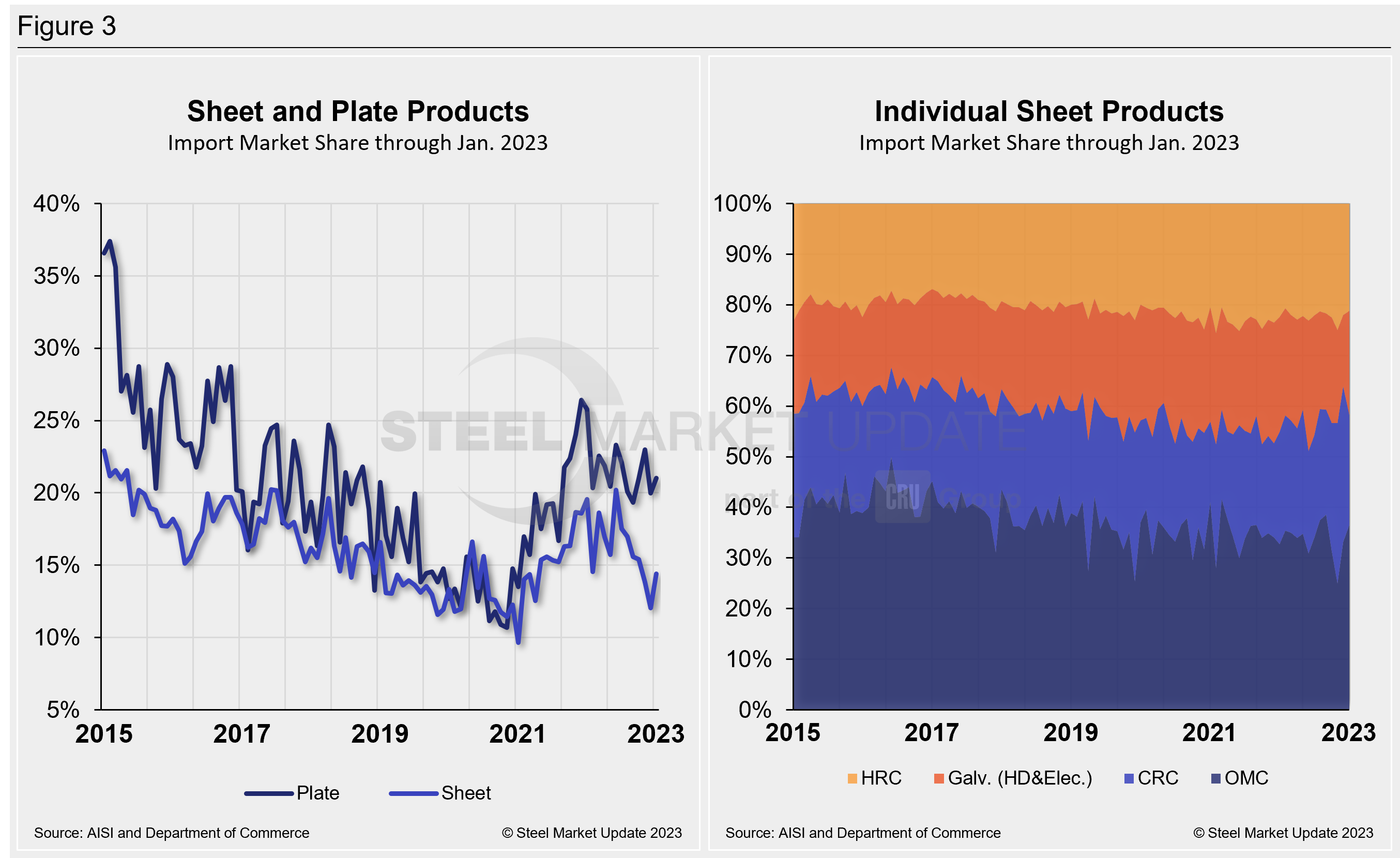

The historical import market share of plate and sheet products, and the import market share of the four major sheet products, are shown side by side in Figure 3.

By David Schollaert, david@steelmarketupdate.com