Overseas

March 2, 2023

Domestic HRC’s Price Advantage Over Imports Continues To Erode

Written by David Schollaert

Domestic hot-rolled coil (HRC) continues to lose its price advantage over imported steel.

The reason: US prices continued to move higher following a wave of domestic mill price hikes that began after Thanksgiving and reached a fever pitch in February with near weekly price increases.

![]() US HRC had held a price advantage over foreign hot band for 16 consecutive weeks. But domestic HRC prices are now accelerating at a faster clip than hot band prices overseas, according to Steel Market Update’s latest foreign vs. domestic price analysis.

US HRC had held a price advantage over foreign hot band for 16 consecutive weeks. But domestic HRC prices are now accelerating at a faster clip than hot band prices overseas, according to Steel Market Update’s latest foreign vs. domestic price analysis.

Domestic hot band is now roughly 8% more expensive than foreign material. That premium is wider than last week, when domestic HRC was approximately 3% more costly than imported product.

US prices had been cheaper than foreign prices for all three regions we follow since the beginning of November after taking into consideration freight costs, trader margins, and applicable tariffs. That changed when US HRC prices rose $155 per ton on in February alone, more than the gains seen abroad over the same period.

Domestic HRC held, on average, an $18-per-ton advantage over imported hot band as recently as mid-February. That flipped to a $77-per-ton disadvantage as US rocketed higher later in the month.

SMU uses the following calculation to identify the theoretical spread between foreign HRC prices (delivered to US ports) and domestic HRC prices (FOB domestic mills): Our analysis compares the SMU US HRC weekly index to the CRU HRC weekly indices for Germany, Italy, and Far East Asian ports. This is only a theoretical calculation because costs to import can vary greatly, which can influence the true market spread.

In consideration of freight costs, handling, and trader margin, we add $90 per ton to all foreign prices to provide an approximate CIF US ports price that can be compared against the SMU domestic HRC price. Buyers should use our $90-per-ton figure as a benchmark, adjusting it based on their shipping and handling costs. If you import steel and want to share your thoughts on these costs, we welcome your insight and comments at david@steelmarketupdate.com.

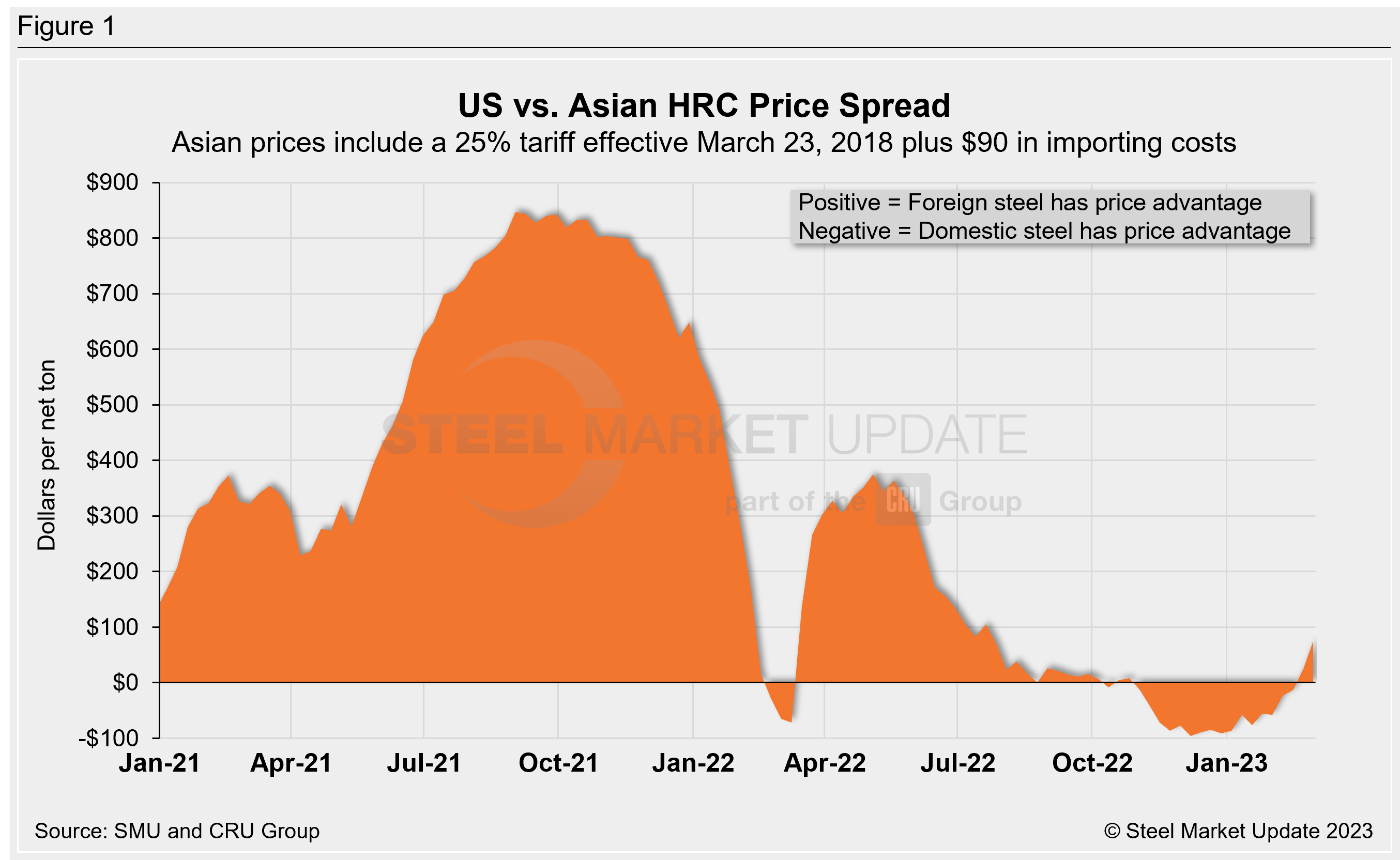

Asian Hot-Rolled Coil (East and Southeast Asian Ports)

As of Thursday, March 2, the CRU Asian HRC price increased by $9 per ton to $617 per net ton ($680 per metric ton), and was up $18 per ton from levels one month prior. Adding a 25% tariff, and $90 per ton in estimated import costs, the delivered price of Asian HRC to the US is $861 per ton. The latest SMU hot-rolled average is $935 per ton, up $60 per ton from our previous price update, and up $155 per ton compared to our price one month ago.

US-produced HRC is now theoretically $75 per ton more costly than steel imported from Asia. This is a reversal from just two weeks ago, when domestic HRC had a $23-per-ton advantage over HRC from Asian markets.

One month ago, we saw a $58-per-ton spread advantage for US HRC, among the biggest price advantages domestic HRC has had over Asian HRC in recent years.

The widest price advantage for Asian hot band was recorded nearly 16 months ago: $847 per ton in September 2021.

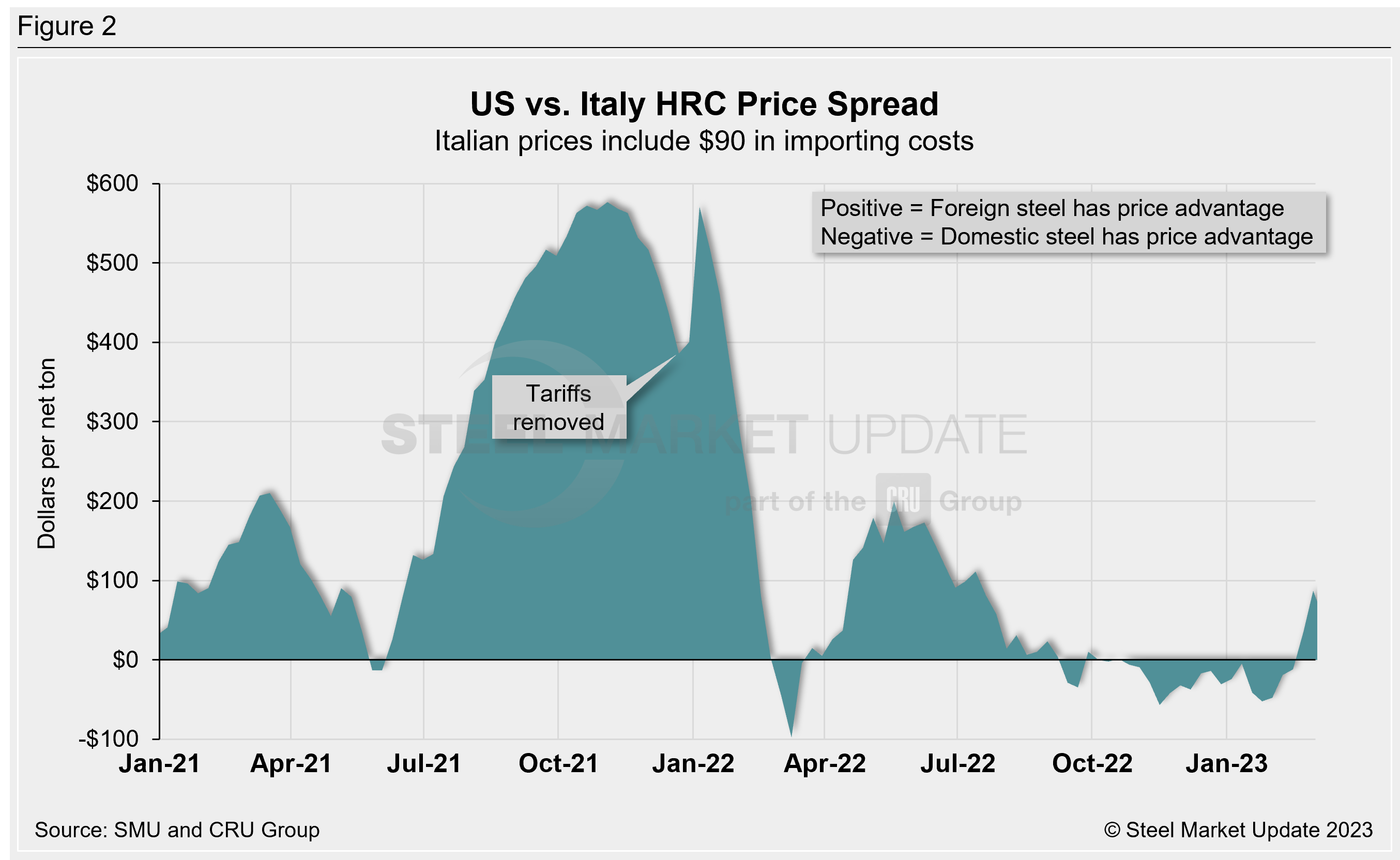

Italian Hot-Rolled Coil

Italian HRC prices increased by $8 per ton WoW to $758 per net ton ($835 per metric ton) this week, and were $19 per ton higher month on month (MoM). After adding import costs, the delivered price of Italian HRC is approximately $848 per ton.

Domestic HRC is now theoretically $87 per ton more expensive than imported Italian HRC. That spread is up $52 per ton WoW and represents a nearly $100-per-ton reversal compared to two weeks ago when US HRC was $12 per ton cheaper than Italian product. Just amonth ago US HRC was in theory $48 per ton cheaper than imported Italian hot band.

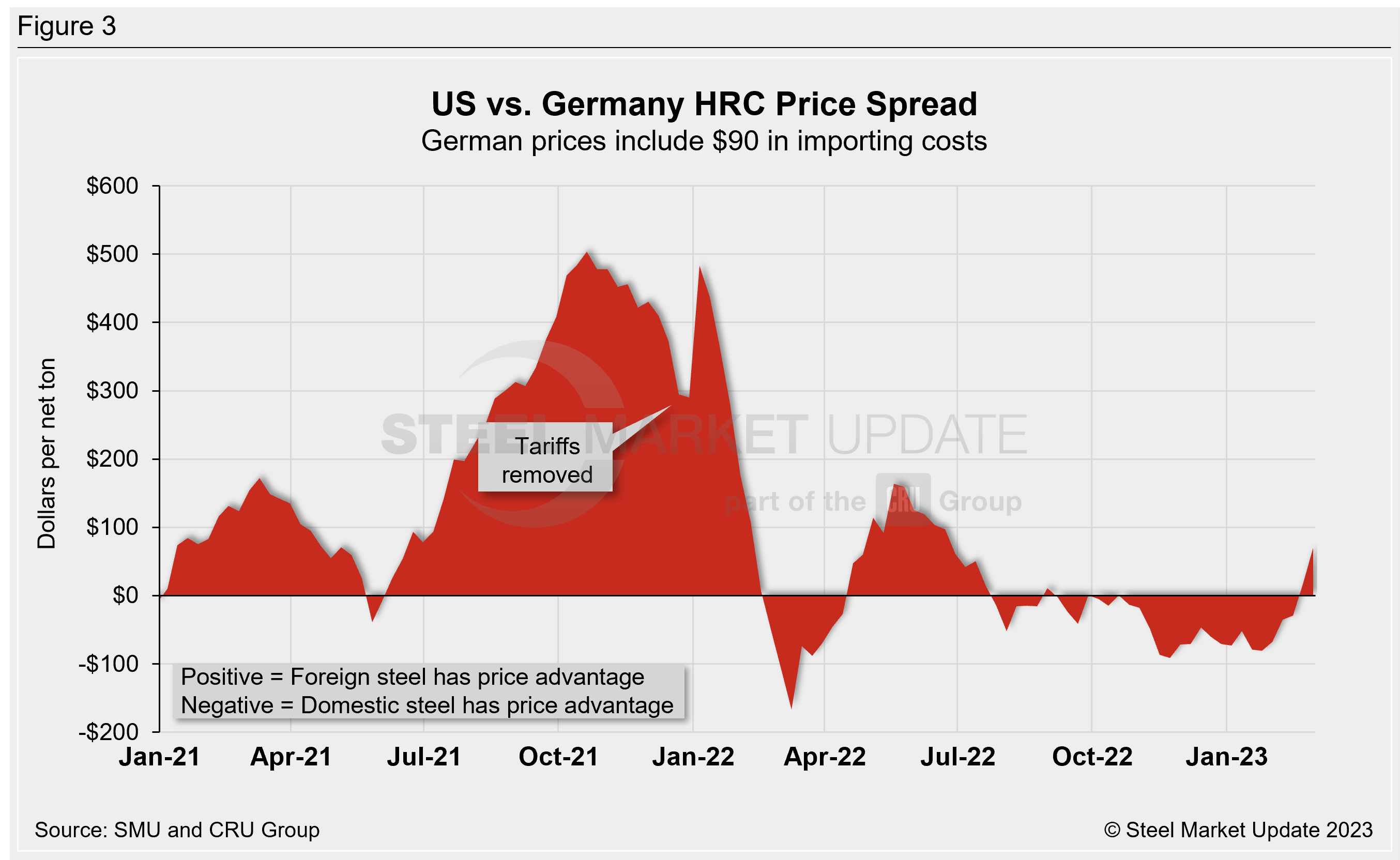

German Hot-Rolled Coil

CRU’s latest German HRC price rose by just $9 per ton WoW to $775 per net ton ($854 per metric ton) and are up $17 per ton MoM. After adding import costs, the delivered price of German HRC is roughly $865 per ton.

Domestic HRC is now theoretically $70 per ton more expensive than imported German HRC. That’s a swing of $99-per-ton turn given that US hot band held a $29-per-ton advantage over domestic hot band just two weeks ago.

US HRC had held a price advantage of German product for all but three weeks since late July.

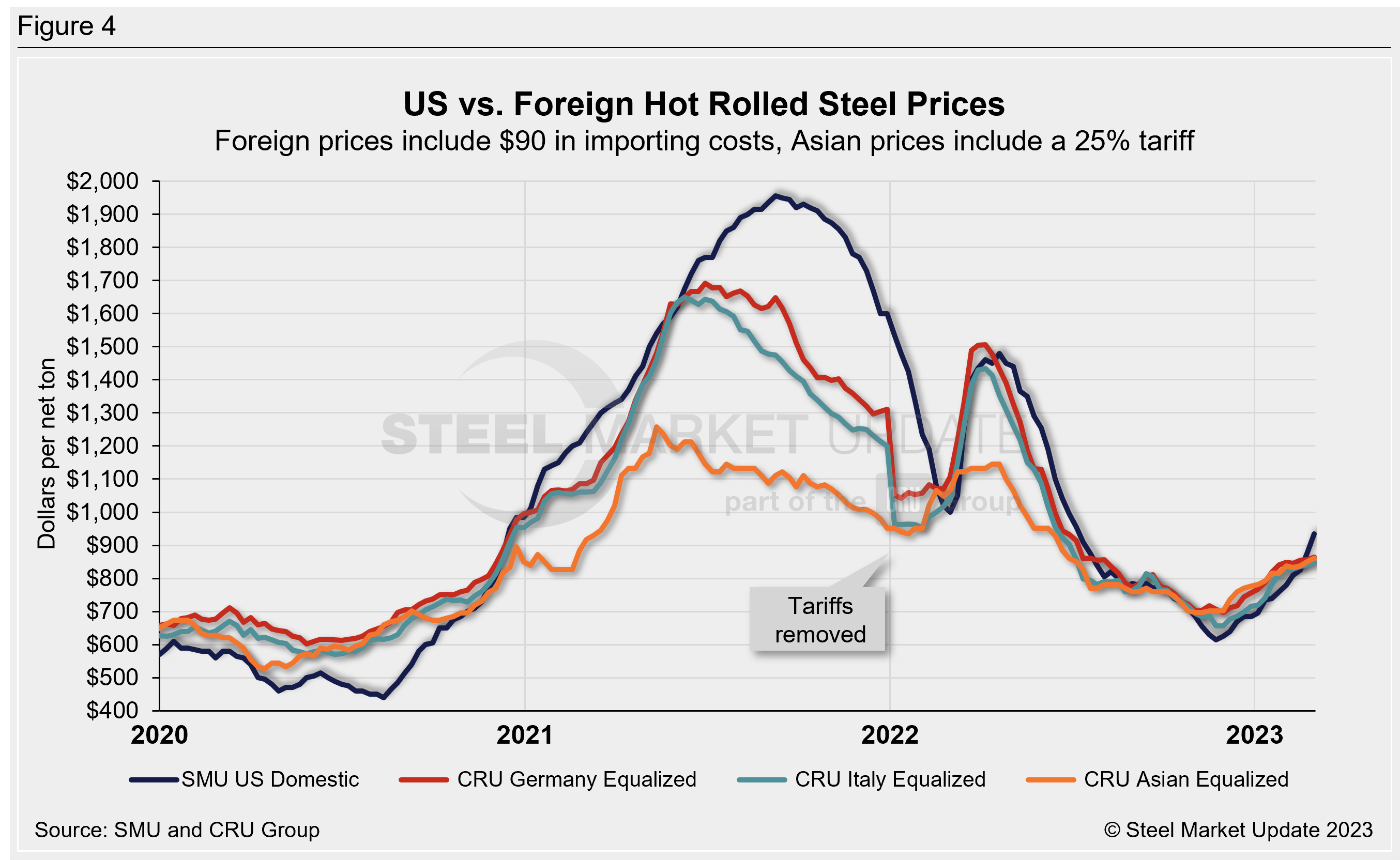

Figure 4 compares all four price indices and highlights the effective date of the tariffs. Foreign prices are referred to as “equalized,” meaning they have been adjusted to include importing costs (and tariffs in some cases) for a like-for-like comparison against the US price.

Notes: Freight is an important part of the final determination on whether to import foreign steel or buy from a domestic mill supplier. Domestic prices are referenced as FOB the producing mill, while foreign prices are CIF the port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. When considering lead times, a buyer must take into consideration the momentum of pricing both domestically and in the world markets. In most circumstances, domestic steel will deliver faster than foreign steel ordered on the same day.

Effective Jan. 1, 2022, the traditional Section 232 tariff no longer applies to most imports from the European Union. it has been replaced by a tariff rate quota (TRQ). Therefore, the German and Italian price comparisons in this analysis no longer include a 25% tariff. SMU still includes the 25% Section 232 tariff on foreign prices from other countries. We do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.

By David Schollaert, david@steelmarketupdate.com