Canada

February 23, 2023

Stelco Posts Sharply Lower Q4 Profit, Sees Better Times Ahead

Written by Michael Cowden

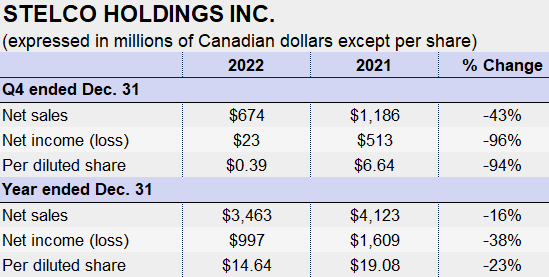

Canadian flat-rolled steelmaker Stelco Holdings Inc. recorded sharply lower fourth-quarter profits.

The culprit: the “triple whammy” of declining steel prices, shorter lead times, and higher costs, company chairman and CEO Alan Kestenbaum said.

Such trends should lead to improved results for the Hamilton, Ontario-based steelmaker in future quarters, he added.

SMU’s pricing and lead time data support the assertion that selling prices and lead times have rebounded sharply from fourth-quarter lows.

Our hot-rolled coil price currently stands at $875 per ton ($43.75 per cwt), up 42% from a 2022 low of $615 per ton in recorded in late November. SMU’s HRC lead time, meanwhile, stands at 5.41 weeks, up 39% from 3.90 weeks posted around the same time. (Editor’s note: You can chart out both prices and lead times with SMU’s pricing tool.)

Headline sales and profit figures for Stelco are in the table above.

The company shipped 670,000 tons in the fourth quarter of 2022, up 7% from 626,000 tons in the fourth quarter of 2021. Approximately 72% of that total was hot-rolled coil, 3% cold-rolled coil, 17% coated product, and 8% was other products such as pig iron and non-prime steel.

Stelco ended the year with CAD $800 million ($590.6 million USD) in cash and a strong balance sheet, chief financial officer Paul Scherzer noted.

“This level of liquidity will provide our business with both optionality and opportunity to explore opportunities to deploy our capital in a manner that strengthens our business and maximizes value for our shareholders,” he said.

By Michael Cowden, michael@steelmarketupdate.com