Market Segment

February 12, 2023

ArcelorMittal Predicts Stronger 2023 on End of 2022 Destocking Cycle

Written by Michael Cowden

ArcelorMittal executives think that the global steel market should rebound in 2023 as the destocking period that characterized 2022 ends.

“I believe the worst conditions of these cycles have passed,” Lakshmi Mittal, executive chairman of the Luxembourg-based steelmaker, said in a conference call with analysts last week.

Mittal made the prediction after the company – one of the world’s largest steelmakers – posted sharply lower earnings for the fourth quarter and full-year 2022.

ArcelorMittal recorded net income of $261 million in the fourth quarter of last year, down 94.5% from $4.01 billion in the fourth quarter of 2021 on net sales that fell 18.7% to $16.89 billion over the same comparison.

For the fully year, the decline was less severe. The company posted net income of $9.30 billion in 2022, down 37.8% from $14.96 billion in 2021 despite sales increasing 4.3% to $79.84 billion.

You can find full details here.

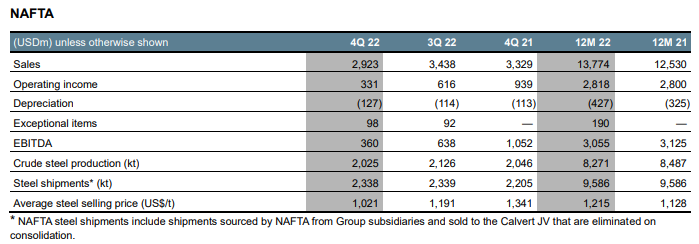

North America

Results for AcelorMittal’s North American operations are below:

Lower crude steel production in North America in Q4’22 compared to Q3’22 resulted mostly from planned maintenance. Lower sales figures stemmed from falling prices. ArcelorMittal said it partially offset the drop in prices with higher sales volumes.

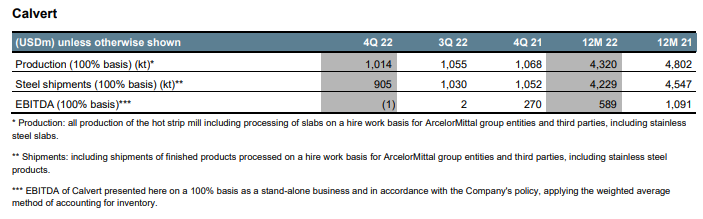

Calvert

Details on financials for AM/NS Calvert are below. Results for Calvert are reported separately from ArcelorMittal’s other North American operations because the Alabama sheet mill is a joint venture with Japan’s Nippon Steel.

Production at Calvert in Q4’22 was lower than in Q3’22 because of planned maintenance on Calvert’s hot-strip mill. Shipments fell because of weaker demand. And the segment recorded an Ebitda loss of $1 million because of a steep decline in spot prices for flat-rolled steel, the company said.

Recall that we recorded the lowest prices of 2022 in the fourth quarter. Hot-rolled coil fell to $615 per ton in November, according to our interactive pricing tool. Mills have since announced a series of price hikes that have sent prices sharply higher into the first quarter of 2023.

Outlook

“We’ve seen some positive signs recently that suggest we have passed the bottom of the current destock cycle,” ArcelorMittal CEO Aditya Mittal said on the earnings call.

“And we’ve seen improvement in steel spreads from the unsustainable lows of the fourth quarter last year,” he added.

ArcelorMittal said it expects apparent steel consumption outside of China to rebound 2-3% in 2023 compared to 2022 levels. The company also predicted that steel shipments would increase 5% this year compared to last year.

In the US, ArcelorMittal forecast that demand growth would be “lackluster” because of the impact of higher interest rates. But the end of destocking is nonetheless expected to increase steel consumption by 1.5-3.5% in 2023 compared to 2022, the company said.

By Michael Cowden, michael@steelmarketupdate.com