Community Events

January 31, 2023

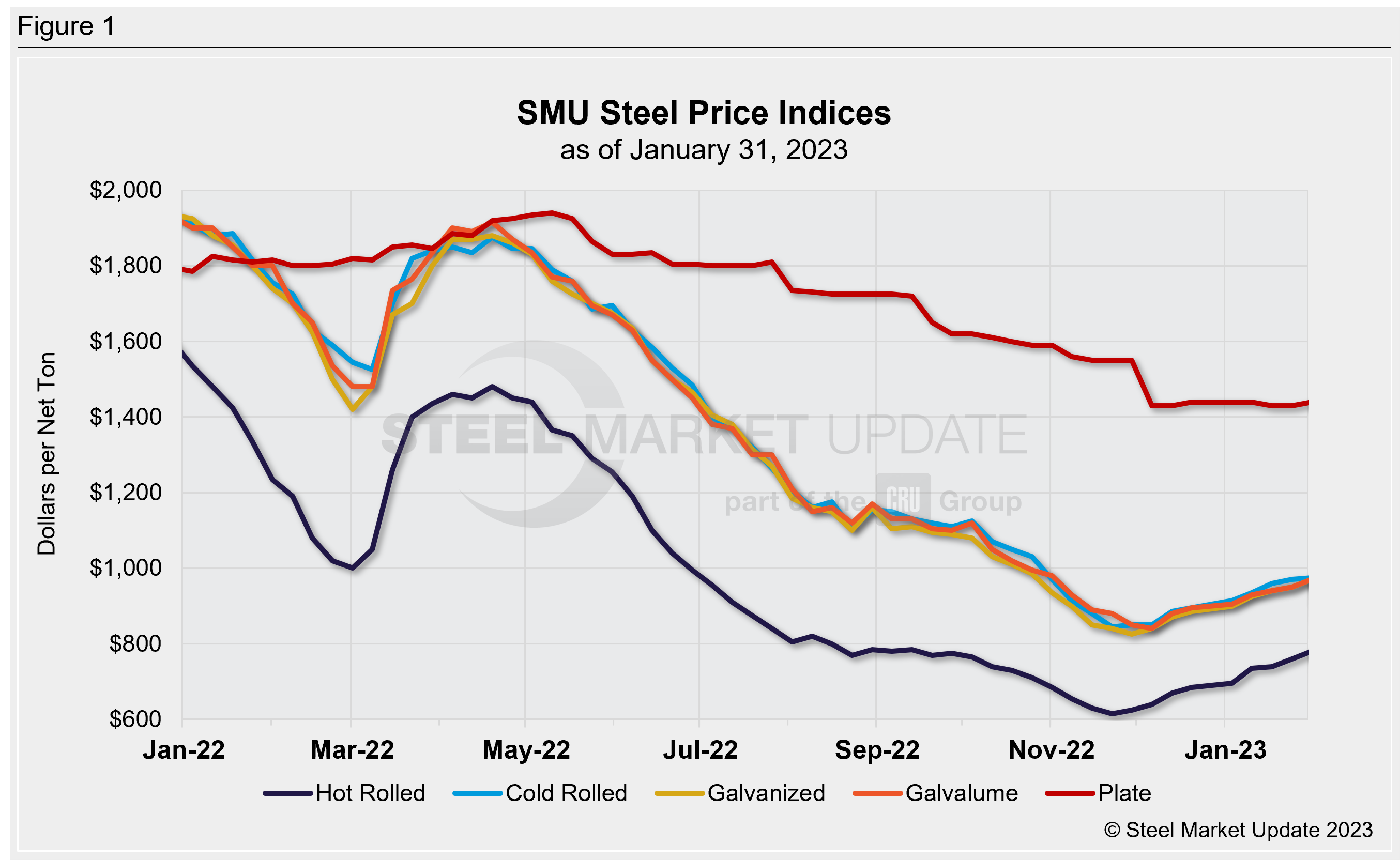

SMU Price Ranges: $800/ton HRC or Bust!

Written by Michael Cowden

Sheet prices rose again this week, continuing a rally that began shortly after Thanksgiving. SMU’s hot-rolled coil price stands at $780 per ton ($39 per cwt), up $20 per ton from $760 per ton last week and up $165 per ton from a 2022 low of $615 per ton recorded in November.

HRC prices haven’t been this high since early October, nearly four months ago. And US mills continue to push for $800 per ton or more – levels not seen in the market since last summer.

Cold-rolled (up $5 per ton week over week) and coated products (up $20 per ton) notched gains too.

Plate prices inched up $10 per ton but remained in the ~$1,430-1,440 per ton range they’ve been in since early December.

SMU’s sheet price momentum indicators remain pointed upward. Our plate price momentum indicator remains at neutral.

Hot-Rolled Coil: The SMU price range is $760–800 per net ton ($38.00–40.00/cwt), with an average of $780 per ton ($39.00/cwt) FOB mill, east of the Rockies. The bottom end of our range increased by $20 per ton, as did the top end of our range compared to one week ago. Our overall average is up $20 per ton from one week ago. Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–7 weeks

Cold-Rolled Coil: The SMU price range is $950–1,000 per net ton ($47.50–50.00/cwt) with an average of $975 per ton ($48.75/cwt) FOB mill, east of the Rockies. Our cold-rolled range tightened this week when compared to last week. Though the bottom end of our range increased by $10 per ton, the top end of our range was unchanged compared to one week ago. Our overall average is up $5 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $940–1,000 per net ton ($47.00–50.00/cwt) with an average of $970 per ton ($48.50/cwt) FOB mill, east of the Rockies. The lower end of the range rose $40 per ton, while the top end of our range was sideways compared to one week ago. Our overall average is up $20 per ton from one week ago. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,037–1,097 per ton with an average of $1,067 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–9 weeks

Galvalume Coil: The SMU price range is $940–1,000 per net ton ($47.00-50.00/cwt) with an average of $970 per ton ($48.50/cwt) FOB mill, east of the Rockies. The lower end of the range rose $40 per ton vs. the week prior, while the top end of our range was unchanged compared to one week ago. Our overall average is up $20 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,234–1,294 per ton with an average of $1,264 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–8 weeks

Plate: The SMU price range is $1,400–1,480 per net ton ($70.00–74.00/cwt) with an average of $1,440 per ton ($72.00/cwt) FOB mill. The lower end of range rose $20 per ton vs. the prior week, whilte the top end of our range was unchanged compared to one week ago. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on steel plate is Neutral, meaning we are still unsure whether prices will remain stable, or move up or down over the next 30 days.

Plate Lead Times: 4–7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com