Prices

January 29, 2023

Final Thoughts

Written by Michael Cowden

We’ll kick off the Tampa Steel Conference next Sunday, and I’m looking forward to seeing many of you there in person.

For kicks, I decided to look back at how the market was in mid-February 2022, when we held the event along with the Port of Tampa Bay last year.

So join me for a trip to the distant galaxy of the steel market in Q1 2022.

Goncalves’ Crystal Ball

Just how far distant? Consider this, the consensus at Tampa Steel last year, echoed by many pundits and analysts, was that Russian forces would not be so reckless as to really invade Ukraine.

Enter Cleveland-Cliffs chairman, president, and CEO Lourenco Goncalves. He said during his fireside chat with John Packard that Russia might indeed invade Ukraine, and that the battle would center around the Donbas – the heart of Ukraine’s iron- and steelmaking industry.

Goncalves prediction was dismissed as “Lourenco being Lourenco.” It was great stuff to entertain the crowd. But it shouldn’t be taken too seriously.

Even as Russian troops massed, electric-arc furnace (EAF) sheet mills in the US and abroad (Turkey, for example, which is also heavily tilted toward EAF steelmaking) were still getting about two-thirds of their pig iron from Russia and Ukraine.

Just a few weeks later, a shocked market would be paying astronomical prices for pig iron and scrambling for alternate sources because Brazil – the one-third of the pig iron supply chain that was still functioning – couldn’t feed everyone.

In short, Goncalves might have been an outlier at the time. But he proved prescient.

Plate’s Revenge

Here’s something that hasn’t stood the test of time so well.

I gave a short presentation at a pre-conference workshop on futures at Tampa last year. I went through SMU’s latest prices, lead times, and other survey results. I focused mostly on hot-rolled coil prices. I also flagged something unusual – namely, that plate prices seemed to have decoupled from sheet.

Recall hot-rolled coil prices peaked at $1,955 per ton ($97.75 per ton) in September 2021. Plate at the time was $1,775 per ton. That made no sense to me. And I thought it was a sure sign that sheet prices were going to fall.

Yes, plate price movements can lag those in sheet, and their respective markets have different dynamics. Broadly speaking, though, discrete plate is more time on the mill, it’s a value-added product, and so it should command a premium to sheet.

Hot-rolled coil’s (HRC’s) premium over plate reminded me of the times when shredded scrap fetches a higher price than busheling scrap. It happens. But the market typically reverts back to the norm of bush carrying a premium over shred.

That reversion to the norm with sheet and plate prices happened in Q4 2021. And then some. By mid-February 2022, it seemed to me that the pendulum had swung too far the other way. Plate prices were $1,800 per ton, and hot-rolled coil was at $1,080 per ton. How could plate possibly maintain a $720 premium over coil for any sustained period?

Fast forward to today. HRC is at $760 per ton. Plate is at $1,430 per ton. That’s a $670 per ton premium for plate. That spread hasn’t collapsed. Which means it’s worth asking: Is plate carrying a $650-750/ton premium over hot band really the new norm?!

Ghosts of Surveys Past

How is the track record of the SMU community. To gauge that, I looked back at survey results released just days after Tampa Steel ‘22 closed. (You can find past survey results here.)

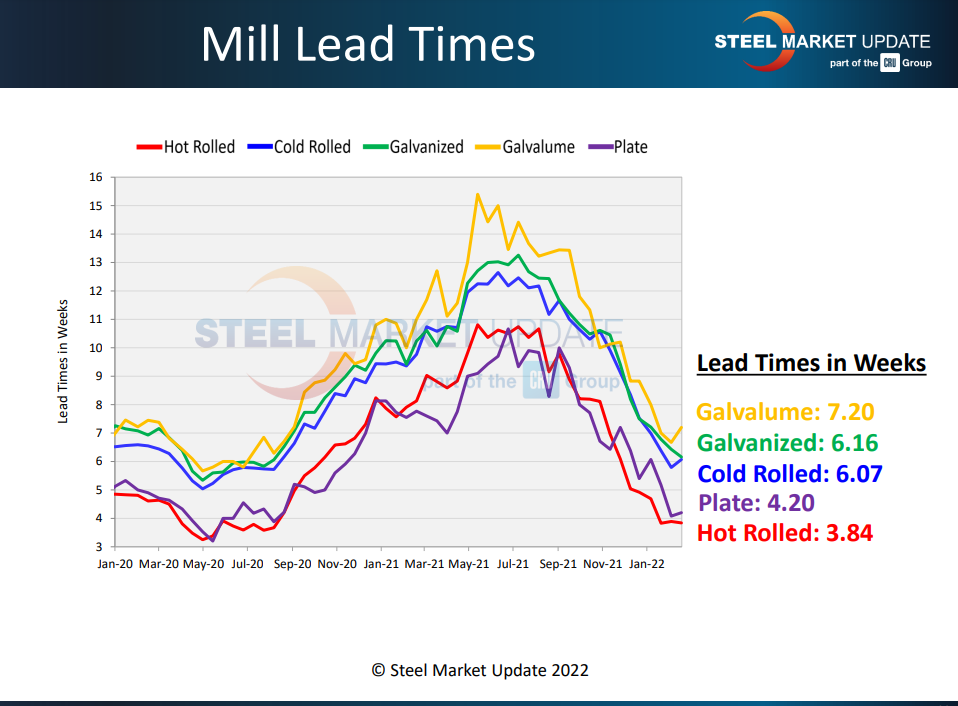

Lead times on Feb. 17, 2022, then for hot-rolled coil were only 3.84 weeks, what would turn out to be just about their lowest point of the year. Only 25% of survey respondents thought they would extend anytime soon.

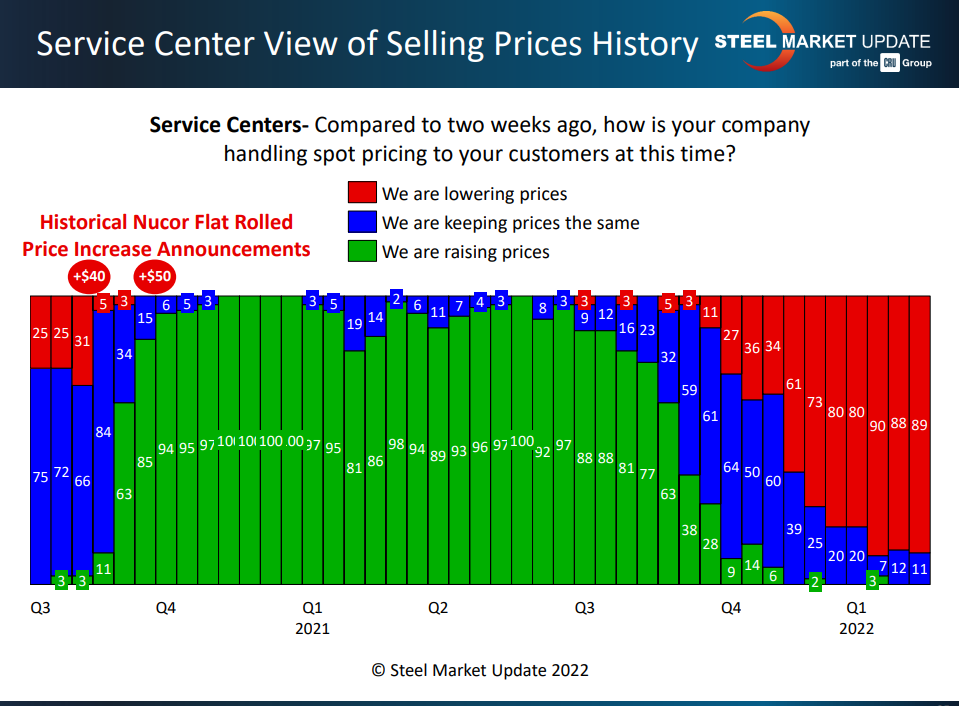

That was a reasonable assessment given that service centers and manufacturers were both trying to slash inventories – and that service centers were slashing prices to do so.

All the trends that we saw in 2021 – record prices, record lead times – were unraveling in early 2022. The consensus was they would continue to do so. Heck, no one had seen a mill increase in more than a year. (No one needed a reminder which way things were going in 2021. But I digress.)

Hot band prices were at $1,080 per ton, and nearly half of survey respondents thought they would fall below $1,000 per ton by the end of the quarter.

Instead, hot-rolled coil prices ended March 2022 at $1,465 per ton with lead times nearing six weeks. The war in Ukraine did not lead to the highest sheet prices ever. But it did cause the sharpest price spike we’ve ever recorded. HRC would ultimately gain $480 per ton in just a month and a half.

What will the big drivers be this year? Will the market follow usual cyclicality? That would mean we’ll spend most of this year talking about the usual stuff: lead times, inventories, mill price hikes, and such.

Or should we be on the lookout for the next black swan? And which is the one to prepare for?

You can, as always, email me with your opinion. Or you can download and log into our conference app, which went live last week, and start asking questions to our speakers now.

Also, I won’t be hard to find. I’ll be up on stage or not far from it for most of Tampa Steel. If you have a minute, please stop and say hello.

Tampa Steel

The Tampa Steel Conference will officially get underway on Sunday, Feb. 5, with a networking reception at the Marriot Water Street hotel at 5 pm. There are no spaces left for the Port of Tampa Bay harbor tour on Monday. But we have a few slots left for interested in the golf tournament.

The final agenda for the conference is here. More than 450 people have registered to date. It’s not too late to join them! More information on registration is here.

By Michael Cowden, michael@steelmarketupdate.com