Market Data

January 24, 2023

SMU Price Ranges: Another Week of Modest Gains, Now What?

Written by Michael Cowden

Sheet prices continued to inch upward as most market participants reported solid first-quarter demand, despite concerns in some corners about 2H activity.

But the pace of price gains appears to have slowed, at least temporarily, and lead times have leveled off as well. Any significant additional sheet price gains will hinge less on mill announcements than on where scrap settles in February, some contacts said.

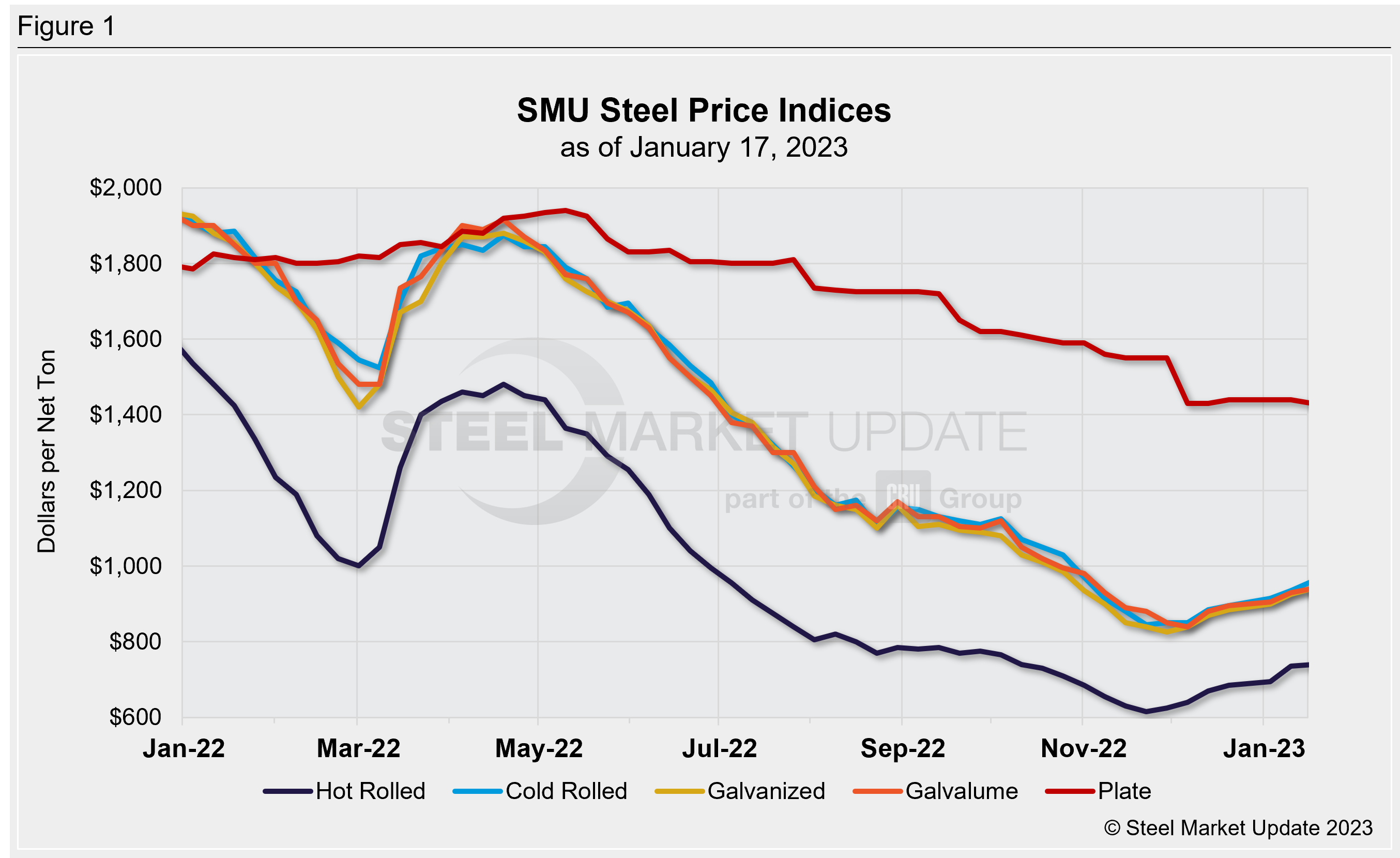

SMU’s hot-rolled coil price now stands at $760 per ton ($38 per cwt) on average, up $20 per ton from $740 per ton last week and up $75 per ton from $685 per ton at the beginning of the year.

Cold-rolled and coated prices, meanwhile, were up $10 per ton compared to last week. Plate tags were flat.

Our sheet price momentum indicators continue to point to higher, although we’re keeping a close eye out for any inflection point. Our plate momentum indicator remains at neutral.

Hot-Rolled Coil: The SMU price range is $740–780 per net ton ($37.00–39.00/cwt), with an average of $760 per ton ($38.00/cwt) FOB mill, east of the Rockies. Though the bottom end of our range increased by $40 per ton, the top end of our range was unchanged compared to one week ago. Our overall average is up $20 per ton from one week ago. Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–7 weeks

Cold-Rolled Coil: The SMU price range is $940–1,000 per net ton ($47.00–50.00/cwt) with an average of $970 per ton ($48.50/cwt) FOB mill, east of the Rockies. Our cold-rolled range tightened this week when compared to last week. Though the bottom end of our range increased by $40 per ton, the top end of our range come down by $20 per ton compared to one week ago. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $900–1,000 per net ton ($45.00–50.00/cwt) with an average of $950 per ton ($47.50/cwt) FOB mill, east of the Rockies. The lower end of the range was unchanged, while the top end of our range increased by $20 per ton compared to one week ago. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $997–1,097 per ton with an average of $1,047 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–9 weeks

Galvalume Coil: The SMU price range is $900–1,000 per net ton ($45.00-50.00/cwt) with an average of $950 per ton ($47.50/cwt) FOB mill, east of the Rockies. The lower end of the range was unchanged, while the top end of our range increased by $20 per ton compared to one week ago. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,194–1,294 per ton with an average of $1,244 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–8 weeks

Plate: The SMU price range is $1,380–1,480 per net ton ($69.00–74.00/cwt) with an average of $1,430 per ton ($71.50/cwt) FOB mill. The lower end and the upper end of our range was unchanged vs. one week ago. Our overall average was sideways week on week.. Our price momentum indicator on steel plate is Neutral, meaning we are still unsure whether prices will remain stable or slide further over the next 30 days.

Plate Lead Times: 4–7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com