Prices

January 17, 2023

SMU Price Ranges: Sheet Up Again. Can the Rally Continue?

Written by Michael Cowden

Sheet prices continued to inch upward this week as market participants debated whether a third round of price increases from Cleveland-Cliffs Inc. would gain traction.

Those who thought the $50-per-ton price hike would stick pointed to higher scrap costs, solid demand, and new capacity still struggling to ramp up.

Those who questioned whether the increases would gain traction contended that the latest rally has been largely momentum driven, that demand later in the year could disappoint, and that mill capacity utilization remains low.

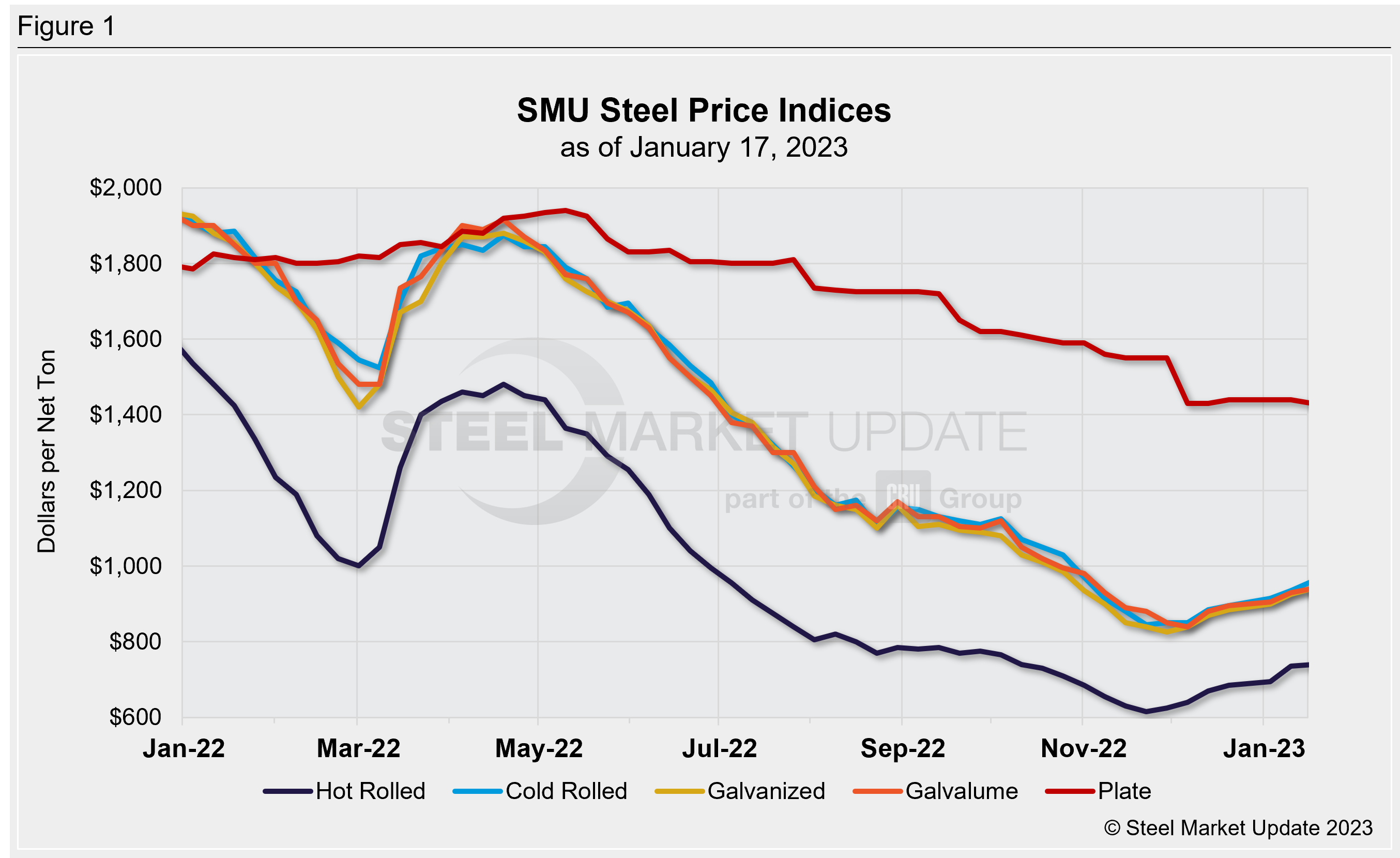

All sheet products we track saw gains this week. Hot-rolled coil was up $5 per ton week-over week, cold-rolled gained $25 per ton, galvanized increased by $15 per ton, and Galvalume was up by $10 per ton.

Plate prices, in contrast, slipped by $10 per ton. But it was unclear whether that modest dip was meaningful or just noise given than plate prices on average remain above $1400 per ton.

Our sheet price momentum indicator remains at higher this week, and our plate momentum indicator continues to be at neutral.

Hot-Rolled Coil: The SMU price range is $700–780 per net ton ($35.00–39.00/cwt), with an average of $740 per ton ($37.00/cwt) FOB mill, east of the Rockies. Though the lower end of our range incresaed $10 per ton, the top end of our ra ge was unchanged compared to one week ago. Our overall average is up $5 per ton from one week ago. Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday).

Cold-Rolled Coil: The SMU price range is $900–1020 per net ton ($45.00–51.00/cwt) with an average of $960 per ton ($48.00/cwt) FOB mill, east of the Rockies. Both the lower end and top end of our range increased when compared to one week ago, up $10 per ton and $40 per ton, respectively. Our overall average is up $25 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks*

Galvanized Coil: The SMU price range is $900–980 per net ton ($45.00–49.00/cwt) with an average of $940 per ton ($47.00/cwt) FOB mill, east of the Rockies. Both the lower end and the top end of our range increased compared to one week ago, up $20 per ton and $10 per ton, respectively. Our overall average is up $15 per ton from one week ago. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $997–1,077 per ton with an average of $1,037 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–9 weeks*

Galvalume Coil: The SMU price range is $900–980 per net ton ($45.00-49.00/cwt) with an average of $940 per ton ($47.00/cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,194–1,274 per ton with an average of $1,234 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–8 weeks*

Plate: The SMU price range is $1,380–1,480 per net ton ($69.00–74.00/cwt) with an average of $1,430 per ton ($71.50/cwt) FOB mill. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end was unchanged. Our overall average is down $10 per ton from one week ago. Our price momentum indicator on steel plate is Neutral, meaning we are still unsure whether prices will remain stable or slide further over the next 30 days.

Plate Lead Times: 4–7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com