Government/Policy

January 10, 2023

SMU Price Ranges: Sheet Continues Strong Start to ‘23

Written by Michael Cowden

Sheet prices continued their upward trek this week on the heels of a $50-per-ton price increase announced by Nucor Corp. on Monday. Plate prices, which were not impacted by that move, were unchanged.

Nucor’s increase, which matched one announced last month by Cleveland-Cliffs Inc., was seen by market participants as timed to reflect an upward movement in January scrap prices. It also coincided with more buyers returning to the market in earnest after the holidays.

SMU’s hot-rolled coil price now stands at $735 per ton ($36.75 per cwt), up 5.8% from $695 per ton last week and up nearly 15% from $640 per ton a month ago. Cold-rolled and coated prices also rose, although some sources noted that coated tags weren’t as strong as cold rolled given widespread availability at certain mills.

Our sheet pricing momentum indicators continue to point toward upward while our plate momentum indicator remains at neutral.

Hot-Rolled Coil: The SMU price range is $690–780 per net ton ($34.50–39.00/cwt), with an average of $735 per ton ($36.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $40 per ton compared to one week ago. Our overall average is up $40 per ton from one week ago. Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–7 weeks

Cold-Rolled Coil: The SMU price range is $890–980 per net ton ($44.50–49.00/cwt) with an average of $935 per ton ($46.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $20 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $880–970 per net ton ($44.00–48.50/cwt) with an average of $925 per ton ($46.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $25 per ton from one week ago. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $977–1,067 per ton with an average of $1,022 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–9 weeks

Galvalume Coil: The SMU price range is $900–960 per net ton ($45.00-48.00/cwt) with an average of $930 per ton ($46.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $25 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,194–1,254 per ton with an average of $1,224 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5–9 weeks

Plate: The SMU price range is $1,400–1,480 per net ton ($70.00–74.00/cwt) with an average of $1,440 per ton ($72.00/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from one week ago. Our price momentum indicator on steel plate is Neutral, meaning we expect prices to remain stable over the next 30 days.

Plate Lead Times: 4–7 weeks

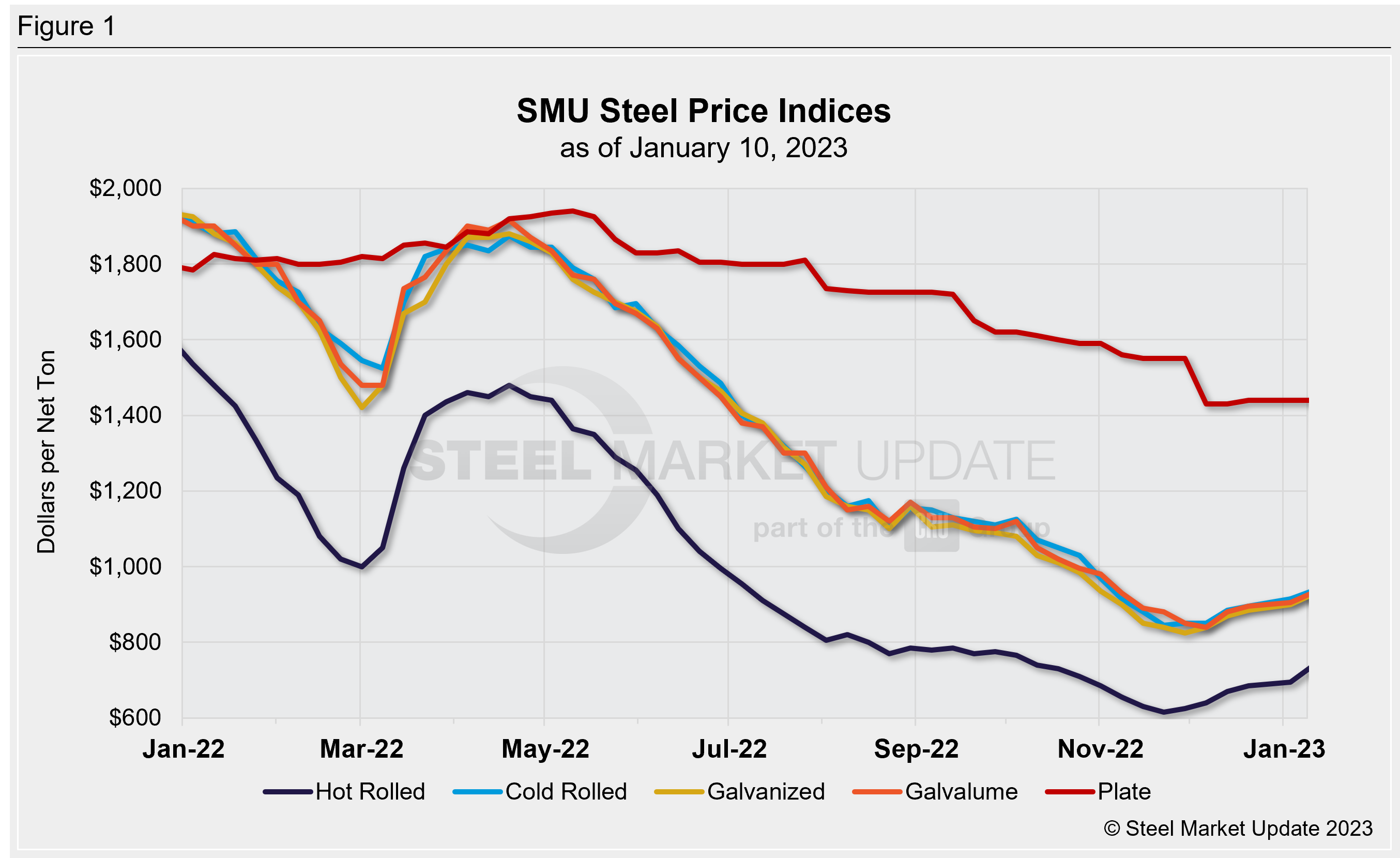

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com