Analysis

December 20, 2022

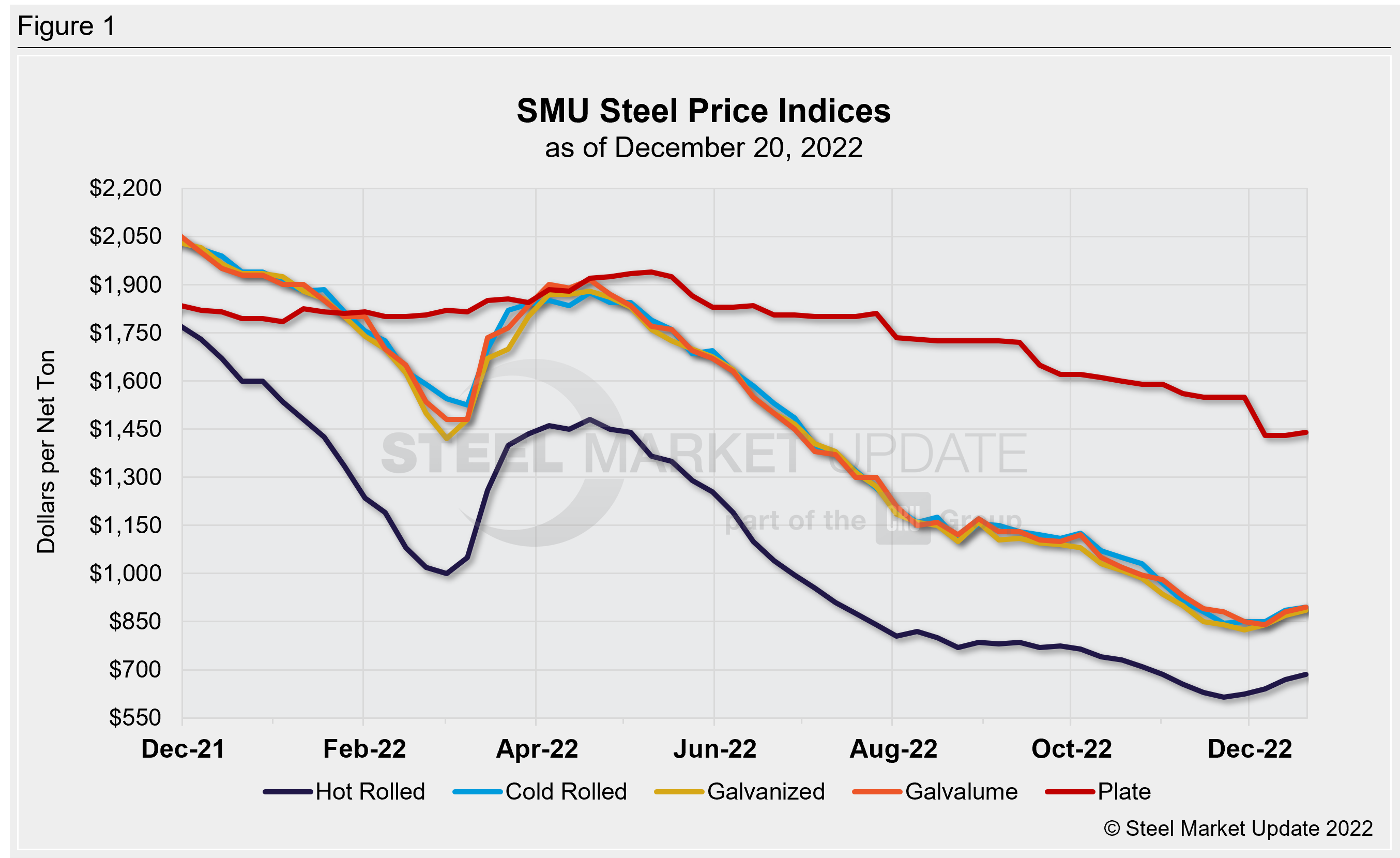

SMU Price Ranges: Sheet Up, But Momentum Slows

Written by Michael Cowden

Sheet prices continued to inch upward this week, but the pace of gains slowed ahead of the holidays.

Some market participants noted sharply higher offers from mills following a round of $50-per-ton ($2.50/cwt) price hikes last week. They also said activity and backlogs were strong heading into 2023.

But others said mills were still offering pre-increase prices for orders as small as a few hundred tons. They questioned how much further prices could rise, especially with lead times still shorter than four weeks at some mills.

All told, SMU’s average hot-rolled coil price stands at $685 per ton, up $15 per ton from $670 per ton last week. We recorded similar gains in cold-rolled, up $10 per ton, and in coated products – with both galvanized base and Galvalume base up $15 per ton.

We are keeping our sheet price momentum indicators pointing upward for now. But we’re keeping a close eye on lead times, sentiment, scrap prices, and mill negotiations to determine whether we will continue to do so in January.

We have moved our plate price momentum indicator from lower to neutral following several weeks of stable pricing, and in anticipation of new published pricing from plate mills next month.

Editor’s note: SMU’s offices will be closed from Dec. 24 to Jan. 2. We will next update prices on Tuesday, Jan. 3.

Hot-Rolled Coil: The SMU price range is $640–730 per net ton ($32.00–36.50/cwt), with an average of $685 per ton ($34.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $15 per ton from last week. Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 3–7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: The SMU price range is $840–950 per net ton ($42.00–47.50/cwt) with an average of $895 per ton ($44.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $20 per ton. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–8 weeks*

Galvanized Coil: The SMU price range is $820–950 per net ton ($41.00–47.50/cwt) with an average of $885 per ton ($44.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $15 per ton from last week. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $917–1,047 per ton with an average of $982 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–8 weeks*

Galvalume Coil: The SMU price range is $830–960 per net ton ($41.50-48.00/cwt) with an average of $895 per ton ($44.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end increased $20 per ton. Our overall average is up $15 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,124–1,254 per ton with an average of $1,189 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5–8 weeks*

Plate: The SMU price range is $1,400–1,480 per net ton ($70.00–74.00/cwt) with an average of $1,440 per ton ($72.00/cwt) FOB mill. The lower end of our range increased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $10 per ton from last week. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4–6 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com