Prices

December 14, 2022

Hot Rolled vs Prime Scrap Price Spread Remains Low

Written by Brett Linton

The spread between hot-rolled coil (HRC) and prime scrap prices is narrowing for the second consecutive month, according to Steel Market Update data.

Prices for both products increased in December, following five consecutive months of declines. The latest HRC-prime spread is one of the lowest recorded in more than two years. The spread is now back in line with pre-pandemic levels.

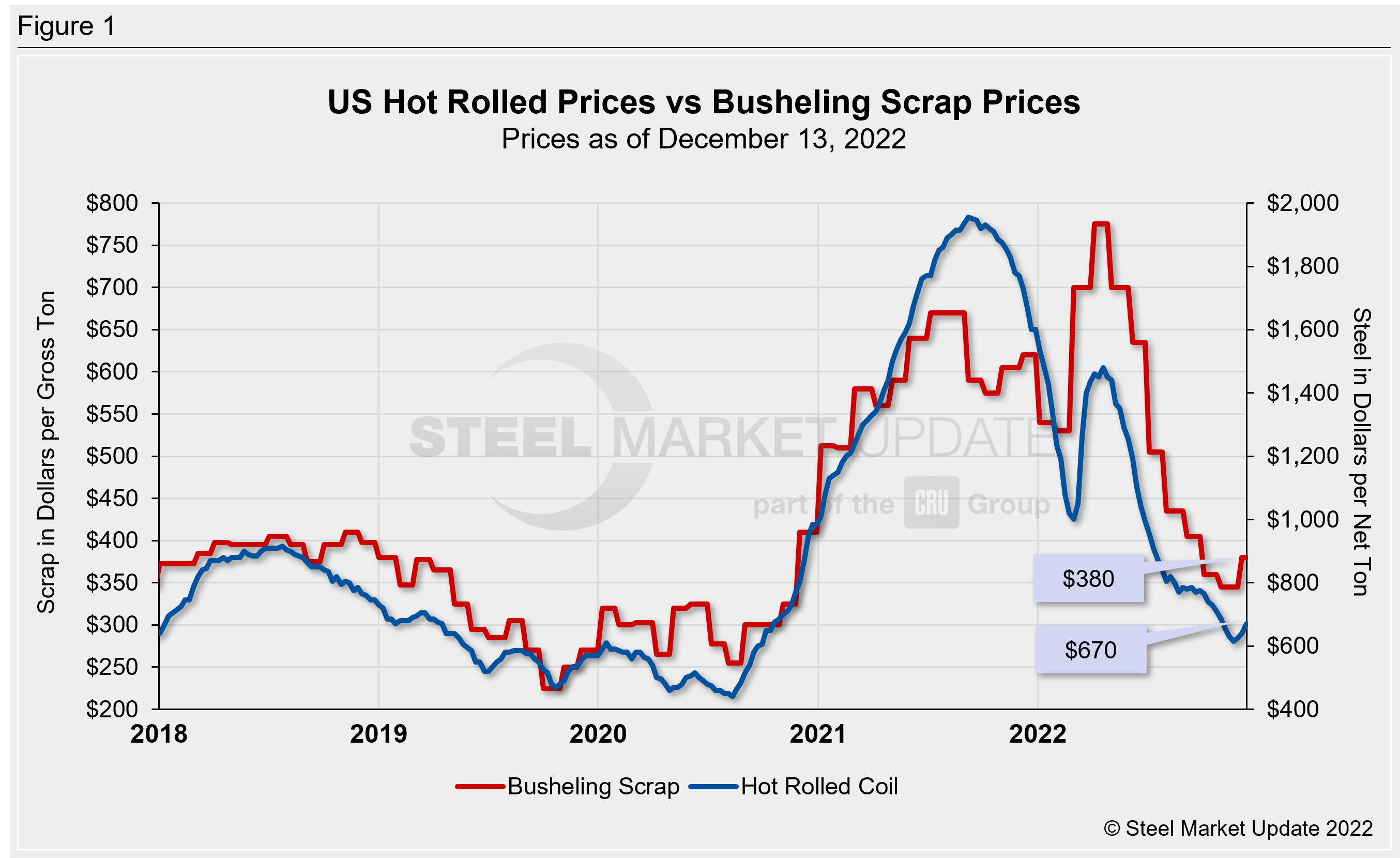

Our hot rolled coil price average increased $30 per ton week-over-week to $670 per net ton ($33.50 per cwt) as of Dec. 13, the third consecutive weekly increase. HRC prices are up $40 per ton versus levels four weeks prior, but we have seen an overall decline of $865 per ton compared to the beginning of the year. Looking back to one year ago when HRC prices were easing from record-high levels, the SMU index through this week is down 60%, or $1,000 per ton.

December scrap prices settled last week, increasing for the first time since March. Busheling prices rose $35 per gross ton month-over-month to $380 per ton. This is $160 per ton less than where prices were at the start of the year. Busheling prices are $395 per ton below April’s historic high of $775 per ton, and $240 per ton less than year-ago levels. Figure 1 shows price histories for each product.

After converting scrap prices to dollars per net ton for an equal comparison, the differential between HRC and busheling scrap prices is $331 per net ton through Dec. 10. Last week we saw a spread of $301 per ton, the smallest recorded since September 2020 (Figure 2). The HRC/scrap price spread has averaged $314 per ton over the last four weeks, $368 per ton over the past three months, and $553 per ton across 2022.

Recall that the spread between these two products had been erratic from late 2020 through mid-2022; it reached a record-high of $1,428 per ton in September 2021, and then fell to an 18-month low of $375 per ton six months later. For comparison, the average spread throughout 2021 was $1,080 per ton, with 2020 averaging $310 per ton and 2019 averaging $324 per ton.

PSA: Did you know our Interactive Pricing Tool has the capability to show steel and scrap prices in dollars per net ton, dollars per metric ton, and dollars per gross ton?

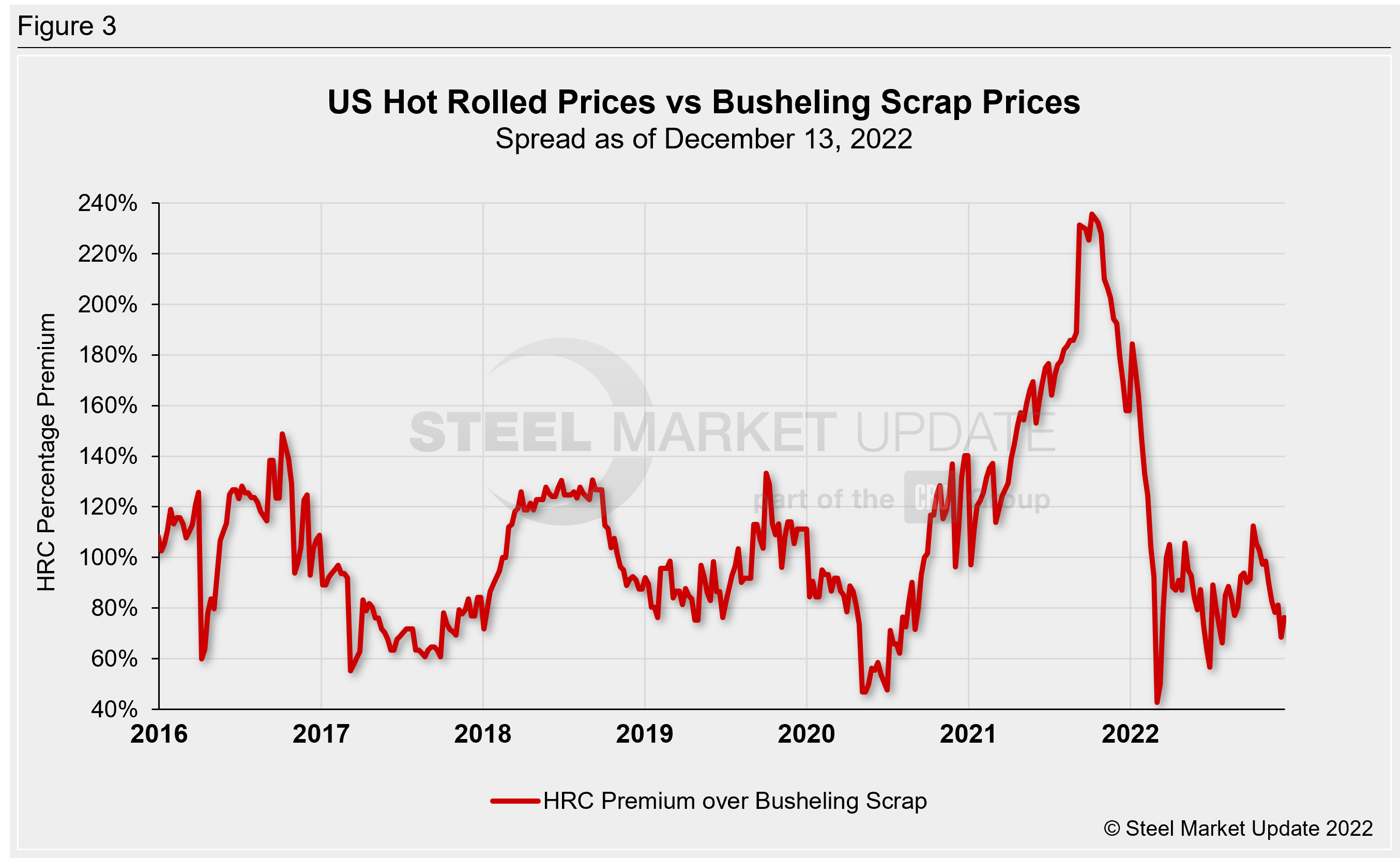

Figure 3 explores this relationship in a different way – we have graphed the spread between HRC and busheling scrap prices as a percentage premium over scrap prices. HRC prices now carry a 76% premium over prime scrap, whereas 2022 YTD has averaged 94%. The month of November averaged 86%, October 105%, September 92%, and August 83%. Back in early March, the premium briefly reached a multi-year low of 43%, having fallen from a record high of 236% last October. The same month one year ago, HRC held an average premium of 166% over scrap, while December 2020 saw an average premium of 124%. HRC held the lowest premium over busheling scrap back in November 2011, when it reached 29%.

This comparison was inspired by reader suggestions. If you would like to chime in with topics you want us to explore, reach out to our team at News@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com