Market Data

December 13, 2022

SMU Price Ranges: We Found the Floor, Where's the Ceiling?

Written by Michael Cowden

Hot-rolled coil prices have risen for a third consecutive on the heels of a $60-per-ton ($3-per-cwt) post-Thanksgiving price hike by domestic mills.

Also providing a lift to sheet prices are higher scrap costs, expectations of buyer restocking in the first quarter, and a sense among mills that momentum is on their side.

A second round of price hikes, this time $50 per ton, was rolled out by Cleveland-Cliffs Inc. on Tuesday and followed by at least one other domestic mill.

The impact of that price hike is not reflected in our current pricing data. But it is part of the reason that we have adjusted our sheet pricing momentum indicators to Higher. Other factors include longer lead times and fewer mills willing to negotiate discounts.

All told, SMU’s benchmark hot-rolled coil price stands $670 per ton, up $30 per ton from the week prior and up $55 per ton from $615 before Thanksgiving – a period that saw discounting ahead of the price hikes.

Also up are cold-rolled coil prices (+$35/ton), galvanized prices (+$30 per ton), and Galvalume prices (+$40 per ton), according to our interactive pricing tool.

Our plate momentum indicator continues to point to Lower in the wake of Nucor’s announced $140-per-ton price decrease. A bit of steel trivia: This is the first time our sheet price momentum indicators and our plate momentum indicators have pointed in opposite directions.

Hot-Rolled Coil: The SMU price range is $630–710 per net ton ($31.50–35.50/cwt) with an average of $670 per ton ($33.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $30 per ton compared to one week ago. Our overall average is up $30 per ton from last week. Our price momentum indicator on hot-rolled steel now points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: The SMU price range is $840–930 per net ton ($42.00–46.50/cwt) with an average of $885 per ton ($44.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end increased $30 per ton. Our overall average is up $35 per ton from one week ago. Our price momentum indicator on cold-rolled steel now points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 4–8 weeks

Galvanized Coil: The SMU price range is $820–920 per net ton ($41.00–46.00/cwt) with an average of $870 per ton ($43.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $30 per ton from last week. Our price momentum indicator on galvanized steel now points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $917–1,017 per ton with an average of $967 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–8 weeks

Galvalume Coil: The SMU price range is $820–940 per net ton ($41.00-47.00/cwt) with an average of $880 per ton ($44.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $40 per ton compared to last week. Our overall average is up $40 per ton from one week ago. Our price momentum indicator on Galvalume steel now points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,114–1,234 per ton with an average of $1,174 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–8 weeks

Plate: The SMU price range is $1,380–1,480 per net ton ($69.00–74.00/cwt) with an average of $1,430 per ton ($71.50/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago, as did our overall average. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–7 weeks

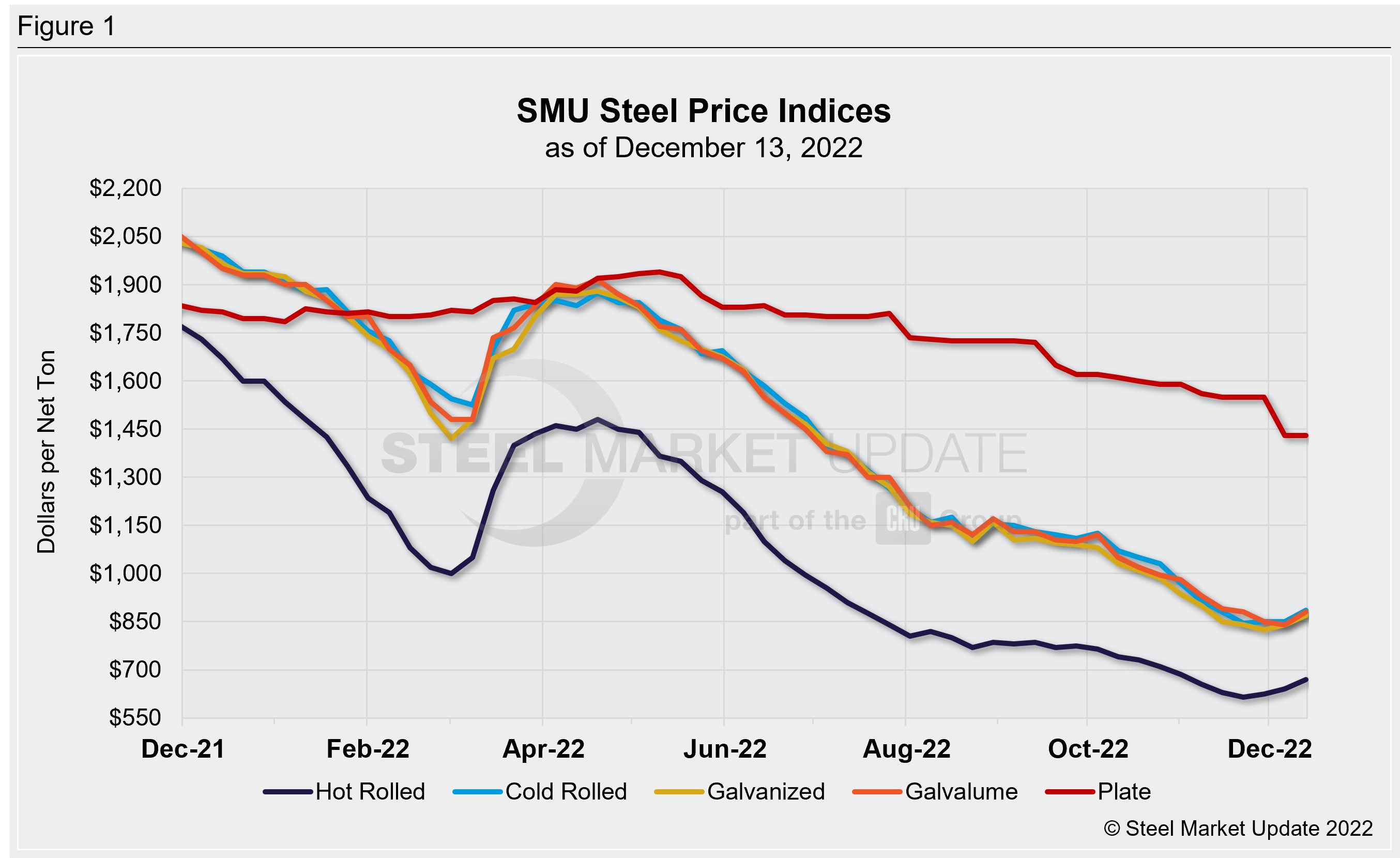

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com