Market Data

December 6, 2022

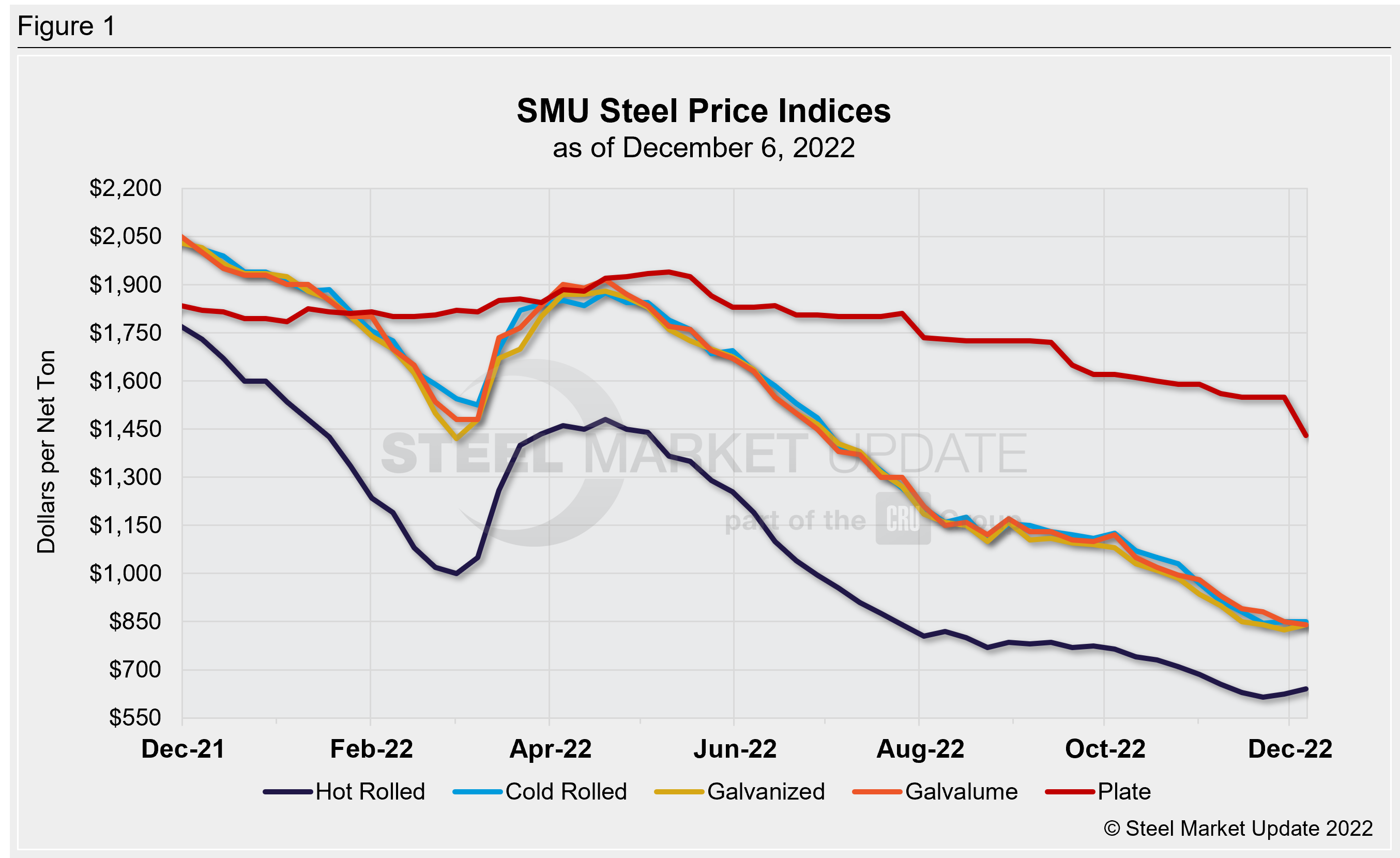

SMU Price Ranges: Sheet Finds a Floor, Plate Still Falling

Written by Michael Cowden

Sheet price hikes announced last week by domestic mills appeared to have succeeded in putting a floor under tags this week.

The question now is to what extent the increases will stick and whether those gains will be sustainable.

Our hot-rolled coil price reflects broader market trends. SMU’s average HRC price stood at $615 per ton ($30.75 per cwt) on Nov. 22, the week before mills rolled out $60-per-ton price increases. It has risen to $640 per ton following two consecutive weeks of modest gains.

Have mills achieved the $60/ton price hike? No. But we have seen prices rise in consecutive weeks for the first time since March, following Russia’s invasion of Ukraine. That’s a notable achievement.

We are keeping our sheet price momentum indicators at neutral for now. We could switch them to higher should we start to see lead times increase and mills less willing to negotiate lower prices when we release full market survey data later this week.

Plate prices went the other way. They fell roughly in tandem with a $140-per-ton price decrease announced by Nucor. Our plate price momentum indicator continues to point toward lower.

We have adjusted our sheet price momentum indicator to Neutral until the market determines whether recent mill price hikes will hold. Our plate momentum indicator, in contrast, continues to point Lower.

Hot-Rolled Coil: The SMU price range is $600–680 per net ton ($30.00–34.00/cwt) with an average of $640 per ton ($32.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $15 per ton from last week. Our price momentum indicator on hot-rolled steel points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 4–6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: The SMU price range is $800–900 per net ton ($40.00–45.00/cwt) with an average of $850 per ton ($42.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago, as did our overall average. Our price momentum indicator on cold-rolled steel points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 4–8 weeks*

Galvanized Coil: The SMU price range is $780–900 per net ton ($39.00–45.00/cwt) with an average of $840 per ton ($42.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end increased $50 per ton. Our overall average is up $15 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $877–997 per ton with an average of $937 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–8 weeks*

Galvalume Coil: The SMU price range is $780–900 per net ton ($39.00-45.00/cwt) with an average of $840 per ton ($42.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $40 per ton compared to last week, while the upper end increased $20 per ton. Our overall average is down $10 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,074–1,194 per ton with an average of $1,134 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 3–8 weeks*

Plate: The SMU price range is $1,380–1,480 per net ton ($69.00–74.00/cwt) with an average of $1,430 per ton ($71.50/cwt) FOB mill. The lower end of our range declined $100 per ton compared to one week ago, while the upper end decreased $140 per ton. Our overall average is down $120 per ton from last week. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com