Analysis

December 1, 2022

Final Thoughts

Written by Michael Cowden

If you’re somewhat new to the steel industry, the wave of $60-per-ton sheet price hikes announced by mills in the US and Canada this week might have seemed a little weird.

Why did they all announce it at once? Why did they all pick the exact same number to go up by?

Let’s say you joined the industry about two years ago. You might have seen some mostly isolated increases here and there. But rarely a coordinated, public effort to raise prices.

For starters, in 2021, no one needed a reminder about which way prices were going – it was just a question of how high they would rise.

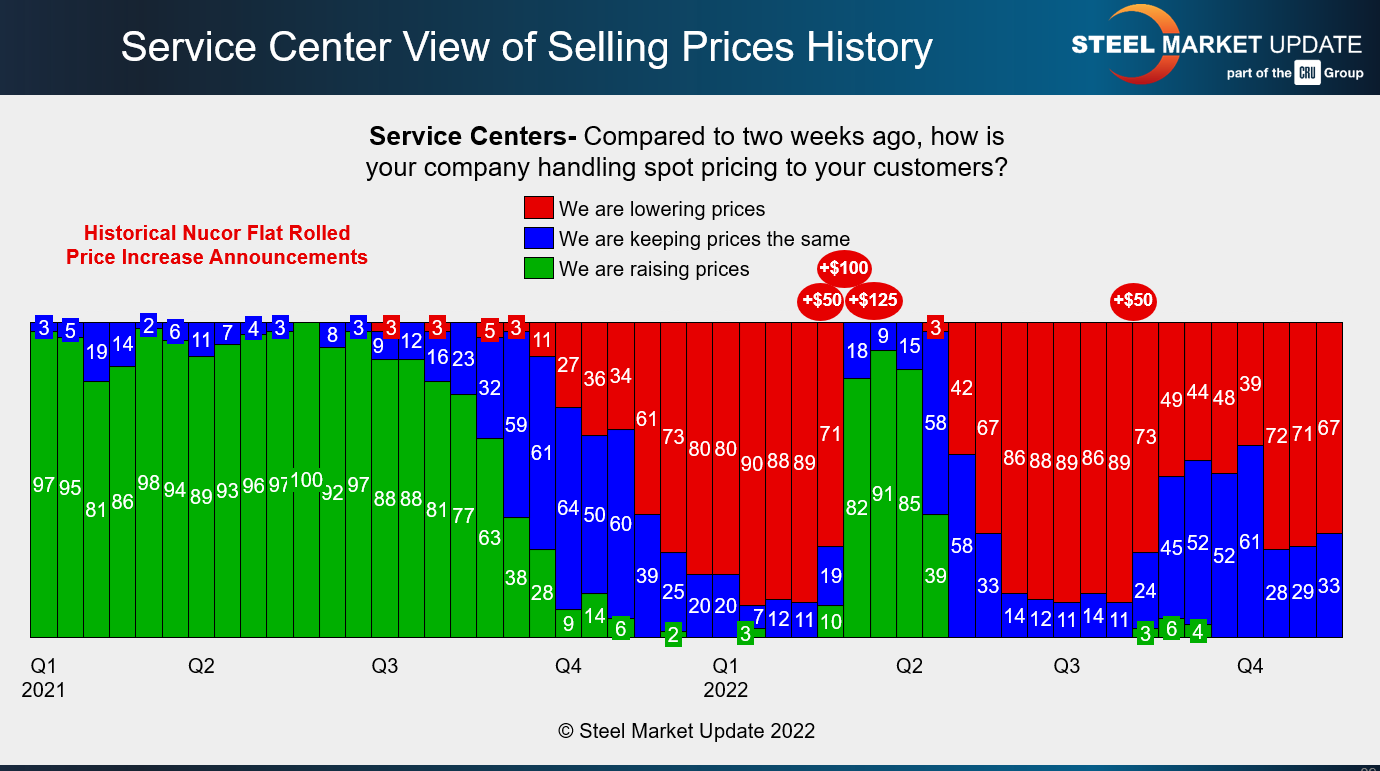

Check out the slide below:

We saw steel prices rise to their highest levels ever in 2021 without one price hike from Nucor, one of the leading sheet producers in the US.

The market was so hot then that it probably didn’t make sense to announce a price hike. If you were a mill, why would you have limited yourself to $60 per ton when you could raise prices every day without much pushback from customers mostly concerned about securing tons?

But if you’ve been in the steel market for a while, the wave of price hikes this week feels like yet another sign that we’re returning to a “new” normal that looks a lot like the “old” normal. Just like current ~$600/650 per ton HRC prices feel a lot like the old normal.

First, the mills announce a price hike to stop the bleeding. Then they announce a second to shore up the first. And then a third hike might actually succeed in significantly raising prices. The third time is a charm! It’s almost axiomatic.

As for why $60 per ton, it’s maybe best not to overthink it. The first mill out of the gate, Cliffs, in this case, was up $60 per ton. So that’s why everyone else was up $60 per ton. The steel industry is sometimes criticized for having a herd mentality. That’s often an unfair criticism. But it tends to fit when it comes to price hike announcements.

Whether these increases will stick is another story. Time will tell. Our sheet momentum indicators remain Neutral for a reason. But it’s notable that the forward curve on HRC futures has moved so much higher than spot prices.

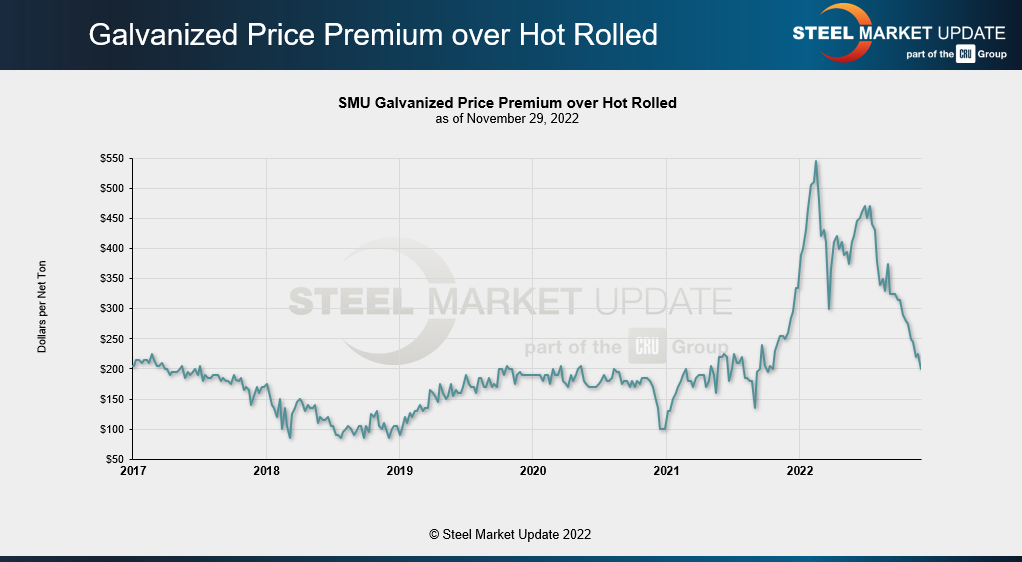

Another thing that’s back to the “old” normal is the spread between hot-rolled coil and base prices for galvanized product:

HR-galv spreads had been on a wild ride. That spread was as high as $550 per ton earlier this year. But just as we’ve seen hot-rolled coil prices return to “old” normal levels, so too have HR-galv spreads. They’ve dropped back to $200 per ton – which was old normal for much of the last five-to-six years

Will they stay there? It’s worth asking. Because we are seeing an increase not only in hot strip mill capacity but also in galvanizing capacity, as Wolfe Research managing director Timna Tanners noted in the SMU Community Chat yesterday.

We saw the HR-galv spread as low as ~$100 per ton for much of 2018. Those of you who’ve been around the industry for a while can probably remember when it was well below that.

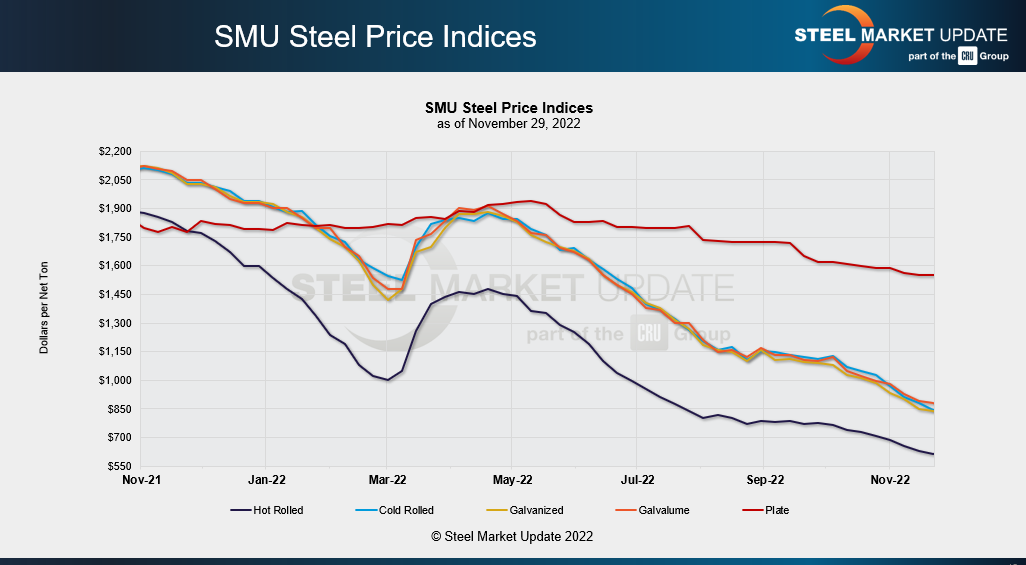

That brings me to plate. That’s one corner of the steel market where things still don’t look anything close to “old” normal:

Yes, sheet and plate are separate markets with different dynamics. Case in point: Nucor is cutting plate prices by $140 per ton even as it raises sheet prices by $60 per ton. Perhaps such moves will help to gradually narrow that gap, which stands at $925 per ton as of our last check of the market.

I still don’t understand how plate maintains such a hefty premium over HR. You have mills like SDI Sinton that can make thick coil that can compete with thinner sizes for plate. You also have Nucor starting up a new plate in Kentucky by the end of the year.

Yes, that mill, like all new mills, will take time to ramp up. But the point is, there is more capacity coming into the market in plate, just as there is in sheet. There is also HR competing aggressively with plate on certain sizes. Why would we predict that new capacity would depress sheet prices but not plate prices?

I’ve been banging on about how the HR-plate spread is unsustainable since a presentation at the Tampa Steel Conference in February 2022. I’d like to think that with time I’ll be proven right.

But I also remember everyone who has told me over the years that a $200 per ton HR-galv spread isn’t tenable. Perhaps they will be right one day. They’ve been wrong for more than a few years in the meantime.

The Tampa Steel Conference

Speaking of Tampa Steel, we’re pleased to announce that US Steel’s chief commercial officer Kenneth Jaycox will be joining us for a fireside chat at the event.

We’ll have senior mill executives from across North America as well as leading experts on everything from steel prices and logistics to energy and geopolitics.

Be a part of the conversation and the networking too. You can learn more about Tampa Steel and register here.

By Michael Cowden, Michael@SteelMarketUpdate.com