Prices

November 29, 2022

SMU Price Ranges: Will Price Hikes Establish a Floor?

Written by Michael Cowden

The bottom end of SMU’s sheet price ranges firmed up this week following price hikes of $60 per ton ($3 per cwt) announced by Cleveland-Cliffs and US Steel on Monday.

It’s not clear yet whether the price increases will stick in full, in part, or simply stop the bleeding.

Case in point: Our sheet price index was mixed this week, with hot rolled and cold rolled up modestly even as coated prices were down.

What we’re seeing – at least for now – is that the deals significantly below $600/ton on HRC and substantially below $800/ton on CR and coated are mostly gone from the market.

It’s not unusual for mills to discount shortly ahead of a price hike. Recall that last week, ahead of the increases, we saw prices for larger orders of HRC slip into the $500s per ton and those for larger orders for cold rolled and coated dip into the $700s per ton.

We have adjusted our sheet price momentum indicator to Neutral until the market determines whether recent mill price hikes will hold. Our plate momentum indicator, in contrast, continues to point Lower.

Hot-Rolled Coil: The SMU price range is $600–650 per net ton ($30.00–32.50/cwt) with an average of $625 per ton ($31.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $10 per ton from last week. Our price momentum indicator on hot-rolled steel now points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: The SMU price range is $800–900 per net ton ($40.00–45.00/cwt) with an average of $850 per ton ($42.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $5 per ton from one week ago. Our price momentum indicator on cold-rolled steel now points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 4–7 weeks

Galvanized Coil: The SMU price range is $800–850 per net ton ($40.00–42.50/cwt) with an average of $825 per ton ($41.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end declined $50 per ton. Our overall average is down $15 per ton from last week. Our price momentum indicator on galvanized steel now points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $897–947 per ton with an average of $922 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–7 weeks

Galvalume Coil: The SMU price range is $820–880 per net ton ($41.00-44.00/cwt) with an average of $850 per ton ($42.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $60 per ton. Our overall average is down $30 per ton from one week ago. Our price momentum indicator on Galvalume steel now points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,114–1,174 per ton with an average of $1,144 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–7 weeks

Plate: The SMU price range is $1,480–1,620 per net ton ($74.00–81.00/cwt) with an average of $1,550 per ton ($77.50/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago and the overall average is unchanged from last week. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–6 weeks

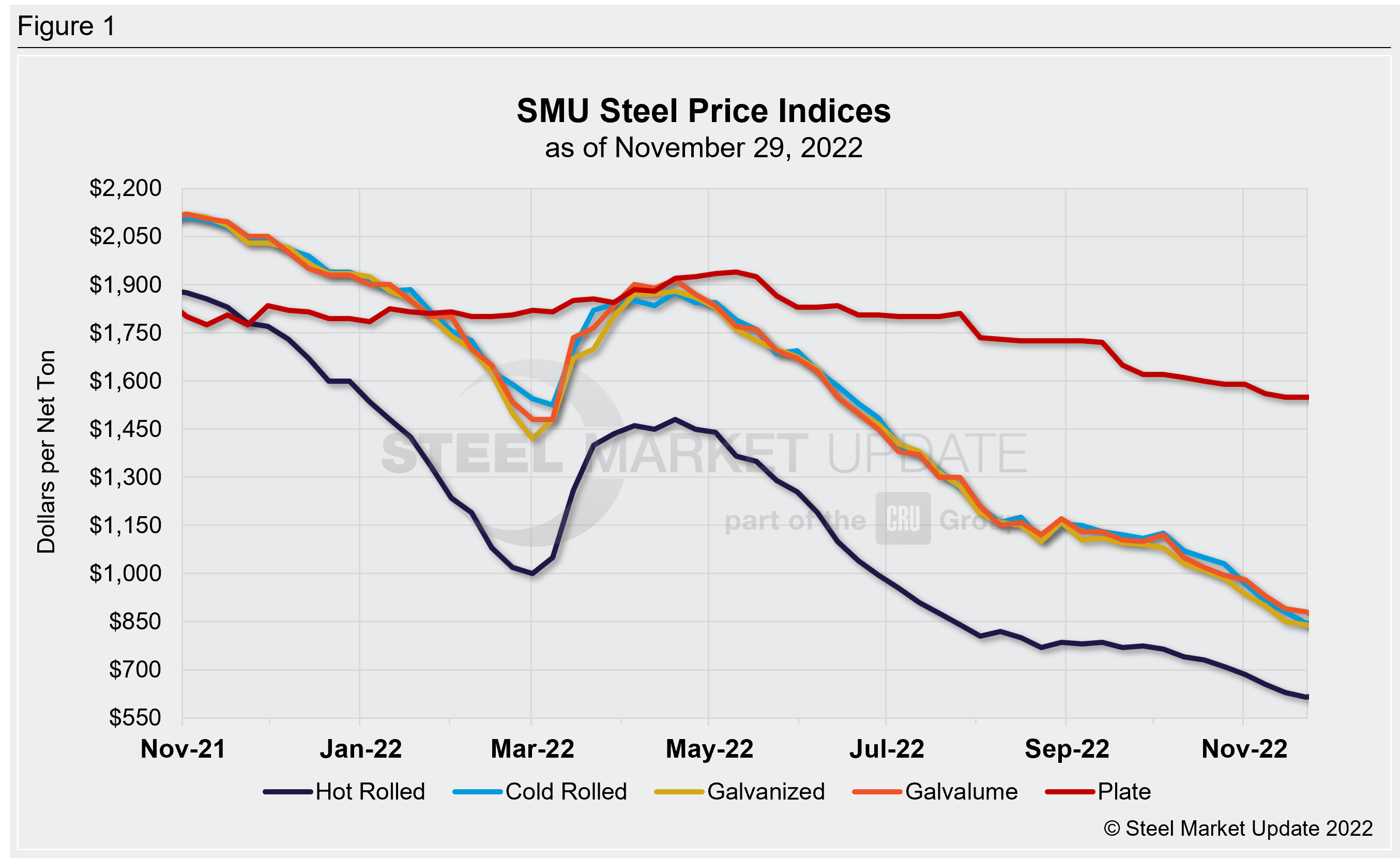

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com