Prices

October 18, 2022

SMU Price Ranges: All Products Grind Lower

Written by Brett Linton

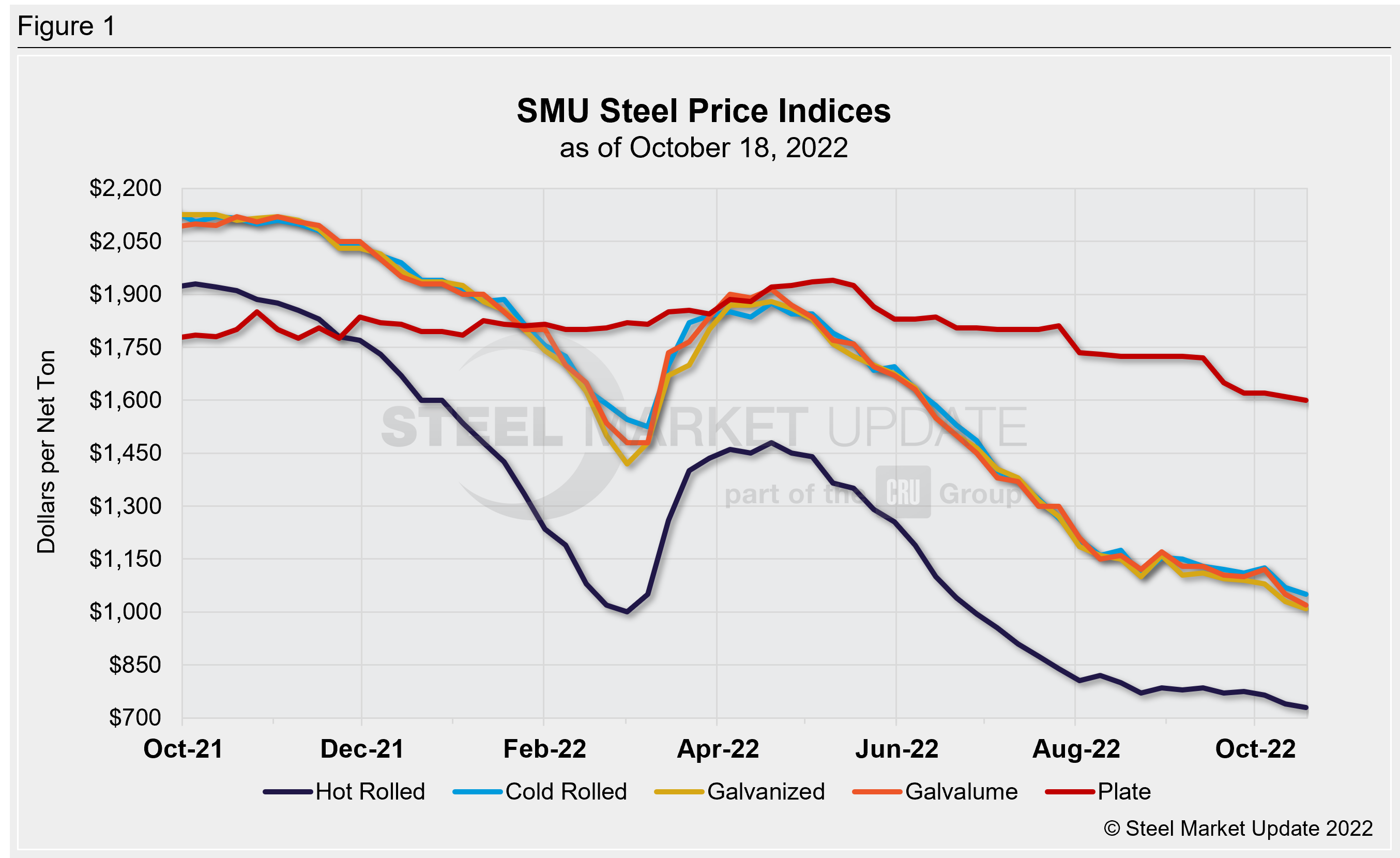

Steel prices trended lower again this week, the second consecutive week of moderate declines, according to Steel Market Update sources. Sheet prices declined between $10–30 per net ton compared to last week, now at levels not seen since late 2020. Plate prices were broadly unchanged from last week, but are slowly easing towards levels last seen 15 months ago. These declines follow nearly two months of mostly sideways or modestly down prices.

Hot-rolled sheet and plate prices eased $10 per ton versus last week, while cold rolled and coated prices fell at a moderately faster rate of $20–30 per ton.

SMU holds its sheet price momentum indicators at Lower, while plate momentum remains at Neutral.

Hot-Rolled Coil: SMU price range is $700–760 per net ton ($35.00–38.00/cwt) with an average of $730 per ton ($36.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $10 per ton compared to one week ago. Our overall average is down $10 per ton from last week. Our price momentum indicator on hot-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: SMU price range is $1,000–1,100 per net ton ($50.00–55.00/cwt) with an average of $1,050 per ton ($52.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $20 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold-Rolled Lead Times: 5–8 weeks

Galvanized Coil: SMU price range is $950–1,070 per net ton ($47.50–53.50/cwt) with an average of $1,010 per ton ($50.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is down $20 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,047–1,167 per ton with an average of $1,107 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–8 weeks

Galvalume Coil: SMU price range is $990–1,050 per net ton ($49.50-52.50/cwt) with an average of $1,020 per ton ($51.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week, while the upper end declined $50 per ton. Our overall average is down $30 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,284–1,344 per ton with an average of $1,314 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5–7 weeks

Plate: SMU price range is $1,580–1,620 per net ton ($79.00–81.00/cwt) with an average of $1,600 per ton ($80.00/cwt) FOB mill. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $10 per ton from last week. Our price momentum indicator on plate steel points to Neutral until the market establishes a clear direction.

Plate Lead Times: 2–6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com