Overseas

October 18, 2022

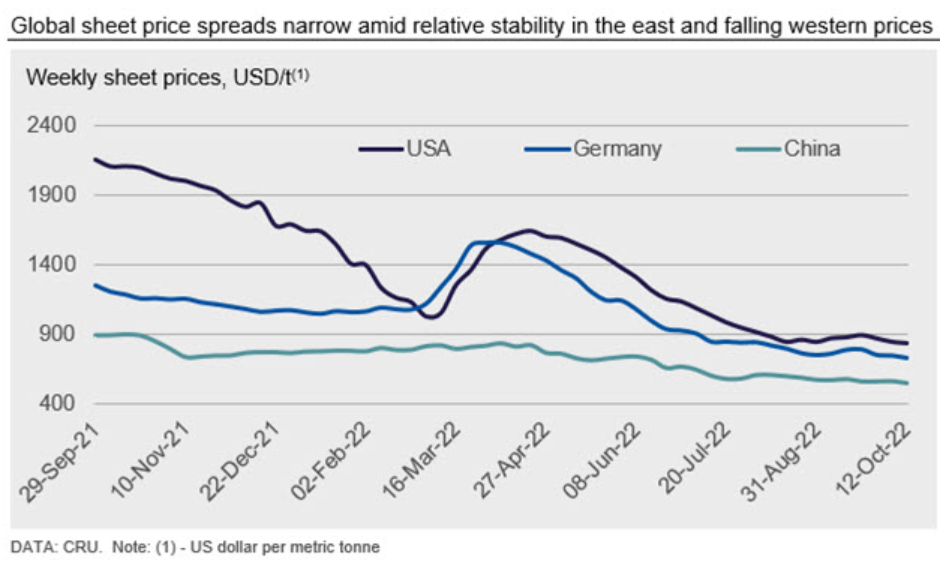

CRU: Sheet Prices Fall in the West, Show Some Stability in the East

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Sheet Products Monitor

Sheet prices took split paths between eastern and western regions. Prices in Asia found support from restocking in China and supply disruptions in South Korea. Meanwhile, western markets remained weak, and we expect this to persist over the near term.

October is the sixth month in a row that the CRUspi has fallen, although price falls were much more pronounced in the US and Europe relative to Asia. In all, The CRUspi fell by 4.4% to 208.5 month-on-month (MoM). In our view, there is still more downside for prices in most markets, and we expect further declines for the remainder of the year.

Sheet price directions around the world were split by region, with stability or even gains occurring in Asia while western markets continued their downward trajectory. For the former, there was a resurgence in buying activity in China following the Golden Week holidays which, along with an uptick in demand from many key end-use sectors, sent weekly prices a little higher, although MoM prices were down slightly. In conjunction with output disruptions in South Korea, this market stability in China carried over into other areas of Asia like Japan, where exporters have taken advantage of market tightness within the region and also had some success in penetrating the European market.

In both Europe and the US, supply continues to meaningfully outweigh demand, resulting in yet more price falls MoM.

Following the conclusion of a seven-day holiday in China, a combination of restocking activity and bullish economic indicators allowed for domestic sheet price stability. Indeed, the automotive, manufacturing, and home appliance sectors all showed increased activity in September—primarily the result of government measures to encourage consumer spending in these areas.

Prices in other areas of Asia also found support from this relative stability in Chinese prices alongside supply disruptions caused by flooding in South Korea. POSCO’s Pohang plant was temporarily closed due to the flooding and, while the blast furnaces at the Pohang works were unscathed and restarted within days, production units including hot rolling lines will take more time to be repaired and restarted. This led to an increase in inquiries for Japanese sheet products in the region and created a tighter market overall.

In Japan, exporters have also had some limited success in sending material to Europe, where domestic mills have curtailed production due to high energy prices.

These output reductions in Europe, while temporarily stabilizing prices, have not proven enough to prevent prices from sliding further in October. In fact, European sheet prices have fallen by an average of almost €40 per ton MoM across Germany and Italy.

Mid-September proved to be the high point of a modest price upcycle that saw sheet prices rise by as much as €48 per ton over a few weeks. This increase has now been completely erased and prices have returned to where they were at the end of August, or lower in some cases.

A similar supply/demand imbalance is at play in the US, where hot-rolled coil prices were down by ~5% MoM. These most recent price declines are the result of high inventory levels relative to demand as yet more new capacity comes online amid a further decline in scrap prices.

Outlook: US, European Prices Will Continue to Slide

Price risks remain largely to the downside for both the US and Europe. For the former, service center inventory levels appear poised to rise further as new capacity continues to ramp up. For the latter, there are few obvious drivers that would reverse ongoing sheet price falls. We expect that continued destocking, weak real demand, and sufficient supply will combine to push spot prices further down before the end of the year. Thereafter, we do see the potential for prices to increase in the first quarter of 2023.

In Asia, stable sheet prices in China are enticing market participants to restock in anticipation that prices will rise further. However, some participants are still holding a wait-and-see approach, especially before the Party Congress meeting on Oct. 16 when government policy guidance will be settled.

Overall, we see this month’s price stability as short-lived given weaker emissions controls from the government and upcoming seasonal market weakness. Meanwhile, export demand for Japanese sheet products should remain supported in October before seasonality starts to slow end-use demand and POSCO’s sheet production lines restart in November.

This article was originally published on Oct.13 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com