Prices

October 16, 2022

CRU: Metallics Prices Have Not Yet Bottomed

Written by Puneet Paliwal

By CRU Senior Analyst, Puneet Paliwal, from CRU’s Scrap, DRI/HBI & Pig Iron Monitor

Global scrap prices stay subdued while those of ore-based metallics have found some support. Overall metallics demand continues to be hampered by the steel market weakness, a trend which may sustain through the short term, particularly in Europe.

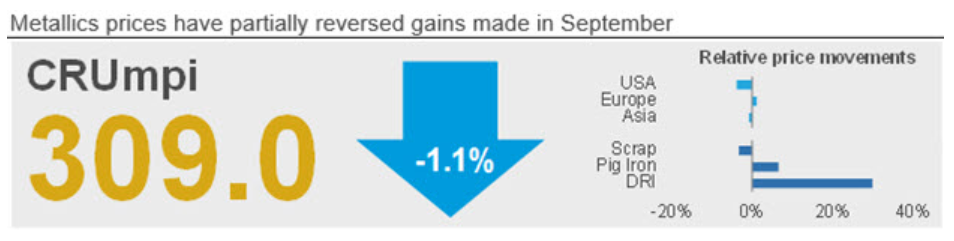

The CRU metallics price indicator (CRUmpi) fell by 1.1% month-on-month (MoM) to 309.0 in October, partly reversing the gains made in September. Scrap prices have weakened across key geographies of Europe and the Americas due to subdued steel market sentiment, continuous curtailment of steel output, and resultant carryover of metallics inventory by major steelmakers.

Over the past month, scrap supply has been higher than demand in several regions, causing delivery lead times to reduce and forcing scrap suppliers to lower their prices amid falling bids from buyers. Even with the downward price revisions, trade volumes have been low as buyers continue to work through existing inventory, which is depleting at a slow pace.

Some gains have been reported for ore-based metallics prices, particularly pig iron, due to further disruption in CIS origin supply, but downside risks remain. There are expectations of winter supply cuts for both steel and scrap in major markets during Q4. Price trends will, thus, be dictated by the relative intensity of these curtailments.

A common theme emerging across key regions including North America, Europe, and China is that the steel market sentiment will remain subdued as we approach the end of 2022. Governments and central banks across these regions are working through various macroeconomic challenges including a rapid rise in inflation, a widening energy crisis, and volatile exchange rates.

Measures being undertaken are not particularly steel intensive, in fact, rising interest rates to control inflation is gradually decreasing demand for steel-consuming goods. Given the related caution, buyers throughout the steel supply chain are trying to conserve cash as profitability weakens. Steelmakers are drawing deeper into existing inventory of raw materials (be it metallics, ferro-alloys, iron ore, or coal), and this destocking is lasting for longer due to output curtailments amid falling steel demand, prices, and margins.

There are several trends worth highlighting in the global metallics market this month. In the US, for instance, shredded scrap now holds a premium to #1 busheling for the first time since 2016. This is because the supply of prime scrap stays robust due to higher automotive output while those of obsolete is affected by adverse weather and subdued prices, which have disincentivized collection.

Moreover, US-based mills have a high inventory of pig iron, which was bought heavily earlier this year, following the outbreak of the war in Ukraine. This has reduced demand for prime-grade scrap and has turned bids lower. Scrap and pig iron prices have also decoupled in the US, as pig iron prices are being driven more by geopolitics than demand. Nevertheless, the sharp contraction in prime scrap prices this month does put into question the sustenance of pig iron prices at current levels.

In Europe, scrap prices are being dragged down by large-scale steel production cuts. These cuts are a response to high energy/electricity costs and persistent weak downstream demand due to deteriorating economic conditions. While governments within the region have introduced several measures to support the general economy, prospects for the steel industry remain bleak.

A notable exception is the Aiuti ter decree in Italy, which has increased tax credits for energy-intensive industries (including steelmakers and re-rollers) from 25% to 40% and has resulted in higher steel output, thereby supporting prices of metallics in the country. Consequently, while scrap prices in the rest of the EU have fallen by 8–12 % MoM, Italian scrap and pig iron prices are up 2% MoM, while HBI import prices increased 30% MoM.

In Asia, ample scrap supply amid weak steel production has dragged down prices this month. Chinese domestic scrap supply has increased due to improved construction and manufacturing activity, while weak profitability has undermined mills’ interest in scrap purchases resulting in lower bids. In the rest of Asia, while Southeast Asian prices stay subdued, a surprise rise in Indian scrap imports has restricted falls in South Asian prices. Indian appetite for imported scrap has increased over the past few months as the lack of coal availability has lowered domestic DRI output, while construction steel demand and prices are on the rise.

Outlook: Prices Upside to be Limited by Cuts in Steel Output

As we enter the winter season in the northern hemisphere, obsolete scrap supply is expected to be seasonally lower, which may provide some support to prices. The extent of price support, however, will be dictated by the intensity of steel production cuts across major economies during this period.

Broadly, we expect metallics demand will remain weak in Q4 alongside inventory management, coupled with the continued weakness in finished steel production and demand. In Europe, macroeconomic developments, as well as energy concerns, will fuel an overall bearish sentiment through year-end. In the US, the rare inversion of shredded and busheling prices is likely to last at least until the end of 2022 and may extend through to the first quarter of 2023 as we expect little to change on the supply side of the different products in the next months.

This article was originally published on Oct. 13 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com