Prices

October 14, 2022

Hot Rolled vs Scrap Price Spread Stabilizes

Written by Brett Linton

The relationship between hot-rolled coil (HRC) and prime scrap prices has stabilized in the last few weeks, according to Steel Market Update data. After briefly stalling in August, hot rolled prices have began to slide downwards again since the beginning of this month. Busheling scrap prices settled at down $45 per gross ton last week, the sixth consecutive month of declining prices. Overall, we had seen a stable delta between the two products since late July. The latest spread is less than one-third what it was this time last year, but it is still higher than pre-pandemic levels.

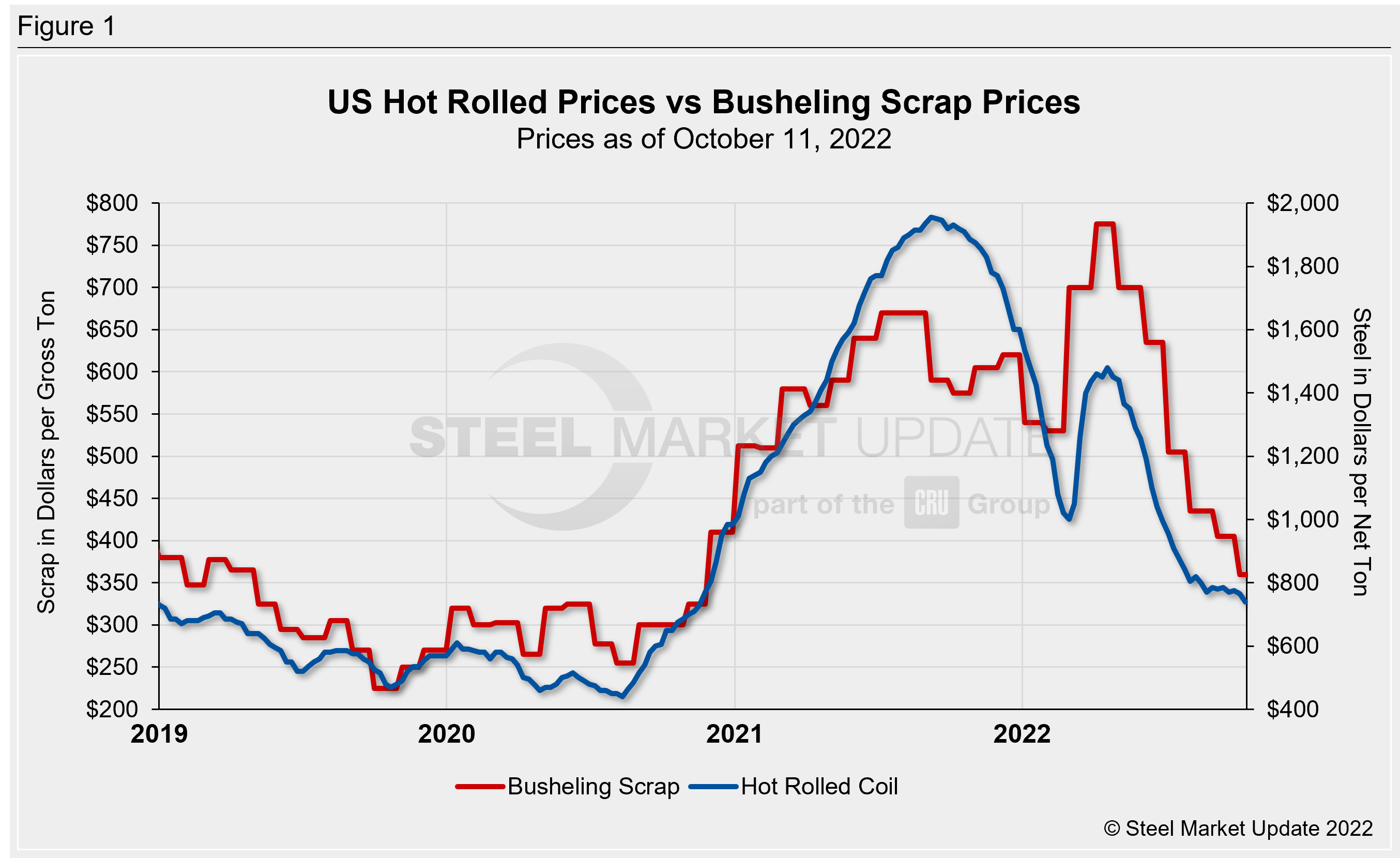

Our hot rolled coil price average declined $25 per ton week-over-week to $730 per net ton ($36.50 per cwt) as of Oct.11. HRC prices are down $45 per ton compared to levels four weeks prior and have seen an overall decline of $795 per ton since the start of the year. Looking back to one year ago, prices today are down $1,180 per ton. Recall our HRC price peaked just over one year ago at $1,955 per ton.

Busheling scrap prices were settled last week at $360 per gross ton for October, down $45 per gross ton from September and down $180 per gross ton compared to the start of the year. Busheling prices are now down $415 per gross ton from April’s historic high of $775 per gross ton, and down $215 per gross ton versus levels one year ago. Scrap prices have fallen by an average of $69 per gross ton per month since peaking in April. Prior to this year, the previous high for busheling scrap was $670 per ton in July and August 2021. Figure 1 shows price histories for each product.

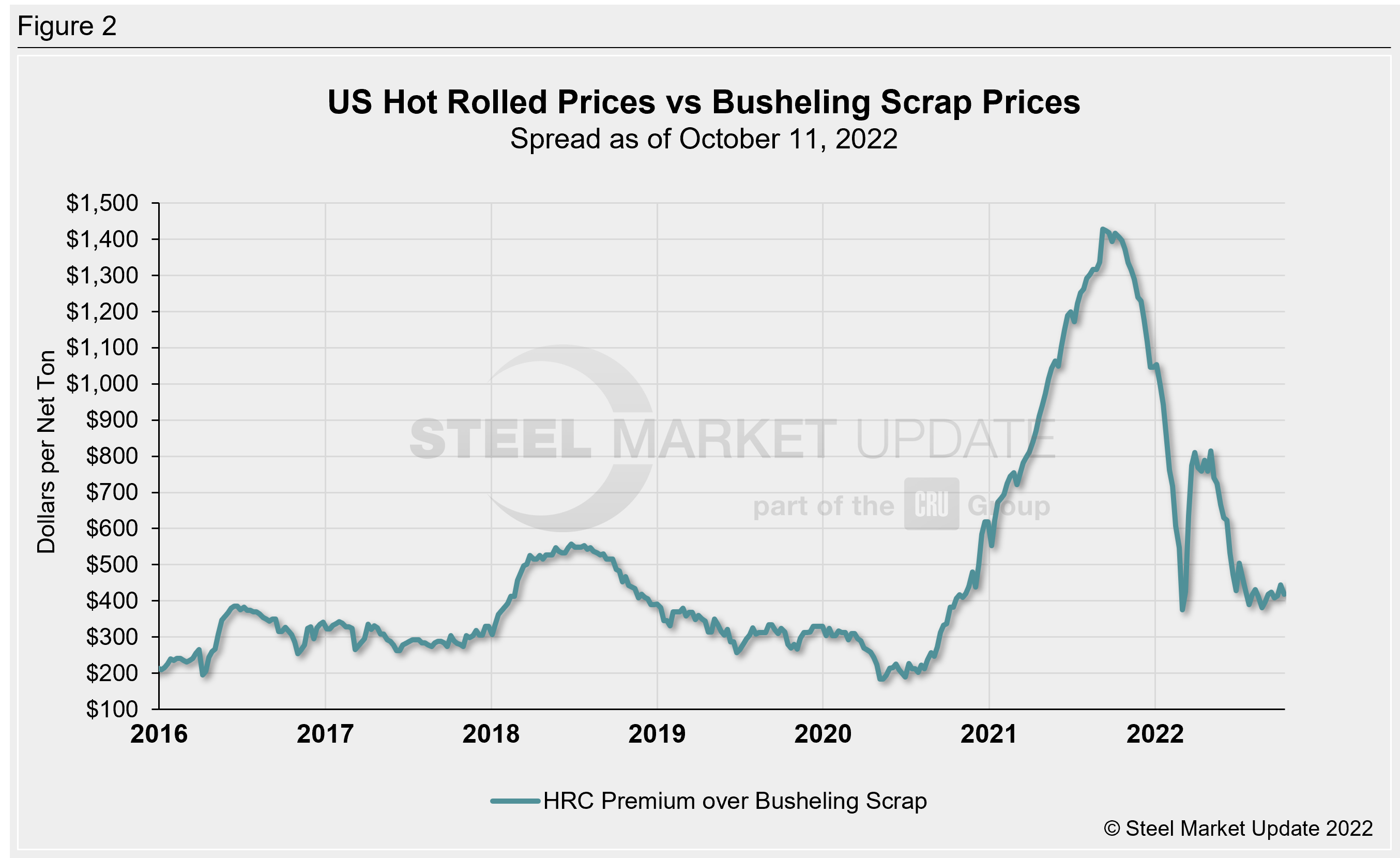

After converting scrap prices to dollars per net ton for an equalized comparison, the differential between HRC and busheling scrap prices is $419 per net ton. This is in line with spreads seen over the past month, and one of the smaller spreads compared to the last two years (Figure 2). Back in mid-August we saw a spread of $382 per ton, the second smallest figure seen since October 2020. The HRC/scrap price spread has averaged $421 per ton over the last four weeks and $414 per ton over the past quarter. Recall that the spread between these two products has been erratic since late 2020. It reached a record-high of $1,428 per ton in September 2021 and fell to an 18-month low of $375 per ton six months later. For comparison, the average spread throughout 2021 was $1,080 per ton, with 2020 averaging $310 per ton and 2019 averaging $324 per ton.

PSA: Did you know our Interactive Pricing Tool has the capability to show steel and scrap prices in dollars per net ton, dollars per metric ton, and dollars per gross ton?

Figure 3 explores this relationship in a different way – we have graphed the spread between HRC and busheling scrap prices as a percentage premium over scrap prices. HRC prices now carry a 106% premium over prime scrap, the second highest premium seen in the last five months. (The highest spread in that time was just one week ago, at 113% on Oct. 4). Over the past four weeks, the premium has averaged 100%. The month of August averaged 83%, July averaged 77%, and June averaged 70%. Back in early March, the premium briefly reached a multi-year low of 43%, having fallen from a record high 236% premium last October. The same month one year ago, HRC held an average premium of 232% over scrap, while October 2020 saw an average premium of 122%. HRC held the lowest premium over busheling scrap back in November 2011, when it reached 29%.

This comparison was inspired by reader suggestions; if you would like to chime in with topics you want us to explore, reach out to our team at News@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com