Plate

October 9, 2022

Plate Market Report: Lack of Buying Expected to Erode Prices

Written by David Schollaert

US plate prices have been unchanged for nearly three weeks. But that doesn’t mean they aren’t under pressure. Buyers remain mostly on the sidelines of the spot market and are working through inventories as demand slows to a crawl.

The market has been quiet since Nucor announced a $120-per-ton ($6-per-cwt) price cut on discrete plate on Sept. 19. That didn’t change when the Charlotte, N.C.-based steelmaker said it aimed to hold plate prices steady with the opening of its November order book.

“I thought the Nucor announcement was a little odd,” one source told SMU. “They just announced the $6-per-cwt reduction two weeks ago, and now they’re announcing carry-over. It’s good communication, and they’re keeping the market apprised of what they’re doing. But it seemed a little redundant.”

“I think Nucor is just giving a ceiling to their negotiations so they can offer special deals or incentives,” a second source said. “There will be room to negotiate the price down further. We haven’t seen any transactions below $1,600 per ton yet, but I’m sure they will get there.”

One reason for the slowdown: High mill prices for plate have caused service centers to buy amongst each other instead.

“Order pens are in the desk, and no one is buying unless it is a fast-moving item and stock has been depleted,” said a third source. “Service centers are selling below mill cost plus freight to get rid of as much inventory as quickly as possible.”

These dynamics, coupled with reports of plate mills running at roughly 60-70% capacity, are not a good sign for prices. “In general, the plate market is really quiet. There isn’t much buying by service centers or their customers,” a fourth source said.

Sources think the key to pricing going forward will be scrap and what it does in Q4. If scrap prices continue down, plate pricing will follow. But if scrap goes up, which it has traditionally done in the fourth quarter, it could support plate prices.

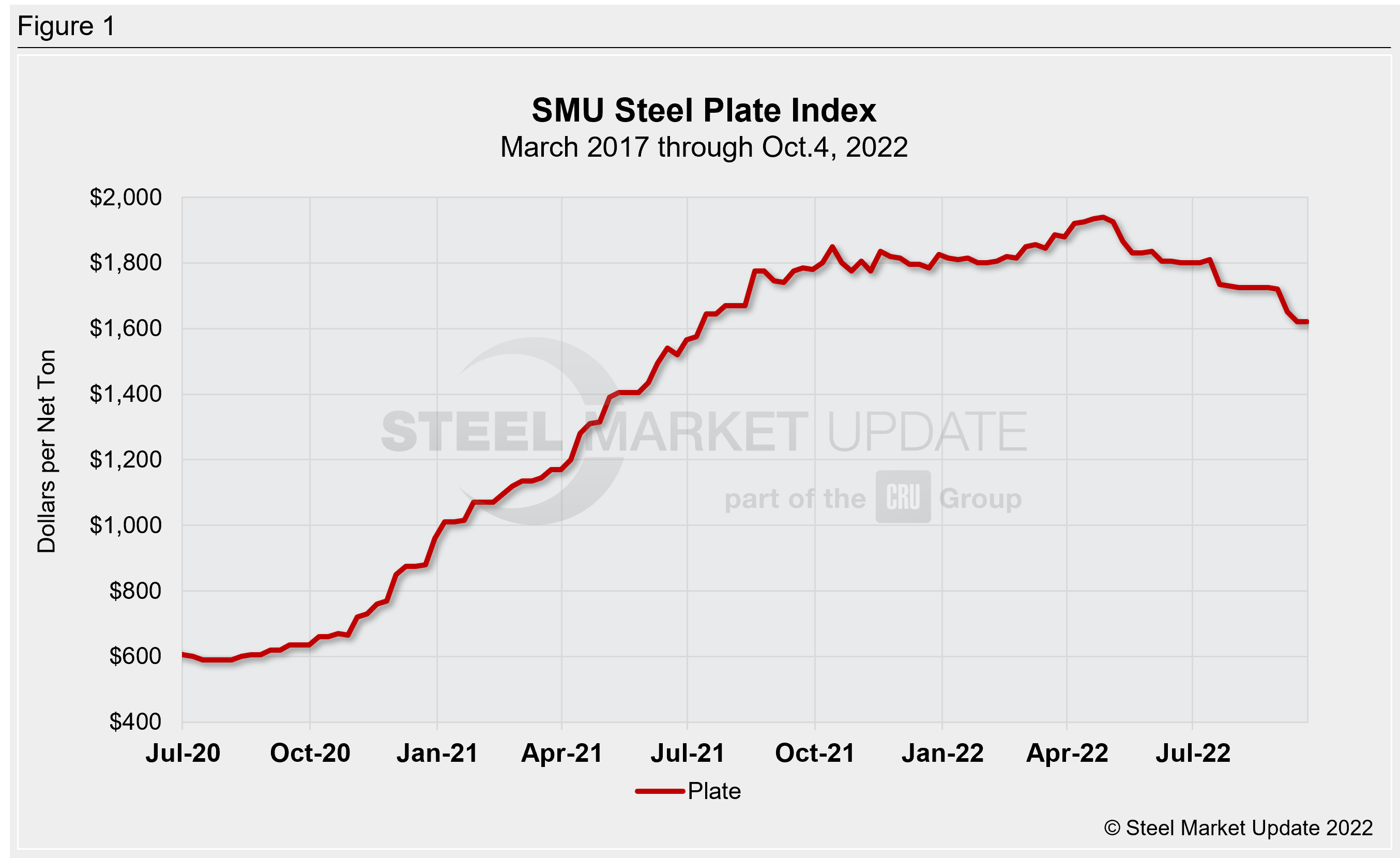

SMU’s most recent check of the market on Oct. 4 placed plate prices between $1,600 and $1,640 per ton with an average of $1,620 per net ton FOB mill, according to our interactive pricing tool (Figure 1). Few deals were done at the top of the range, with the bulk of the market quoting Nucor’s price as the mid-point.

Some Q4 contract business has been done below the $1,600-per-ton mark, and import plate prices are around $1,340 per ton, sources said. But there’s little traction with imports either because of uncertainty around the direction of domestic prices.

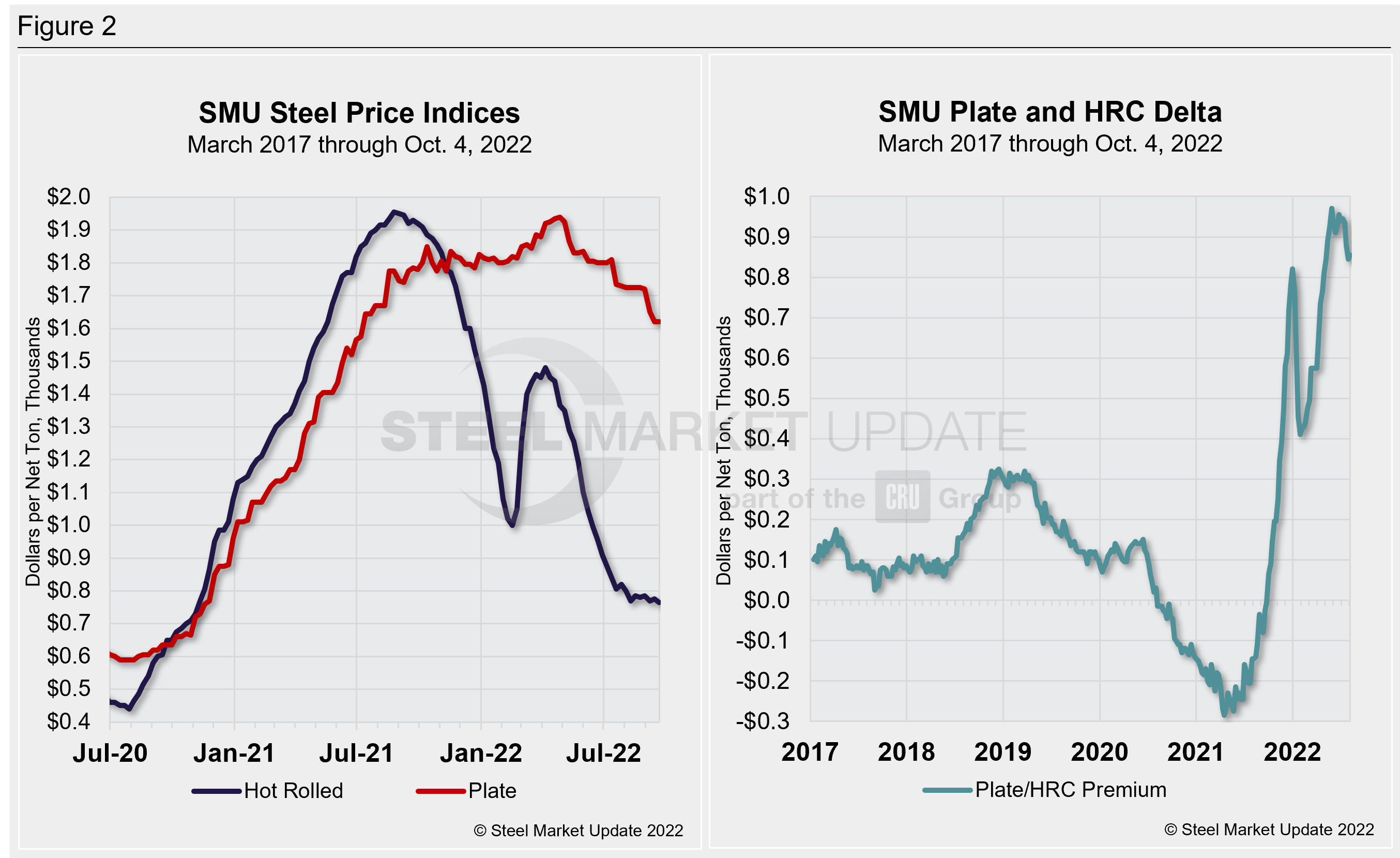

Plate prices remain more than double hot-rolled coil prices. And while sheet and plate markets have different dynamics, the delta remains historically wide. Some sources think the two products are unlikely to move in tandem again because their markets no longer correlate as they once did.

SMU’s average HRC price now stands at $765 per ton, according to our latest check of the market on Oct. 4. Our overall average is down $10 per ton week-on-week. Prices have been ebbing and flowing between $765 per ton and $785 per ton for the better part of the past six weeks.

Discrete plate lead times are running at four weeks, but in some cases are even lower. Sources told SMU that some plate lead are as short as 2-3 weeks. That is another indication more downward pressure on prices is likely.

By David Schollaert, David@SteelMarketUpdate.com