Prices

October 4, 2022

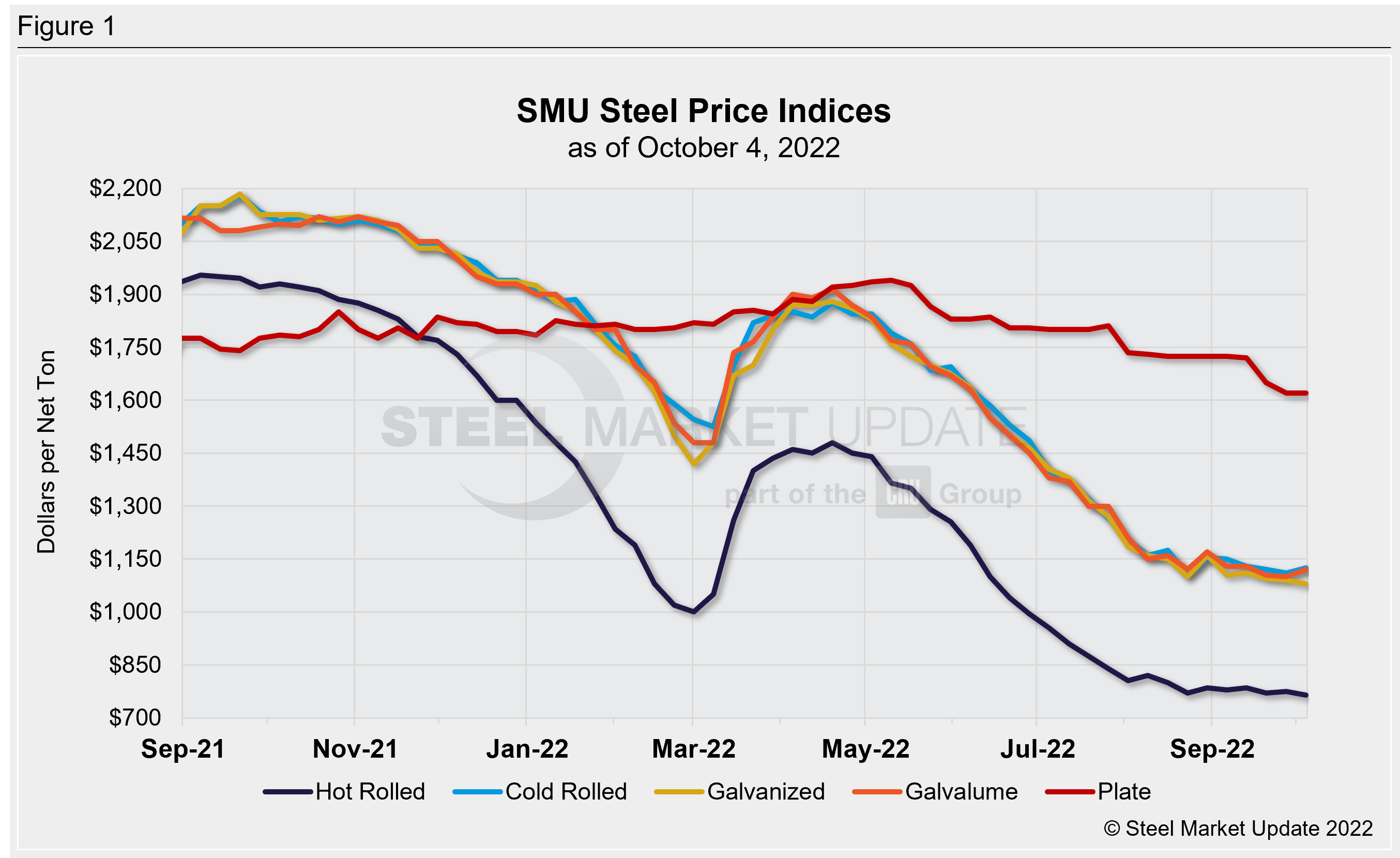

SMU Price Ranges: How Long Can Steel Prices Tread Water

Written by Michael Cowden

Sheet prices continued to tread water this week, with modest declines in hot-rolled coil and galvanized base prices offset in part by minor gains in cold-rolled coil and in Galvalume.

Plate prices were also flat, following declines in prior weeks, on the heels of Nucor on Monday announcing unchanged pricing for discrete plate.

Our benchmark hot-rolled coil prices dipped to $765 per ton ($38.25 per cwt), its lowest reading since $740 per ton in mid-November 2020.

But it was unclear whether that number was meaningful or just noise. Broadly speaking, HRC remains in a narrow band between approximately $750-800 per ton ($37.50-40 per cwt). That’s where it’s been since early/mid-August, a remarkable two months of stability following two years of unprecedented volatility.

And yet some market participants said the calm was unnerving given the possibility for prices to resume their downward trajectory should demand disappoint in the fourth quarter or, on the contrary, to shoot higher should labor contract talks between US Steel and the USW lead to a work stoppage. (Some also noted that those negotiations might also be impeding price contract talks.)

SMU is again keeping our sheet pricing momentum indicators at neutral. We have adjusted our plate momentum indicator from lower to neutral pending market reaction to Nucor’s price announcement.

Hot-Rolled Coil: SMU price range is $730–800 per net ton ($36.50–40.00/cwt) with an average of $765 per ton ($38.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $10 per ton compared to one week ago. Our overall average is down $10 per ton from last week. Our price momentum indicator on hot-rolled steel points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 3–5 weeks

Cold-Rolled Coil: SMU price range is $1,100–1,150 per net ton ($55.00–57.50/cwt) with an average of $1,125 per ton ($56.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end decreased $10 per ton. Our overall average is up $15 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 4–6 weeks

Galvanized Coil: SMU price range is $1,040–1,120 per net ton ($52.00–56.00/cwt) with an average of $1,080 per ton ($54.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $20 per ton. Our overall average is down $10 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,137–1,217 per ton with an average of $1,177 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–7 weeks

Galvalume Coil: SMU price range is $1,050–1,190 per net ton ($52.50-59.50/cwt) with an average of $1,120 per ton ($56.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $40 per ton. Our overall average is up $20 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,344–1,484 per ton with an average of $1,414 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–7 weeks

Plate: SMU price range is $1,600–1,640 per net ton ($80.00–82.00/cwt) with an average of $1,620 per ton ($81.00/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com