Plate

September 20, 2022

Plate Market Report: Prices Fall, More Easing Expected

Written by David Schollaert

US plate prices fell this week, responding to Nucor’s latest price announcement on Monday, Sept. 19. Price tags remain under pressure and further declines are expected through the fourth quarter as spot demand is likely to remain limited.

But few expect Nucor’s latest plate price announcement to generate any immediate business, sources told SMU, speculating that it will only cause buyers to stay on the sidelines longer as they await further decreases.

“Not sure why they announced such a significant decline, dropping the price doesn’t create demand,” said one source. “Maybe just aligning with lower deals already in the market.”

“Interesting timing when this came out late last night,” said another source. “The plate market is still fairly sluggish. This will lower prices into the low $80’s (per cwt), but seems like it’s got more room to go down from there.”

“Market’s taking a time out. Customers are not sure if there is more to follow, especially if Cliffs and SSAB respond and drop prices further,” said a third source. “Lots of risk in this environment for service centers that have inventory right now.”

“Not sure who will stock the shelves at this price as more decreases sure to come,” said another source. “Demand is steady but has slowed, plate mills need orders and lead times are short as three weeks.”

Though a shock to many in the market, the decline is also overdue and likely a result of falling scrap prices. Nucor has now lowered discrete and normalized plate prices, as well as prices for certain cut-to-length items, for its October order book.

Recall that Nucor initially kept some plate prices flat and decreased certain cut-to-length items in its first price announcement this month with the opening of its October order book.

The Charlotte, N.C.-based steelmaker’s $120 per ton ($6 per cwt) decline this week comes as other major mills have already been offering or moving material in the low $1,600-per-ton range for nearly a week.

“If you thought things were quiet yesterday, just wait,” said a source. “It’s just crickets in the plate world. Nobody’s buying.”

“I would say that’s a pretty big deal, really reflective of the scrap market falling as it has,” said another source.

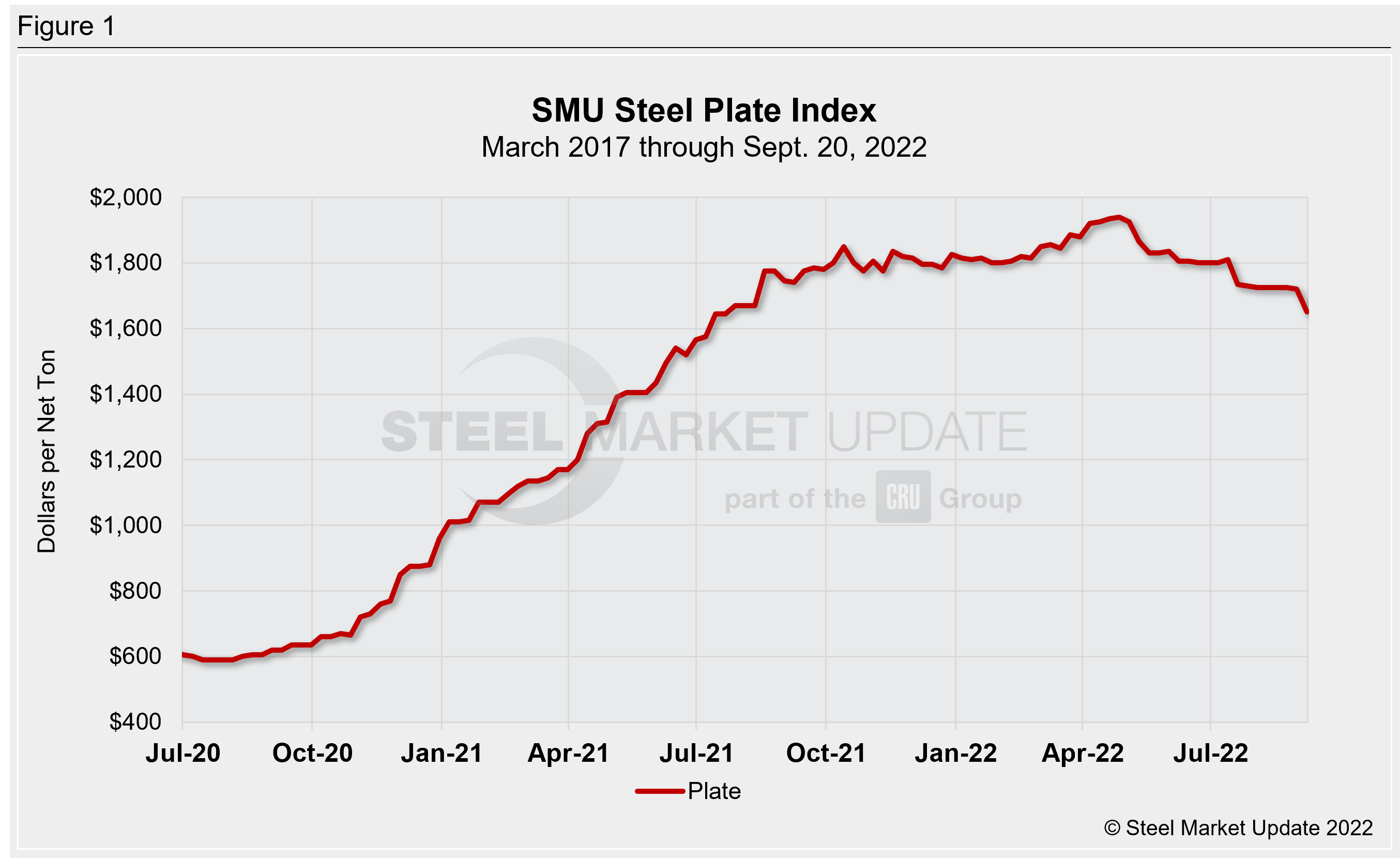

SMU’s most recent check of the market on Sept. 20 placed plate prices between $1,600 and $1,700 per ton with an average of $1,650 per net ton FOB mill, according to our interactive pricing tool (Figure 1). Though some Q4 contract business has been done below the $1,600-per-ton mark, SMU didn’t capture any business at the latest price announcement mark. Many expect little business in the near term as buyers hold for further declines.

Buying patterns have been largely limited to gap-filling and project-specific needs. Some fixed-priced forward buying around $1,540 per ton was reported, while spot buying has been largely quiet. Prices are expected to fall more in Q4 as fundamental demand seems to be stalling out.

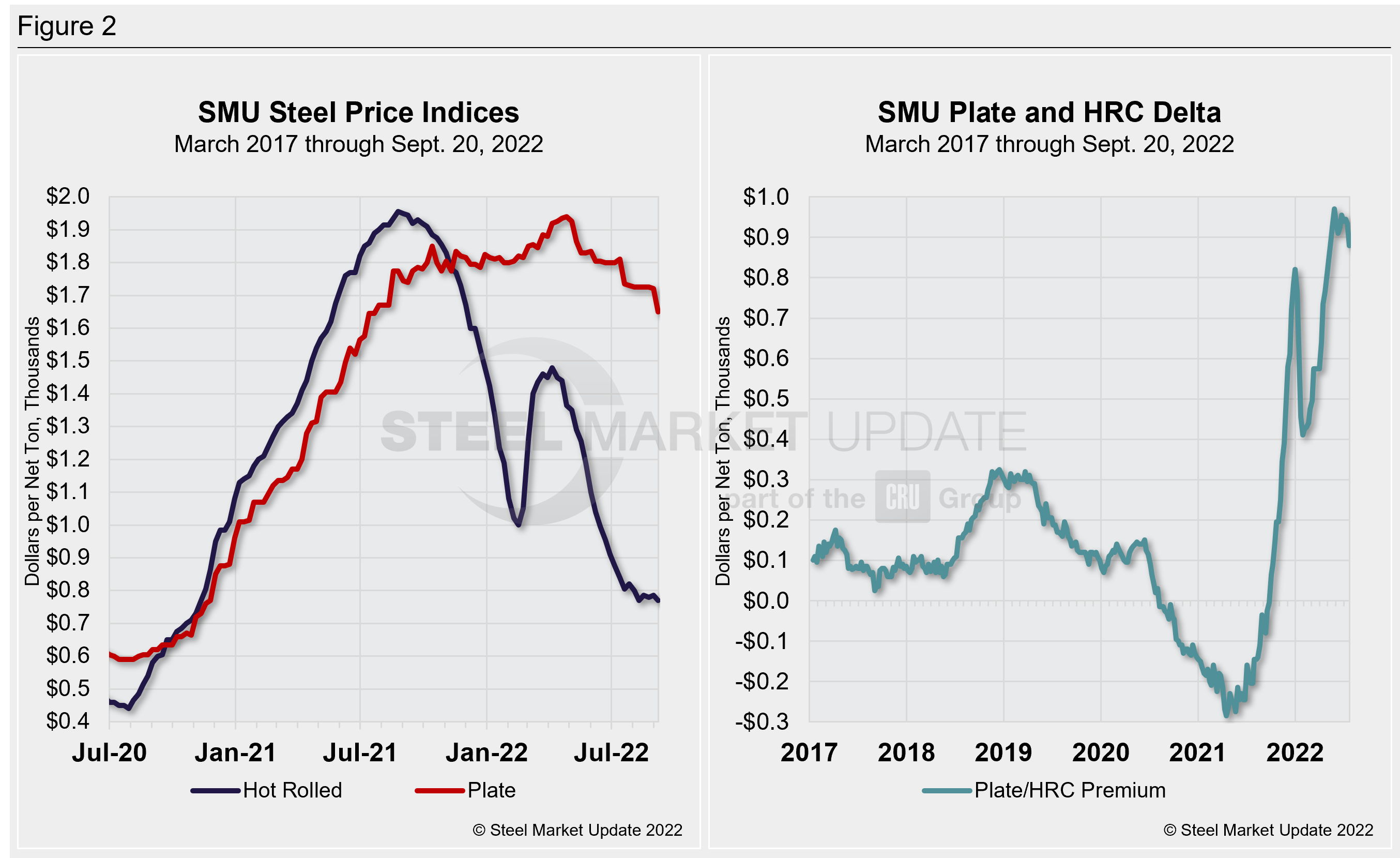

Plate prices remain more than double hot-rolled coil prices. And while sheet and plate markets have different underlying dynamics, the delta between the two is likely to contract. But some sources suggest it’s nonsensical to look at the spread between HRC and plate because their markets no longer correlate as they once did.

“The correlation between HRC and plate is plowing with horses mentality,” said a source. “There is no connection whatsoever anymore.”

“It’s reflective of hot rolled,” said another source. “They can’t keep prices where they are with scrap coming off as they have been. If scrap continues to fall, plate will fall further.”

SMU’s average HRC price now stands at $770 per ton, according to our latest check of the market on Sept. 20. Our overall average is down $15 per ton week-on-week.

But the delta between HRC and plate will continue to drive imports, sources agreed, saying that more imports will find their way onto US soil if the gap remains at these unprecedented levels. Others, however, still caution that domestic buyers are keen to source “melted and made” plate in the US, a dynamic that could help keep domestic plate prices well above HRC moving forward.

Foreign plate for mid- to late-Q4 arrival through ports on the West Coast and the Gulf Coast is priced in the low $1,600s per ton, while offers for South Korean plate with a mid-Q4 ship date are nearing the mid-$1,400s per ton, DDP, and falling.

Cut-to-length and discrete plate lead times are running at four weeks, and service center inventories are reportedly expanding slightly. And in many cases, plate is arriving closer to three weeks, adding more downward pressure on prices.

“I hope for better but believe plate prices will struggle into and possibly through second quarter 2023,” said a source.

By David Schollaert, David@SteelMarketUpdate.com