Plate

September 11, 2022

Plate Market Report: Prices Hold for Now, Decreases Expected

Written by David Schollaert

US plate prices were unchanged this past week but remain under pressure. Spot demand is limited, with sources noting that Nucor’s efforts to keep prices flat might be short-lived.

Recall that Nucor announced it would keep some plate prices flat and decrease certain cut-to-length items as much as $150 per ton ($7.50 per cwt) with the opening of its October order book.

Sources told Steel Market Update (SMU) this past week that Nucor’s move wasn’t surprising given that they only moved pricing on items that overlap with hot-rolled coil (HRC), likely to compete with SDI’s rolling capabilities. Yet most anticipate price softening for discreet plate is still forthcoming, and Nucor’s move will likely just delay the inevitable.

“There’s just too much pressure on plate right now,” said one market source. “Some mills are doing all they can to keep prices from following sheet. But as scrap continues to drop, they’ll have to correct.”

Others also noted pressure for less expensive plate imports, but those aren’t likely to hit the market until late Q4 or early 2023.

Though declines are probably still in store for plate, most anticipate it will fare better than hot-rolled coil over the long haul, especially given its greater participation in infrastructure.

“Most plate deals are still at the published price, but it does seem like there is room to move down,” said a second source. “The general expectation is that the pricing will move down further.”

A third source reasoned that the apparent resilience in plate prices was due to mills running at lower-than-normal levels. “We don’t see the need for them to lower price until more supply comes in or one of them feels like they aren’t getting their fair share of the market.”

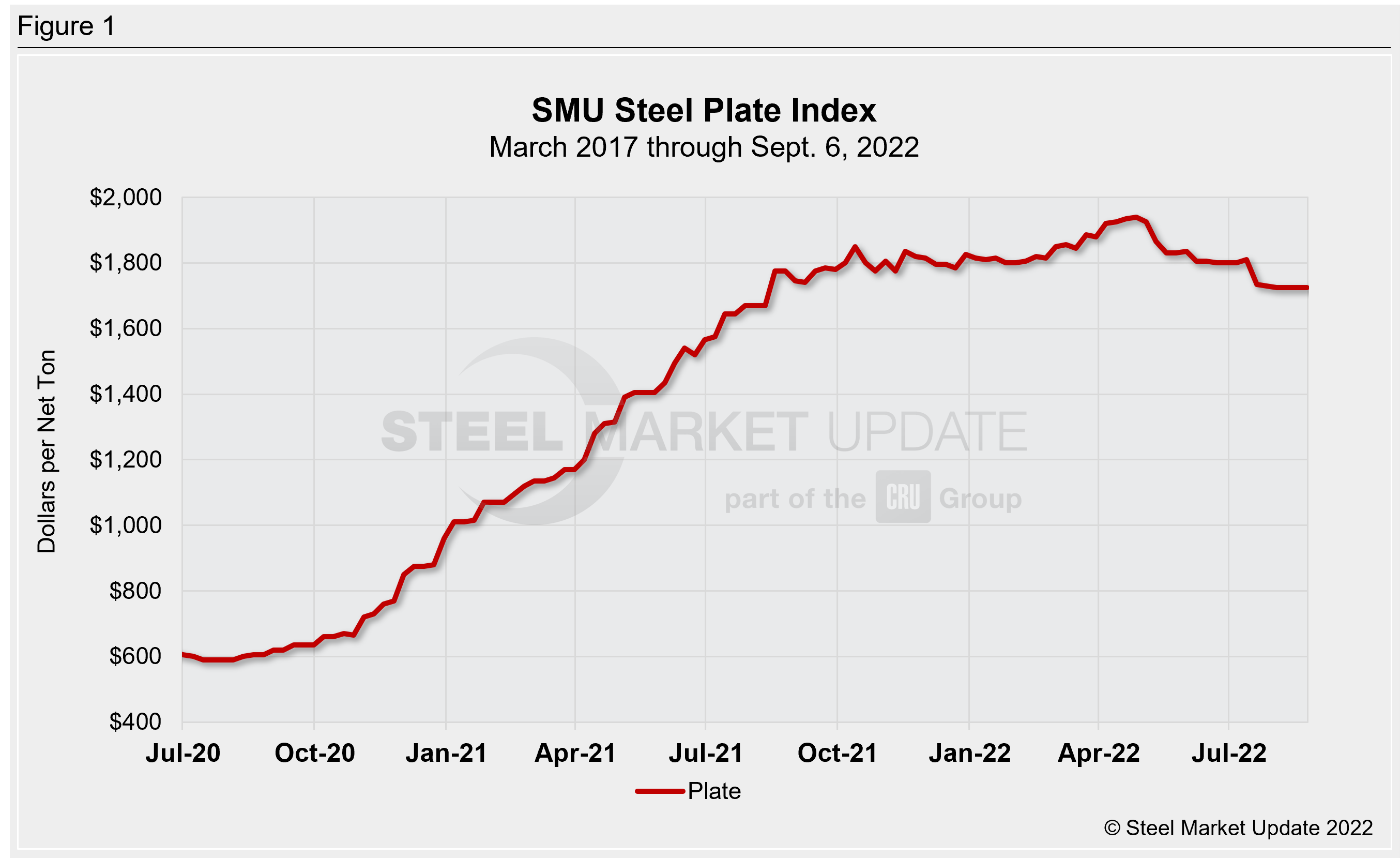

SMU’s most recent check of the market on Sept. 6 placed plate prices between $1,700 and $1,750 per ton with an average of $1,725 per net ton FOB mill, according to our interactive pricing tool (Figure 1).

Buying patterns are still largely limited to gap-filling and project-specific needs. But if contract orders or forward buys are any indication of where plate prices could go come Q4, a decline of $150-200 per ton may be in store.

A major mill agreed on a fixed price in the mid-$1,500s per ton for fourth quarter requirements. “I don’t see that happening unless there’s some underlying pressure to bring pricing down,” said a source. “But when and how fast it will come down, that’s not clear.”

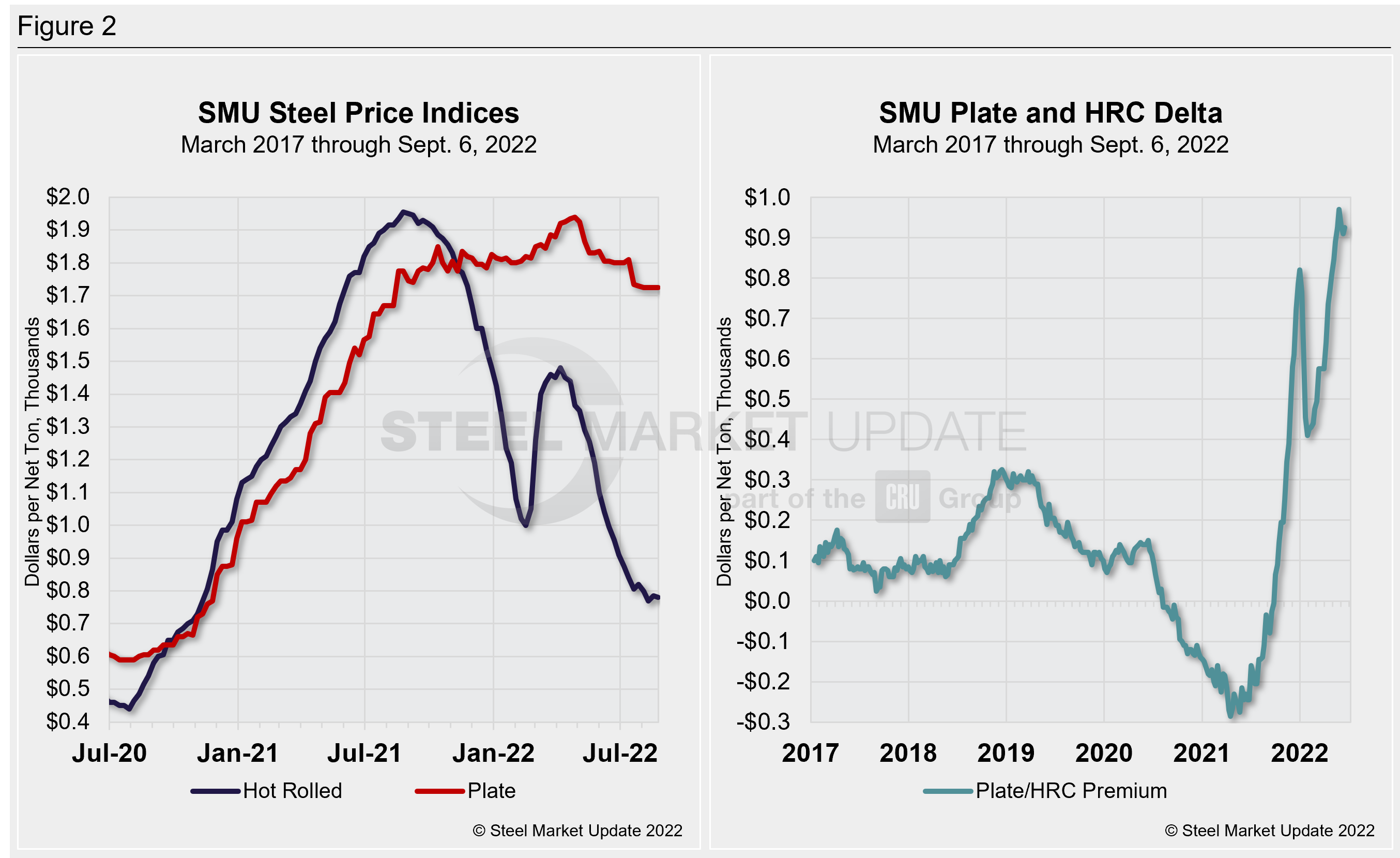

Many speculate that spot plate prices will be fall back below $1,600 per ton by mid-Q4, especially as Nucor’s new plate mill in Brandenburg, Ky., comes online amid what are widely seen as unsustainable spreads between plate and HRC. The majority, though, don’t anticipate plate prices to plunge as sharply as HRC tags have.

And though unconfirmed, some sources have reported small spot purchases below SMU’s current bottom end of $1,700 per ton ($85/cwt), with others purportedly offering around those levels.

Plate prices remain more than double HRC prices. And while sheet and plate markets have different underlying dynamics, the delta between the two is likely to contract.

SMU’s average HRC price now stands at $780 per ton, according to our latest check of the market on Sept. 6. Our overall average is down $5 per ton week on week.

If the delta remains at such historic levels, some anticipate more imports to find their way to US ports. Others, however, think “melted and made” in the US requirement could help keep domestic plate prices well above HRC.

Foreign plate for mid- to late Q4 arrival through ports on the West Coast and the Gulf Coast was said to be priced from $1,620–1,660 per ton. Offers for South Korean plate mid-Q4 ship date were priced at $1,480 per ton, DDP, and falling, sources said.

Cut-to-length and discrete plate lead times are running at four weeks, and service center inventories are reportedly expanding slightly. And in many cases, plate is arriving closer to three weeks. This is another indicator that steel plate demand might be slowing down.

By David Schollaert, David@SteelMarketUpdate.com