Analysis

September 6, 2022

Final Thoughts

Written by Michael Cowden

Will flat-rolled steel prices bounce around roughly where they’ve been for the past few weeks or inflect downward?

Our hot-rolled coil price was down a modest $5 per ton today. And HRC prices have been holding roughly between $770-800 per ton since mid-August.

How did things stand this time last year? Steel prices popped above $1,950 per ton in September 2021, a record high, following Steel Summit. Then they declined steadily for the balance of the year and into early 2022.

But there are reasons for optimism in our last survey results, which were released Friday – just before the long Labor Day weekend. So I’ll point out some of the highlights you might have missed.

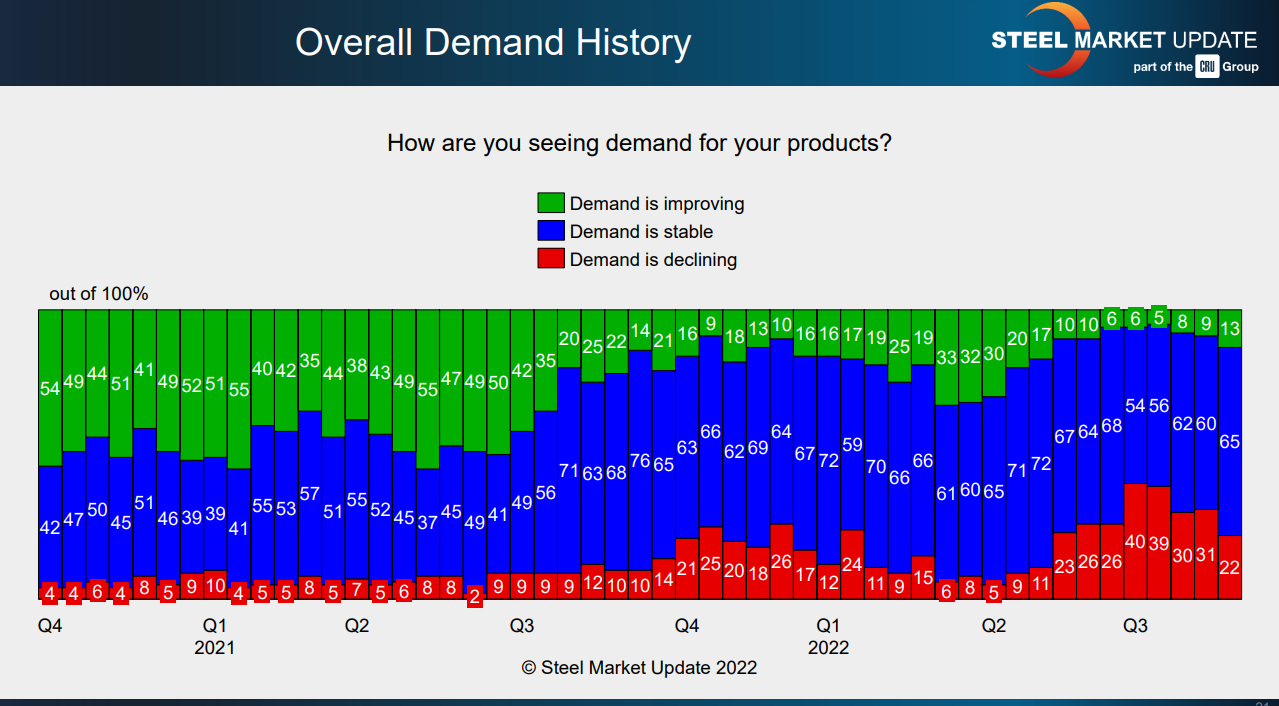

We’ve got slightly more respondents reporting stable or increased demand. And the number of people reporting decreased demand is significantly lower than it was over the summer.

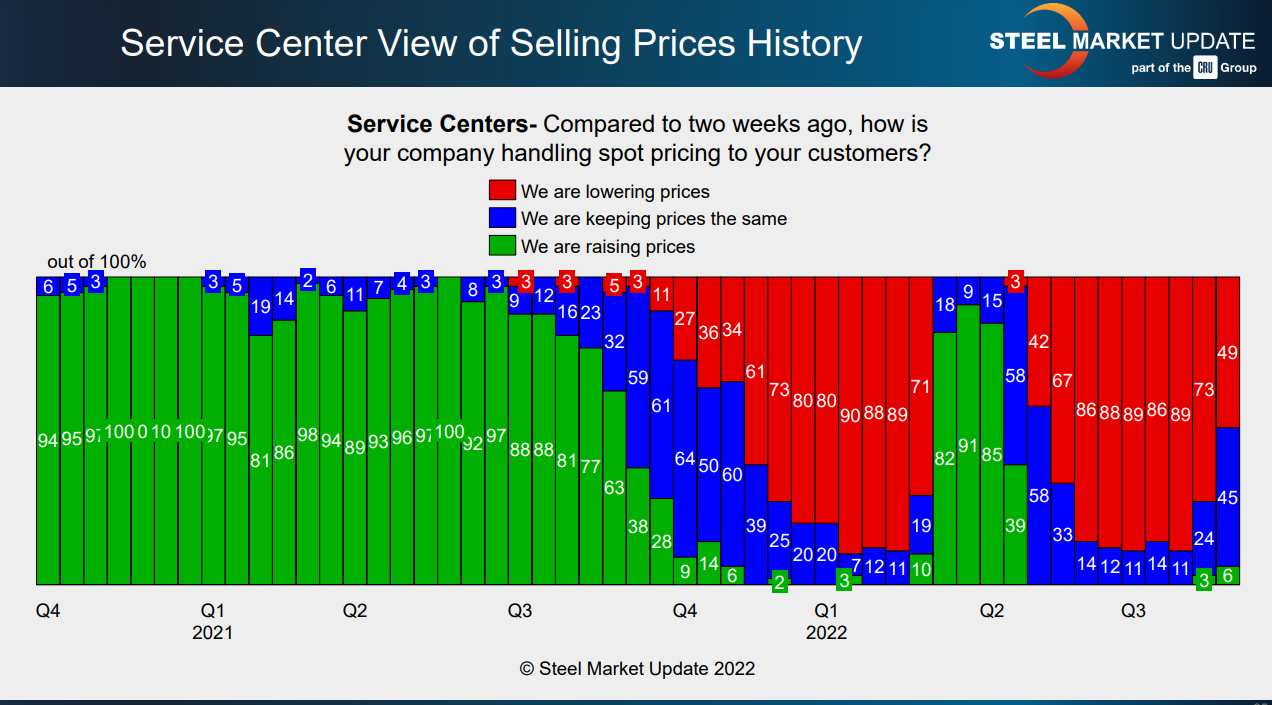

We’ve also seen significantly more service centers reporting that they have stopped lowering prices to downstream customers – probably on the heels of price increase announcements by several domestic mills.

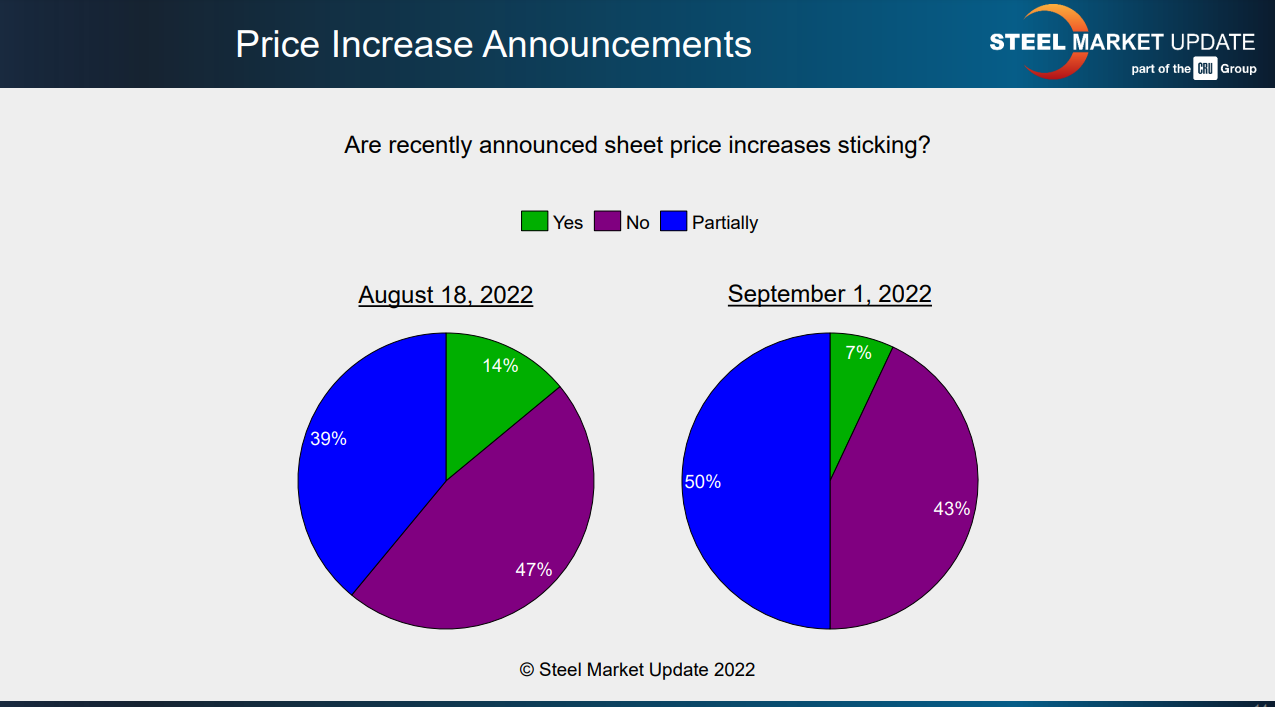

Are those increases sticking, or did they merely stop the slide? The jury is still out on that one.

If price increases were sticking, you’d think tags would have done more than roll mostly sideways-to-lower over the last few weeks. And I’d expect lead times to kick out more than they have so far.

What worries me a little is that sentiment, after rebounding from its July lows, has flattened out more recently.

In the meantime, it’s hard to ignore that we’re seeing a wave of idlings or extended outages in Europe on weaker demand and higher costs. And we’re starting to see more idlings and outages here in the US as well.

Is what’s happening in Europe a prelude of what’s to come in the US? Or will domestic mills – thanks to the US being far more energy independent – be able to weather the inflationary storm battering Europe?

I’d like to think the US is in better position to ride it out. But prices in the US, Europe, and Asia tend to trend together over time. And the US, at the end of the day, is not an island.

By Michael Cowden, Michael@SteelMarketUpdate.com