Analysis

August 18, 2022

Final Thoughts

Written by Michael Cowden

We’ll kick off our Steel Summit conference in Atlanta in just a few short days. I’m looking forward to learning from executives across the supply chain – from steel mills and service centers to automakers and trucking companies.

I’m also looking forward to getting the mood of the room when we do our annual poll on where people think hot-rolled coil prices will be this time next year. I say mood of the room because, for forecasting purposes, our collective track record is, well, almost hilariously bad.

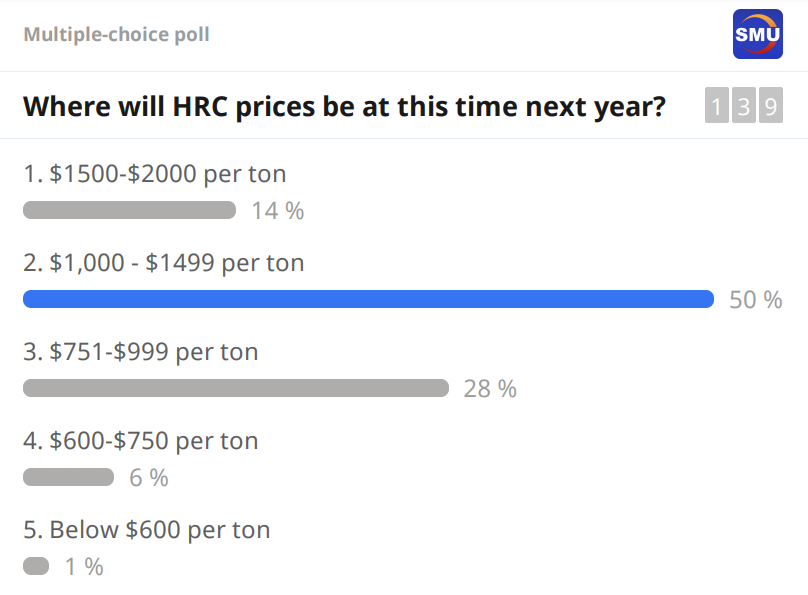

Here are the results from our last poll, in August 2021, when we asked attendees where they thought HRC prices would be during Steel Summit 2022.

Keep in mind that HRC prices were at the time $1,915 per ton ($95.75 per cwt). The consensus opinion was that steel prices would be between $1,000-1,499 per ton. Among some attendees, the question wasn’t whether we’d get to $2,000 per ton but when.

Our HRC index was at $800 per ton when this article was filed. In other words, most of you reading this (and myself writing this) were wrong. By a mere $200 per ton in some cases. By $1,200 per ton (or roughly twice the price of HRC in past market cycles) in others.

It’s hard to resist the zeitgeist. And you could make a case that last year’s conference marked peak bullishness for the steel industry.

The market had snapped back unexpectedly fast from the frightening early days of the Covid-19 pandemic, and not only had the economic world not ended – the post-pandemic period saw record spending on steel-intensive stuff like home appliances and passenger vehicles.

But we never quite got to $2,000 per ton. The market hit what turned out to be a 2021 peak – also an all-time high – of $1,955 per ton in September, just a month later. And the $2,000-per-ton mountain was never summited. (Sorry, I couldn’t resist the pun.)

Not even the war in Ukraine, another black swan event, brought us anywhere close to that point again. That said, the post-war price spike holds the record for the fastest ascent ever in HRC prices. Nearly $500 per ton in less than two months!

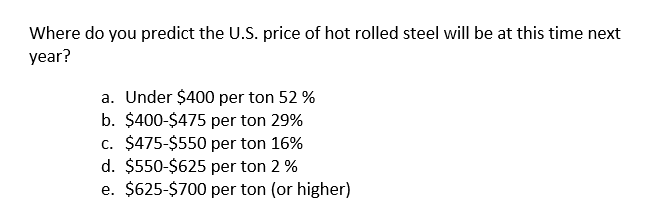

As far as predictions go, we collectively did no better in 2020. Here are the results when we asked people in August of that year – when the conference was virtual because of the pandemic – where prices would be in August 2021.

(Excuse the varying formats. We’ve changed poll apps a few times over the years.)

If Steel Summit 2021 was peak optimism, then Steel Summit in August 2020 was peak pessimism.

HRC prices at the time were at $485 per ton, only modestly higher than a 2020 low of $440 per ton reached just two weeks earlier. Most of you thought that it would only get worse and that prices would be below $400 per ton (!!!) in August 2021. No one – not one – thought prices would be higher than $625 per ton a year later. Which is to say that nearly everyone was off by $1,500 per ton or so.

Clearly we’re getting better at this as time goes on! So when we ask the room this year where HRC prices will be in August 2023, don’t hesitate to chime in. If you’re off by less than $1,000 per ton, you’ll be an overachiever.

In fairness, it used to be that you could make a prediction within a reasonable bandwidth of where steel prices were at the time and be relatively confident that you wouldn’t be too far off. That brings us to black swans and their impact on markets.

Very few of us correctly predicted the impact of Covid or of the war in Ukraine. Maybe we’re more on the lookout for black swans now, and so we’ll spot the next one before it causes too much havoc. It certainly seems lately that people speculate just as much about the next catastrophe as they do about prices.

That said, humanity has a long and proud history of not learning from history. I’m not going to do a poll question on what the next black swan will be. But if you want to speculate about it, it’ll make for good conversation over a meal or a drink.

So, on top of all our great speakers, don’t miss the networking. And if you still haven’t registered, it’s not too late. Click here and join ~1,250 of your closest friend in steel.

Thanks, everyone, for your continued support of SMU. And I look forward to seeing you at the Georgia International Convention Center on Monday.

By Michael Cowden, Michael@SteelMarketUpdate.com