Plate

August 19, 2022

Plate Market Report: Prices Down Marginally, Demand Unchanged

Written by David Schollaert

US plate prices edged down marginally this week, declining for the third straight week. The easing was driven by a tightening of the range, though sources feel pricing has flattened.

The repeated declines are not exactly a surprise given plate prices have been holding an unsustainable premium over coil, while buying remains strategic and mainly hand-to-mouth. The easing this week happened as the top end came off a bit, in line with mill published tags.

The current trend is consistent with the overall sentiment that smaller, more marginal decreases would follow the largest plate price decline seen in nearly five years, just two weeks prior.

Sources told Steel Market Update (SMU) this week that further price softening is forthcoming, and mills seem more willing to negotiate, but everyone is waiting for the next price announcement.

“I think plate could take another slight dip $60 per ton tops, but I also think fifty-fifty it doesn’t change either,” said a buyer. “We will find out in a week or so when Nucor publishes its next price.”

“I’m still confident we will get to somewhere around $1,550 per ton for fourth quarter pricing levels,” said another source.

Others expect a plate price to come off pretty strong, to the tune of 30–40% from the peak.

“Order books are not as strong as mills lead on and demand is okay,” said a source. “Most believe plate prices are poised to come down and I am in that camp.”

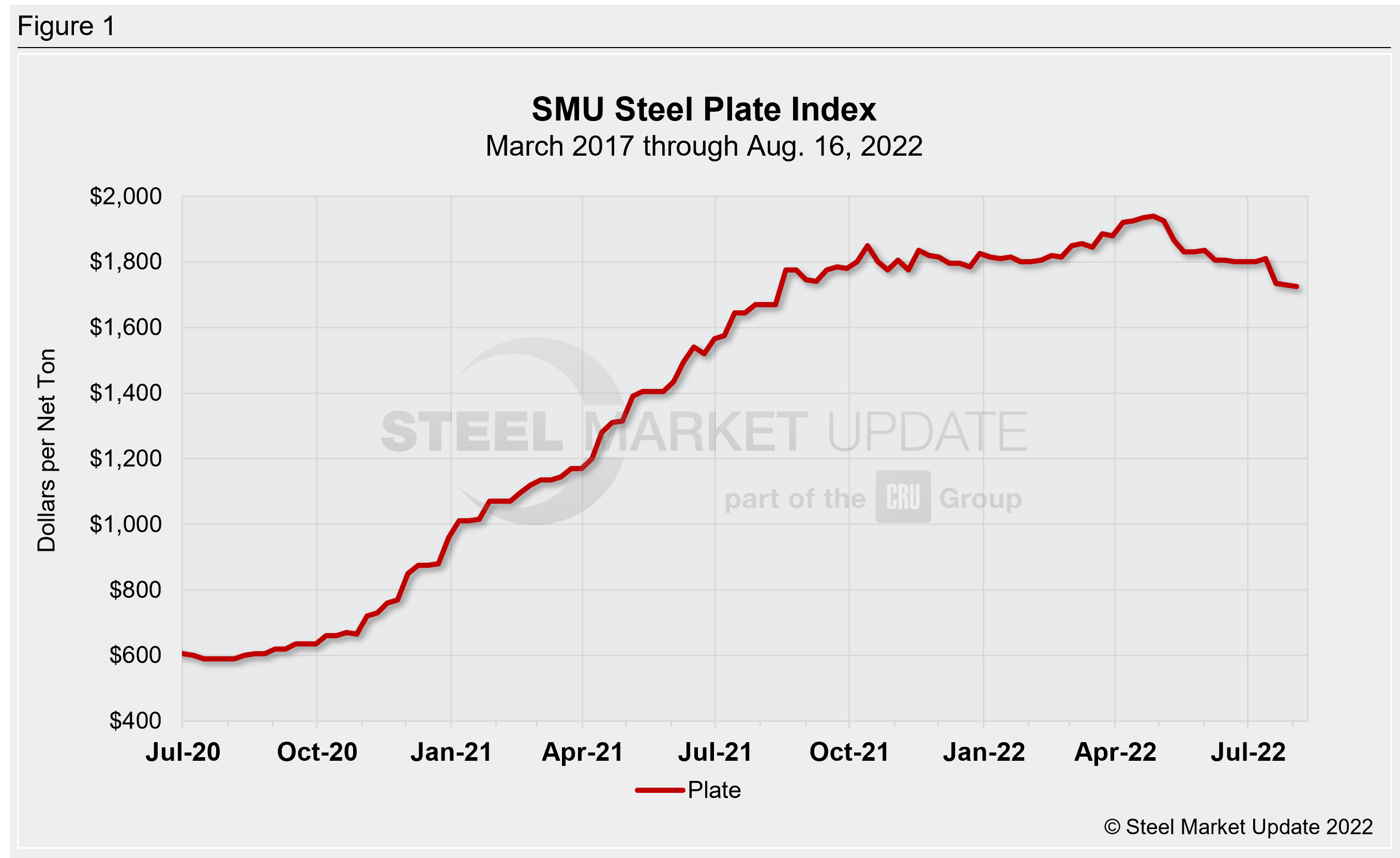

SMU’s most recent check of the market on Aug. 16 places plate prices between $1,700–1,750 per net ton ($85–87.50/cwt) with an average of $1,725 per net ton ($86.25/cwt) FOB mill, according to our interactive pricing tool (Figure 1).

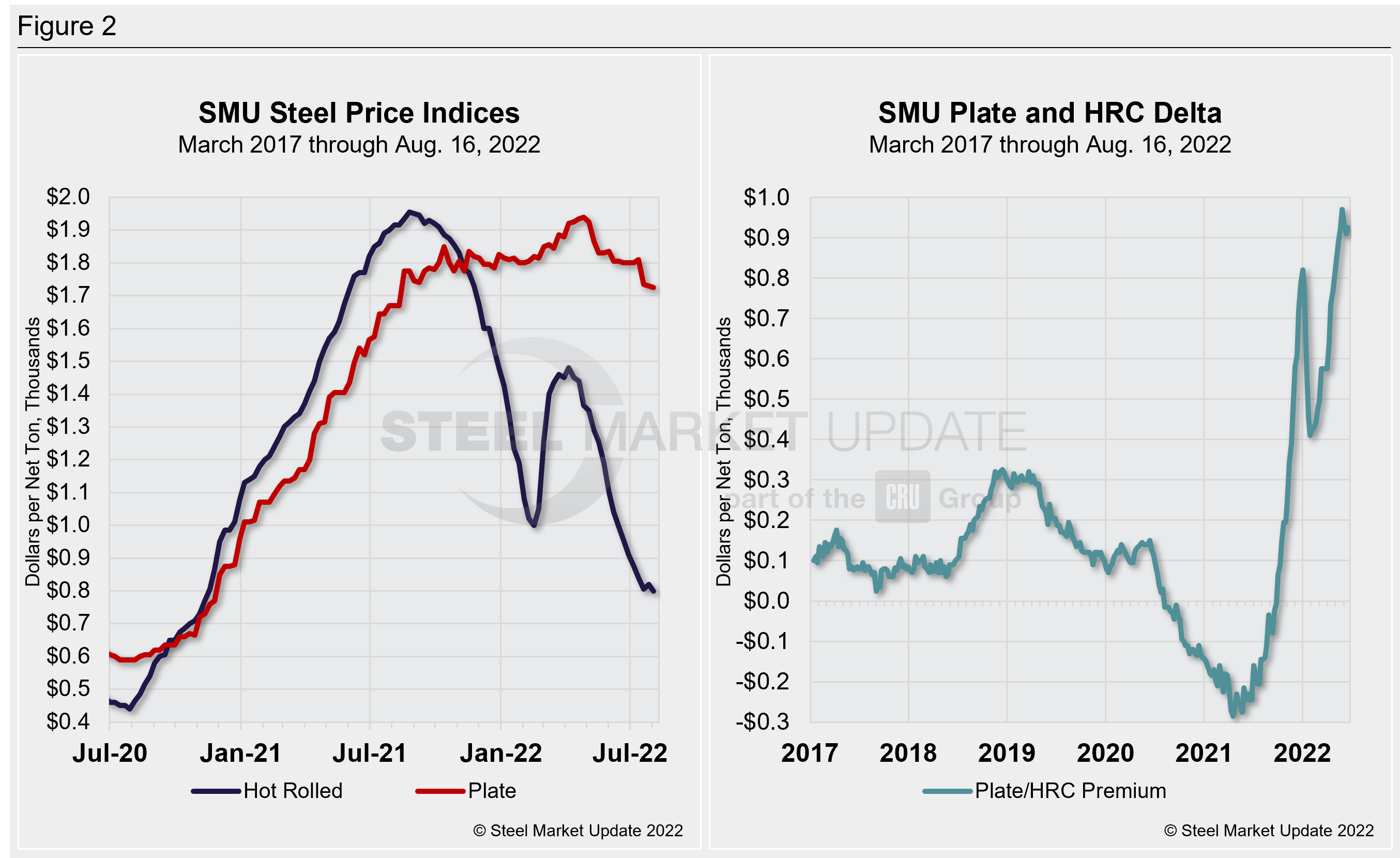

Though buying patterns are still largely limited to gap-filling and project-specific needs, the jury isn’t out on whether further decreases will be precipitous or more controlled. There are those who point to unsustainable spreads between plate and hot-rolled coil (HRC), while others say that the premium is the new normal.

The majority, though, don’t anticipate plate prices to fall from the sky as HRC tags have. They anticipate them to be sparse, largely due to downstream sectors.

“The premium is unprecedented, but I believe plate is going to be a strong product compared to HRC,” remarked a source. “HRC is in more consumer-related products which are going to be marginal at best as the economy goes forward. Plate is going to be involved in the infrastructure and that’s already funded.”

To date, plate prices, unlike sheet prices, have been resilient and relatively stable despite massive swings in sheet prices before and since Russia’s war in Ukraine began.

This week’s plate decline was more moderate than the decline seen for HRC. The delta between plate and hot band widened slightly as a result, and is just $45 per ton lower that the historic high seen in late July.

Plate prices remain more than double HRC prices. And while sheet and plate markets have different underlying dynamics, the delta between the two is not likely sustainable. The gap is bound to contract.

And even though mills seem eager to set a price floor—particularly for HRC—and are less willing to negotiate, they seem to lack staying power.

SMU’s average HRC price now stands at $800 per ton ($40/cwt), according to our latest check of the market on Aug. 16. Our overall average is down $20 per ton week-on-week.

If the delta remains at such historic levels, could more imports find their way to US ports?

Mid-to-late Q4 arrival of foreign plate is priced between $1,620–1,660 per ton ($81–84/cwt). Offers for South Korean plate mid-Q4 ship date are $1,480 per ton ($74/cwt), DDP west coast, said sources.

“The spread between HRC and plate will have to get back to a more historical delta but might not happen until Q1 or Q2 next year,” said a source. “Plate has been strong, but when Nucor gets Brandenburg up and running, we will have a supply imbalance for a year or two until offshore wind production kicks in. That could be a tough year or two from a pricing standpoint.”

The bulk of plate transactions were at the mid-point of SMU’s range, in line with published and ‘unofficial’ prices from the three major US mills. But with sources noting that some mills are starting to negotiate, further erosion could be in the cards.

Cut-to-length and discrete plate lead times are running between 4–5 weeks. But in many cases, material is arriving closer to 3–4 weeks. This is another indicator that fundamental steel plate demand is slowing down.

The market consensus remains that plate prices could make another correction this month, though probably not as large as the last reduction. But there’s still a lot of unknowns at the moment. Thus gap-filling is likely to remain the buying pattern of choice for the time being.

By David Schollaert, David@SteelMarketUpdate.com