Prices

August 16, 2022

SMU Price Ranges: Firm Floor or Soft Sideways?

Written by Michael Cowden

Sheet prices were mixed this week as market participants continued to debate whether a recent round of price hikes had stuck.

While some said the increases would provide a floor and prevent further price erosion, others said prices were more likely to resume their downward trend in the weeks ahead.

There were also questions about whether the increases—officially announced by Nucor in the US and ArcelorMittal Dofasco in Canada—had been enforced or merely evaluated by other mills.

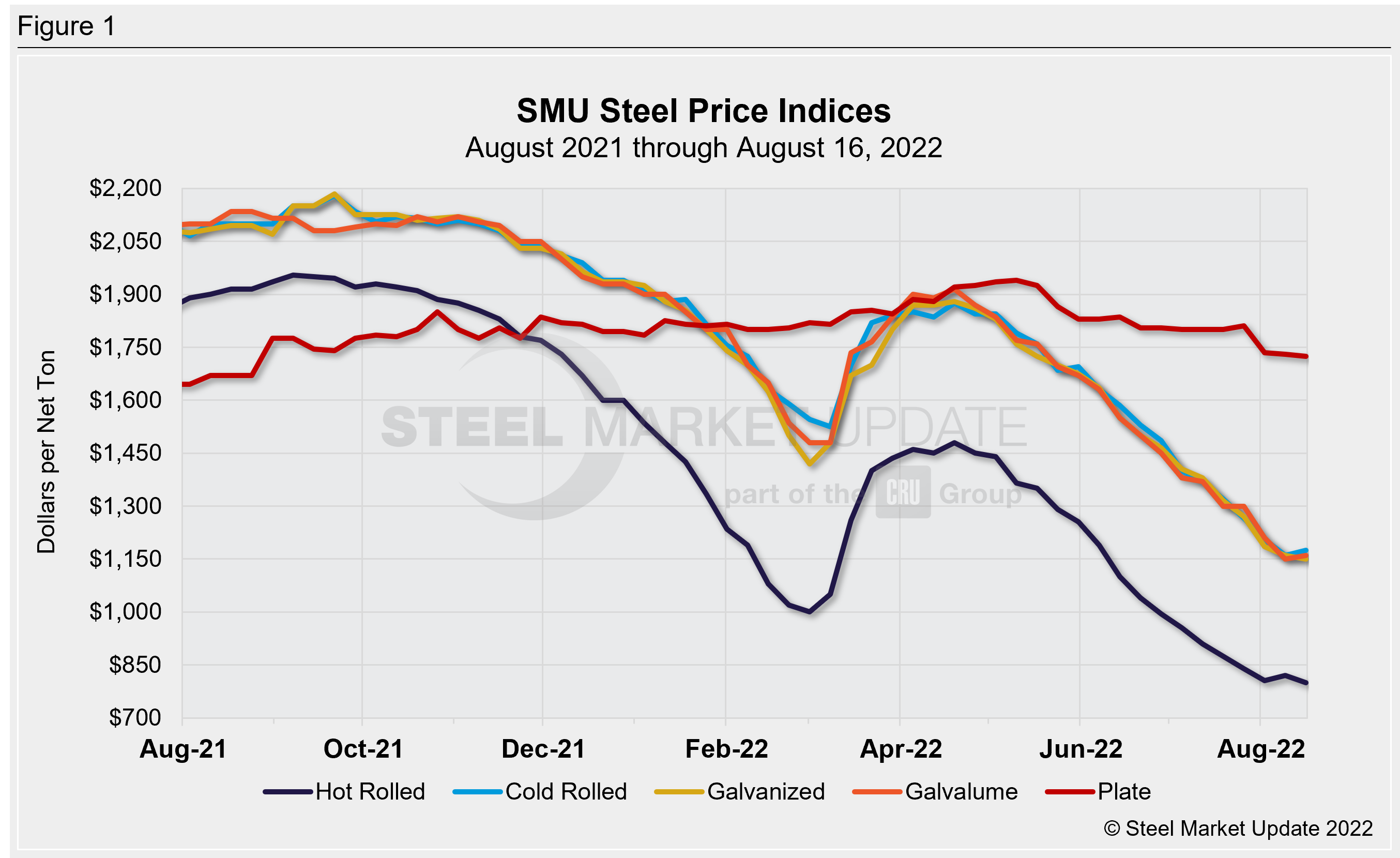

SMU’s benchmark hot-rolled coil price slipped back to $800 per ton ($40 per cwt), down $20 per ton from a week ago and roughly even with $805 per ton in early August—before the increases were announced.

The general impression was of a sideways market. Hot-rolled, galvanized and plate prices were down slightly. But cold-rolled and Galvalume prices were up modestly. The diverging trends means it might be too early to make any sweeping claims about the direction of the market.

SMU has decided to keep its price momentum indicators at Neutral until the market establishes a clear direction.

Hot-Rolled Coil: SMU price range is $750–850 per net ton ($37.50–42.50/cwt) with an average of $800 per ton ($40.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $20 per ton from last week. Our price momentum indicator on hot-rolled steel points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 3–7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: SMU price range is $1,120–1,230 per net ton ($56.00–61.50/cwt) with an average of $1,175 per ton ($58.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end increased $10 per ton. Our overall average is up $15 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 4–8 weeks*

Galvanized Coil: SMU price range is $1,060–1,240 per net ton ($53.00–62.00/cwt) with an average of $1,150 per ton ($57.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is down $10 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,157–1,337 per ton with an average of $1,247 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–8 weeks*

Galvalume Coil: SMU price range is $1,100–1,220 per net ton ($55.00-61.00/cwt) with an average of $1,160 per ton ($58.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $20 per ton. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,394–1,514 per ton with an average of $1,454 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks*

Plate: SMU price range is $1,700–1,750 per net ton ($85.00–87.50/cwt) with an average of $1,725 per ton ($86.25/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4–6 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com