Analysis

August 9, 2022

Final Thoughts

Written by Michael Cowden

Nucor announced a price hike on Monday, and our HRC price is up modestly for the first time since mid-April.

It’s too early to say whether those two trends are related. Our HRC price went up $15 per ton. Nucor’s price increase was $50 per ton, and the jury is still out on whether it will stick.

If you think prices are still falling, you could point to the lower end of our price range, which slipped. If you think they are rising, you could point to the higher end of our range, which increased.

Some of you might not like that our HRC price range is wider than usual. But that’s not uncommon in the immediate aftermath of a price hike. Past markets have seen mills offering discounts at the last minute, or offering pre-increase prices – right up to the moment a price hike officially goes out.

And make no mistake, while it might have been a surprise to finally see the Nucor increase in writing, it had been rumored for some time.

We see some reasons that might support higher prices, or at least a floor, for HRC. Lead times have increased modestly of late, prices couldn’t keep falling at the $50/ton per week we’d seen without mills entering money-losing territory, and the massive gap between foreign HRC and US HRC prices has narrowed.

Did the increased possibility of labor turmoil in Canada play a role? Maybe.

Let’s not get carried away though. While HRC prices might have bottomed, cold-rolled and coated prices continue to fall. Why? One reason might be that the import spigot has been mostly turned off for HR but that it continues to flow freely for foreign downstream products.

Recall that the spread between domestic HRC and galv base prices, for example, remains far wider than usual. And that probably means that the spread between US and foreign galv prices is wide too. (Our latest full survey results support this. Check out slides 52 and 53.)

What the Charts Say

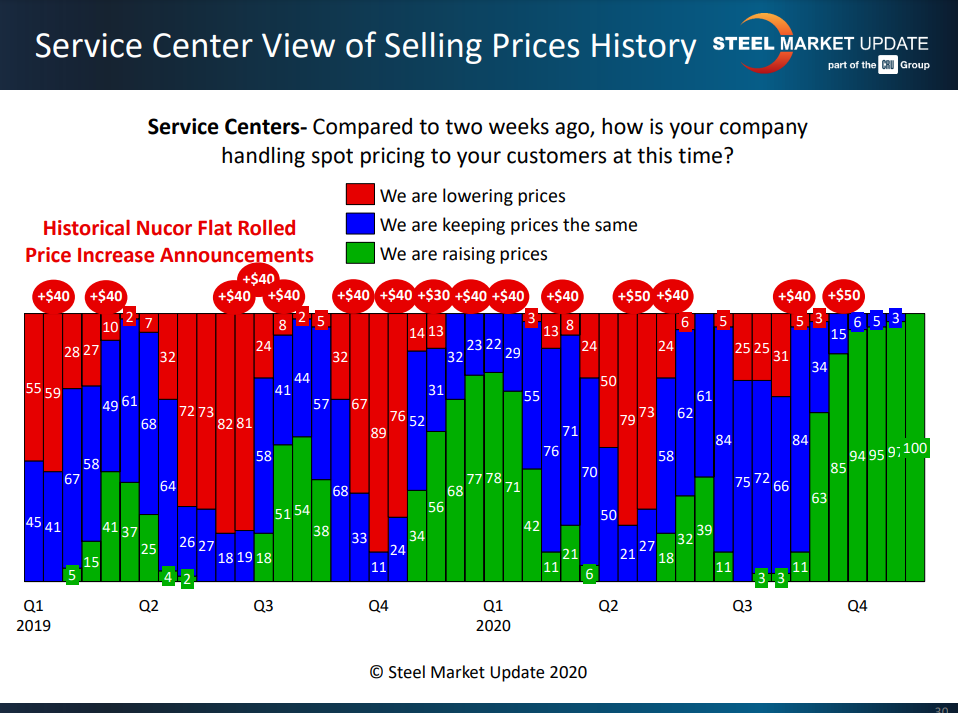

Check out the correlation between Nucor price hikes and service center resale price trends over time.

You can see in the chart below that Nucor probably successfully used price hikes to change the psychology of the market twice over the last two years. Once as demand snapped back in H2 2020 following the initial outbreak of the pandemic. And again this year following the outbreak of full-fledged war in Ukraine.

The fundamentals supported higher prices in the back half of 2020. And no one needed a reminder of which way prices were going for the first eight months of 2021. But as pricing trends following the war indicate, the jolt provided by price hikes can only be sustained if underlying fundamentals support the upward move. The fundamentals did not support higher prices for long earlier this year, despite a combined $275 per ton in price hikes.

You can see that pattern – of price hikes not sticking for long – repeated throughout much of 2019 too.

(Excuse the differing color schemes. We’ve changed things up a little since 2020.)

Price hikes were not enough, for example, to offset the impact of Section 232 being lifted from Canada and Mexico in 2019, and so their impact was fleeting.

So will mill price hikes change service center psychology this time around, or will they fall on deaf ears?

What Our Members Say

What do our readers say about the Nucor increase? We asked them. Here are some of their thoughts:

“I don’t think Nucor’s move will do much to change the course of steel dropping. They may be tight on spot sales. But out of the eight mills that I deal with, I have heard nothing about filling the books – and lead times are still normal.”

“For once the rumor mill proved to be spot on – we were told late last week to expect a Monday a.m. increase from Nucor and Boooooommmmm! there it came. I’m somewhat torn on whether I think this will actually hold or not though. … I think this might stop the slide, but I don’t actually think it’ll raise numbers. Lead times are still too short, and the newer capacity mills are all still too hungry. But, again, this is better than nothing.”

“The mills need to draw a line in the sand and stand on it. Every time there is an increase, they always make a secret deal.”

“With the amount of outages coming up and the lack of imports arriving the balance of the year, I believe we have found the floor and should get some bounce back.”

“I have felt for a while the mills have been at a floor. I think other mills will follow. It should put a floor on pricing. That said, could be a dead cat bounce.”

“The hope is that it’ll continue to ease the declines and maybe even draw the much ballyhooed line in the sand.”

Steel Summit Update

As of this morning we have 1,155 total registrations for the 2022 SMU Steel Summit Conference. This is a new record, and we still have 13 days before the start of the conference on Aug. 22. You can join these executives by clicking here.

We have approximately 50 rooms available at the Atlanta Airport Marriott Hotel. We will be running shuttle buses between this hotel and the convention center on Monday-Wednesday to accommodate those who stay at this hotel, which is about one mile from the Georgia International Convention Center. The room block expires on Aug. 17. Here is the link to make reservations.

By Michael Cowden, Michael@SteelMarketUpdate.com