Prices

July 26, 2022

SMU Price Ranges: Still Falling (Mostly)

Written by Brett Linton

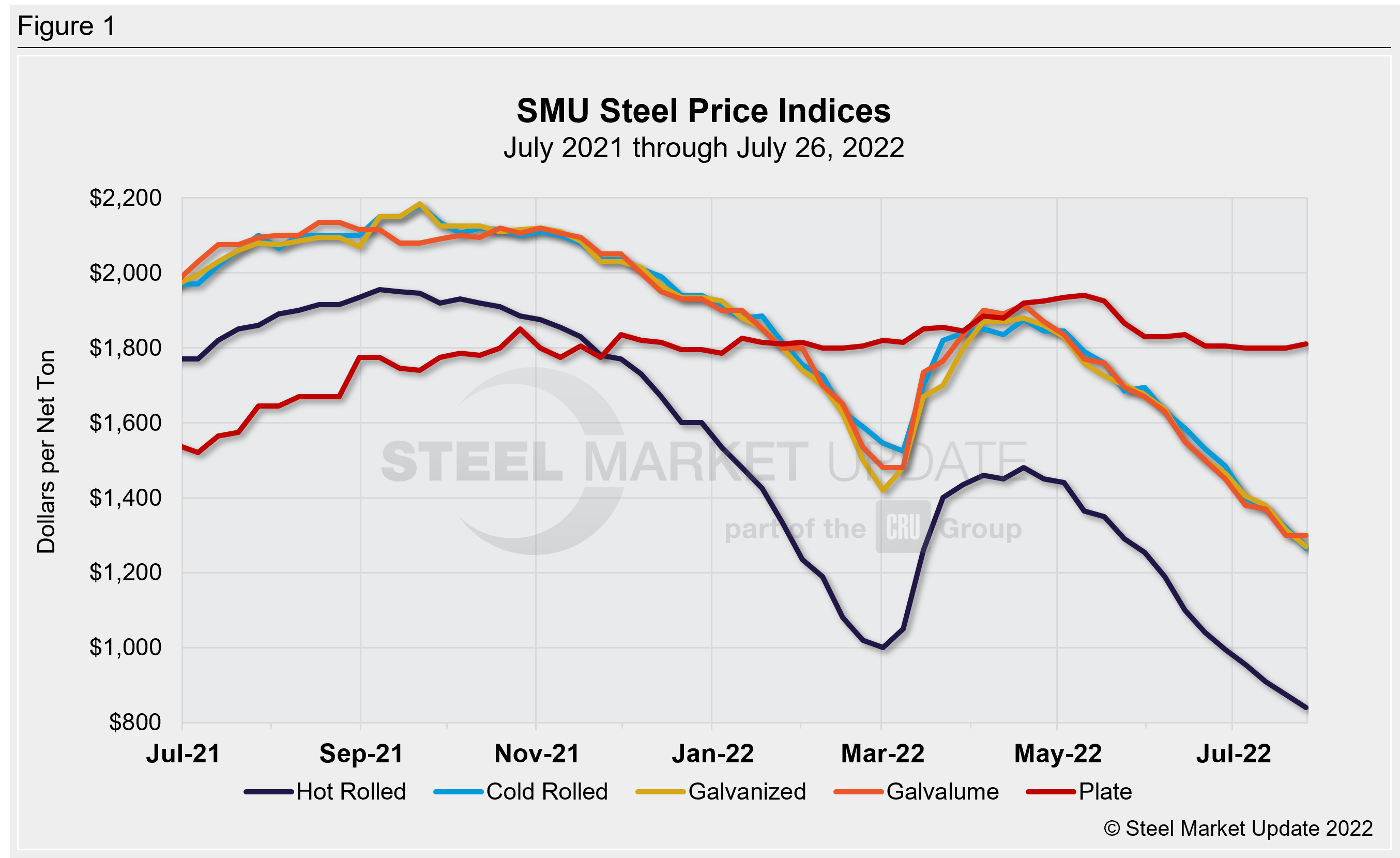

Prices for hot-rolled, cold-rolled and galvanized flat-rolled steel fell again this week with little signs of a near-term bottom.

Hot-rolled prices fells into the low $800s per ton ($40s per cwt). Cold-rolled and galvanized base prices, meanwhile, fell into the $1,200s per ton ($60s per cwt) for the first time since mid-March.

Spreads between highs and lows remained wide, with market participants reporting significantly lower prices for large-volume orders. Lower prices were also achieved by some smaller buyers able to leverage competing mills offers.

Galvalume prices, unlike those for other sheet products, were flat. Plate prices were roughly flat as well. The wide spread between these products and hot-rolled coil is not tenable, some sources said. Others said it was because there are fewer producers of both products, which means mills are better able to enforce price discipline.

While we heard some rumors of mill price hikes, our price momentum indicators remain at Lower – meaning we expect prices to continue to decline over the next 30 days.

Hot Rolled Coil: SMU price range is $780-900 per net ton ($39.00-45.00/cwt) with an average of $840 per ton ($42.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $35 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $1,180-1,350 per net ton ($59.00-67.50/cwt) with an average of $1,265 per ton ($63.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to last week, while the upper end decreased $60 per ton. Our overall average is down $55 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU price range is $1,180-$1,360 per net ton ($59.00-68.00/cwt) with an average of $1,270 per ton ($63.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $45 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,277-1,457 per ton with an average of $1,367 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks

Galvalume Coil: SMU price range is $1,200-1,400 per net ton ($60.00-70.00/cwt) with an average of $1,300 per ton ($65.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remain the same compared to last week. Our overall average is unchanged from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,494-$1,694 per ton with an average of $1,594 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

Plate: SMU price range is $1,760-1,860 per net ton ($88.00-93.00/cwt) with an average of $1,810 per ton ($90.50/cwt) FOB mill. The lower end of our range increased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $10 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3-7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com