Prices

July 5, 2022

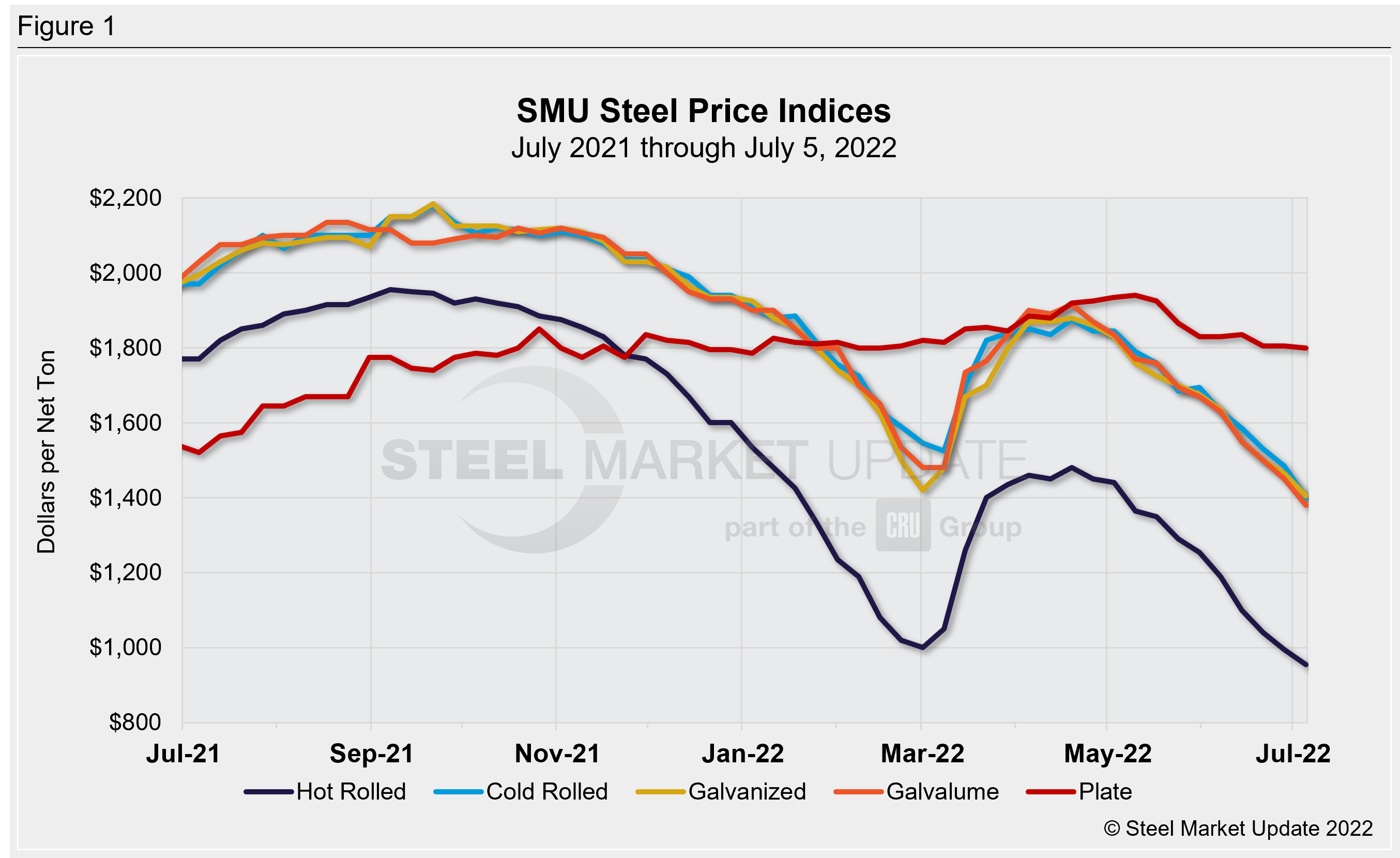

SMU Price Ranges: Tags Continue to Drift Lower

Written by Brett Linton

Domestic sheet prices continue to slide back to levels not seen since late 2020 or early 2021.

Even plate prices, which had been stable to date, are starting to show signs of cracking.

SMU’s average hot-rolled coil price now stands at $955 per ton ($47.75 per cwt), down $300 per ton (24%) from early June and marking their lowest point since $950 per ton in mid-December 2020.

Declines in cold-rolled coil and coated base prices haven’t been as sharp. But the ~$1,400 per ton base prices in that space now hadn’t been seen in the market since February 2021.

Plate prices are down only $5 per ton week-over-week. But sources indicated that mills, some which had been trying to “hold the line,” are now willing to negotiate.

All of our pricing momentum indicators remain at Lower, meaning we expect prices to decline over the next 30 days.

Hot Rolled Coil: SMU price range is $910-$1,000 per net ton ($45.50-$50.00/cwt) with an average of $955 per ton ($47.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $40 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,300-$1,500 per net ton ($65.00-$75.00/cwt) with an average of $1,400 per ton ($70.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $110 per ton compared to last week, while the upper end decreased $60 per ton. Our overall average is down $85 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4-9 weeks*

Galvanized Coil: SMU price range is $1,320-$1,490 per net ton ($66.00-$74.50/cwt) with an average of $1,405 per ton ($70.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to one week ago, while the upper end decreased $20 per ton. Our overall average is down $60 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,426-$1,596 per ton with an average of $1,511 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks*

Galvalume Coil: SMU price range is $1,360-$1,400 per net ton ($68.00-$70.00/cwt) with an average of $1,380 per ton ($69.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $140 per ton. Our overall average is down $70 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,679-$1,719 per ton with an average of $1,699 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-9 weeks*

Plate: SMU price range is $1,745-$1,855 per net ton ($87.25-$92.75/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill. Both the lower and upper ends of our range declined $5 per ton compared to one week ago. Our overall average is down $5 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-8 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com