Market Data

June 12, 2022

SMU Survey: More Respondents See HRC Going Below $1,000/Ton

Written by Michael Cowden

A growing number of steel market participants think that hot-rolled coil (HRC) prices will fall below $1,000 per ton ($50 per cwt).

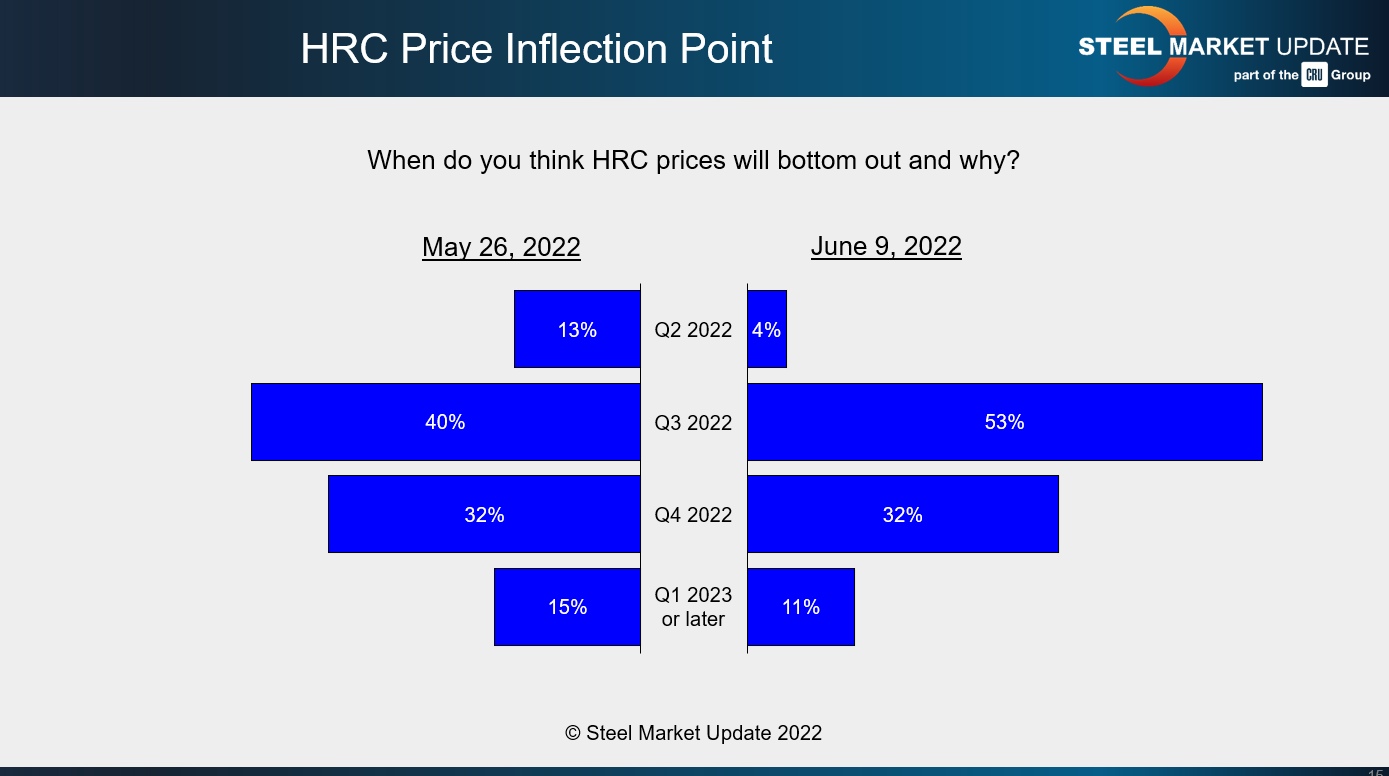

An increasing number also think that prices won’t hit bottom until the third quarter at the earliest.

Check out the charts below.

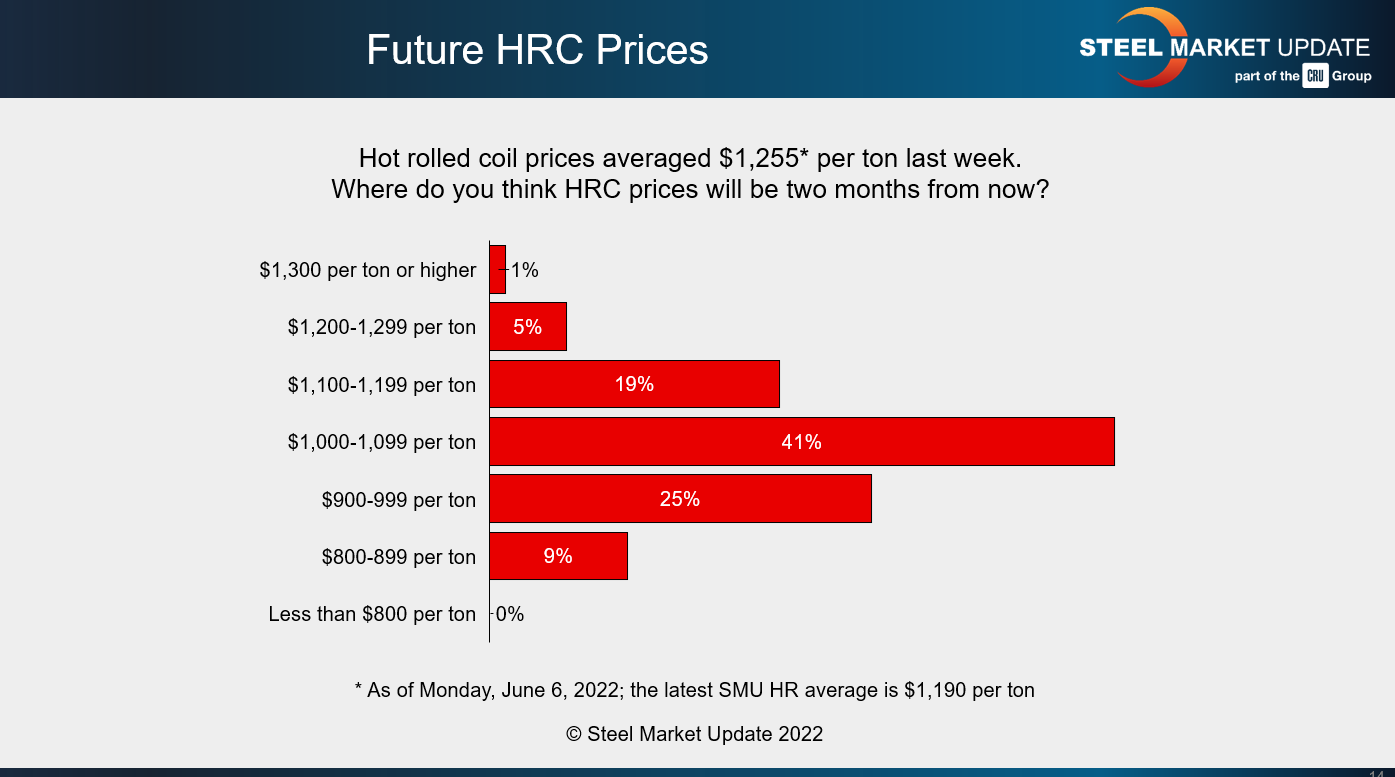

SMU’s HRC price was at $1,190 per ton ($59.50 per cwt) last week. (We will next update prices on Tuesday evening.) The bulk of survey respondents, 41%, think HRC prices will bottom out well below current levels – at $1,000-1,099 per ton. And a significant minority (34%) think prices won’t find a floor until $800-999 per ton.

Rewind to late May, and you get some sense of how abruptly things have changed just over the last few weeks. Only 6% of respondents at the end of last month thought that HRC prices would fall below $1,000 per ton.

There has also been a shift in consensus on when prices might bottom out. In late May, 13% of respondents still held out hope that HRC prices would find a floor in the second quarter. Even fewer (4%) think that now.

Here is what some survey respondents had to say about where and when prices might find a floor:

“Anticipating this will be the bottom.”

“I’m going to say $1,000/ton. But that is probably me being a ‘glass-half-full’ steel bull.”

“We will be sub $1,000/ton by early August assuming mills don’t take additional capacity offline.”

“Unless capacity comes offline, prices will continue to slide.”

“Domestic and import pricing should hit a parity by the end of June.”

“Prices (further) forward on the supply chain are continuing to go up. Nobody needs a price decrease.”

“We believe service center inventories are relatively lean currently. At some point the major players will need to reload, and this could establish a bottom for this cycle.”

“Based on current demand … buyers will have to return to normalized buying at some point in Q3.”

“Unchecked inflation/monetary policies will continue to drive toward a recession, which won’t be transitory”

“I believe strong mill resistance coupled with consistent demand and high inflation will keep prices high.”

“A slow decline to where we were headed in February.”

“Despite the bump from the Ukraine war, the trend should continue downward to close to 2019 levels due to an overall slowing global economy.”

Editor’s note: The information above comes from the survey we send out to the market every two weeks. If you are an SMU member, you can see those full results here.

By Michael Cowden, Michael@SteelMarketUpdate.com