Prices

June 21, 2022

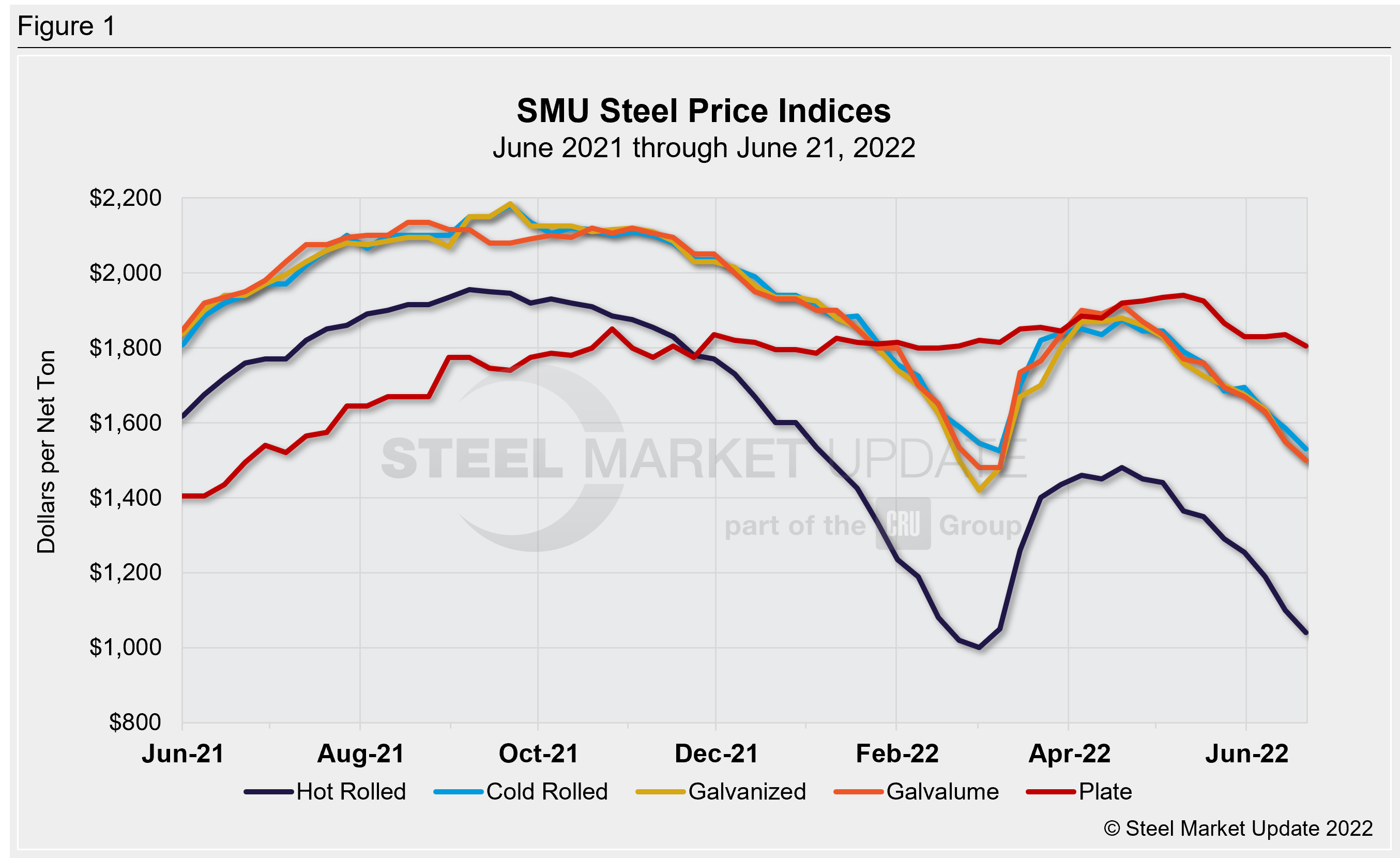

SMU Price Ranges: HRC Falls Below $1,100/ton for First Time Since Early March

Written by Brett Linton

Sheet prices continued to fall this week on lower raw material costs, a buyers’ strike and concerns in some corners about a potential recession.

But that gloomy sentiment was not universally shared, with some sources pointing to strong or at least steady demand despite the lower prices.

SMU’s average hot-rolled coil price now stands at $1,040 per ton ($52 per cwt), down $60 per ton from $1,100 per ton last week and down $440 per ton from a mid/late April high of $1,480 per ton.

Our average price fell below $1,100 per ton for the first time since early March. The low end of our price range ($980 per ton) also dipped below $1,000 per ton for the first time since the beginning of the first quarter – shortly before prices shot higher following the outbreak of full-scale war in Ukraine.

The higher end of the HRC range, $1,100 per ton, was reported by market participants to be pricing available from major mills for standard spot tonnages. Sources said figures around or below $1,000 per ton were from certain regional mills or for large volume orders (thousands of tons).

The declines in HRC were mirrored in other products, with cold-rolled down $55 per ton week-over-week and galvanized and Galvalume both down $50 per ton. Plate slipped a more modest $30 per ton.

Our price momentum indicators remain at Lower, meaning we expect prices to continue to trend down over the next 30 days.

Hot Rolled Coil: SMU price range is $980-$1,100 per net ton ($49.00-$55.00/cwt) with an average of $1,040 per ton ($52.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $45 per ton compared to one week ago, while the upper end decreased $75 per ton. Our overall average is down $60 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,480-$1,580 per net ton ($74.00-$79.00/cwt) with an average of $1,530 per ton ($76.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to last week, while the upper end decreased $70 per ton. Our overall average is down $55 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-9 weeks*

Galvanized Coil: SMU price range is $1,440-$1,560 per net ton ($72.00-$78.00/cwt) with an average of $1,500 per ton ($75.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end decreased $60 per ton. Our overall average is down $50 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,546-$1,666 per ton with an average of $1,606 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-10 weeks*

Galvalume Coil: SMU price range is $1,440-$1,560 per net ton ($72.00-$78.00/cwt) with an average of $1,500 per ton ($75.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $60 per ton compared to last week, while the upper end decreased $40 per ton. Our overall average is down $50 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,759-$1,879 per ton with an average of $1,819 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks*

Plate: SMU price range is $1,750-$1,860 per net ton ($87.50-$93.00/cwt) with an average of $1,805 per ton ($90.25/cwt) FOB mill. The lower end of our range decreased $50 per ton compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $30 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com