Prices

June 14, 2022

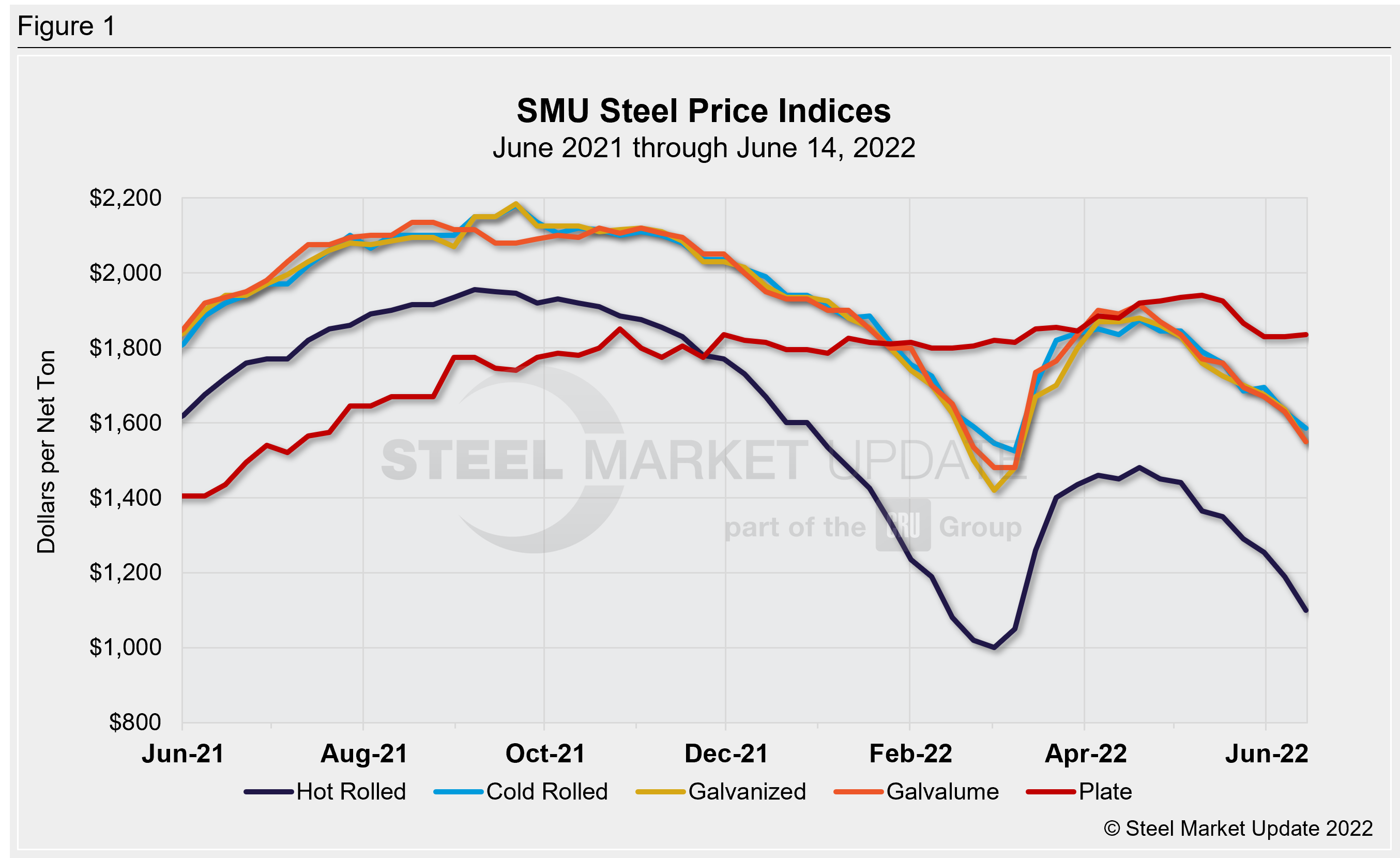

SMU Price Ranges: HRC Falls to $1,100/ton in Steepest Drop Since Ukraine War

Written by Brett Linton

Hot-rolled coil prices have suffered their biggest week-over-week decline since before the war in Ukraine sent tags sharply higher.

Steel Market Update’s average hot-rolled coil price stands at $1,100 per ton ($55.50 per cwt), down $90 per ton from $1,190 per ton last week and down $265 per ton from $1,365 per ton in mid-May.

The last time prices saw such a steep week-over-week drop was in mid-February, when they fell $110 per ton.

Price inputs were received in a wide range from approximately $1,000 per ton to $1,180 per ton. The lower figure was for large orders, thousands of tons, while the higher figure represented mill offer prices and/or transaction to smaller inland buyers.

Similar declines – and similarly wide spreads between highs and lows – were seen in cold rolled (down $40 per ton), galvanized (down $85 per ton), and Galvalume (down $80 per ton).

Recall that wide spreads are often an indication of a market moving rapidly up or down.

Plate prices were effectively unchanged from last week. We will watch that market closely over the next week following Nucor’s announcement of a cut-to-length plate price cut of $85-125 per ton.

Our price momentum indicators for all sheet and plate products remain at Lower, meaning we expect lower prices over the next 30 days.

Hot Rolled Coil: SMU price range is $1,025-$1,175 per net ton ($51.25-$58.75/cwt) with an average of $1,100 per ton ($55.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $115 per ton compared to one week ago, while the upper end decreased $65 per ton. Our overall average is down $90 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $1,520-$1,650 per net ton ($76.00-$82.50/cwt) with an average of $1,585 per ton ($79.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to last week, while the upper end decreased $50 per ton. Our overall average is down $45 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU price range is $1,480-$1,620 per net ton ($74.00-$81.00/cwt) with an average of $1,550 per ton ($77.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to one week ago, while the upper end decreased $90 per ton. Our overall average is down $85 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,586-$1,726 per ton with an average of $1,656 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks

Galvalume Coil: SMU price range is $1,500-$1,600 per net ton ($75.00-$80.00/cwt) with an average of $1,550 per ton ($77.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to last week, while the upper end decreased $60 per ton. Our overall average is down $80 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,819-$1,919 per ton with an average of $1,869 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-8 weeks

Plate: SMU price range is $1,800-$1,870 per net ton ($90.00-$93.50/cwt) with an average of $1,835 per ton ($91.75/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com