Plate

June 15, 2022

April Import Share of US Sheet and Plate Markets

Written by David Schollaert

Imports of less expensive sheet and plate products continue to arrive at US ports, though at a much slower pace in April. Following a boost in volumes in March, imports of flat products decelerated in April and saw their share of the domestic steel market fall, according to Commerce Department data.

Imports’ share of US sheet and plate markets peaked in December, reaching their highest levels in the past 4.5 years. The trend was driven by the need for buyers to find relief from inflated steel prices in the US. As the market slowed at year-end, so did imports. That trend reversed in March, but the arrival of foreign sheet and plate products tumbled back down in April.

Imports’ share of total sheet shipments into the US was 16.9% in April, down from 18.6% month-on-month (MoM) and further behind the peak of 19.5% in January. Though domestic shipments were down 3.4%, the decrease was driven by a 13.9% decline in foreign sheet. The market share of plate product imports also slipped in April to 21.9% from 22.5% the month prior.

April’s sheet imports totaled 821,490 tons, down from the 954,134 tons that arrived in March, and the lowest total since June 2021.

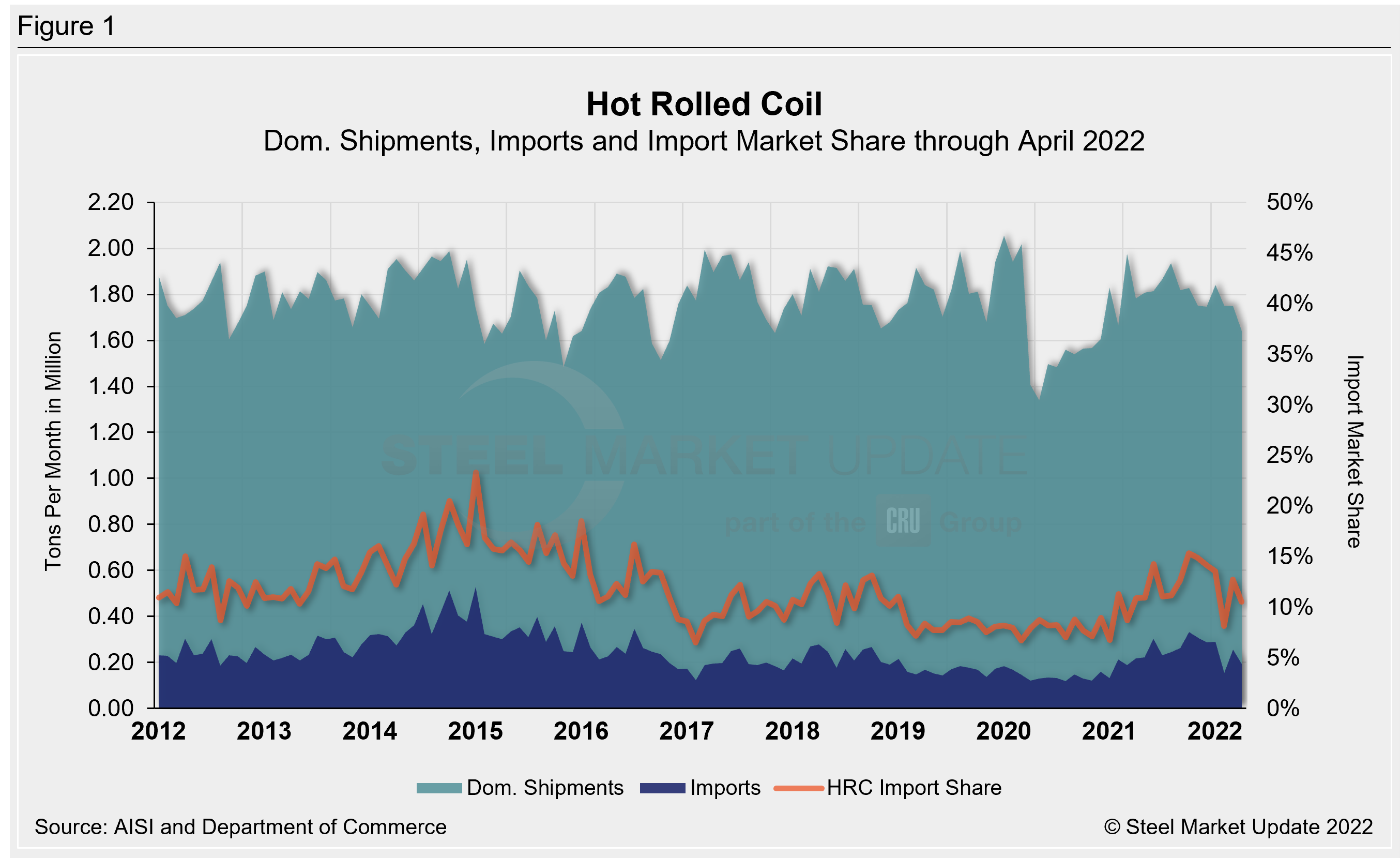

Overall sheet product shipments (domestic shipments plus imports) were down 5.4% in April versus March. They totaled 4.85 million tons, and that lower figure was driven by a 132,645-ton decrease in foreign shipments. Hot-rolled coil (HRC) imports totaled 193,020 tons in April, down 24.4% MoM. The details are below in Figure 1.

The import share of HRC slipped 1.7 percentage points to 16.9% in April, historically still a healthy share despite the decline. The declined share was driven by a 13.9% slide in foreign material, while domestic shipments also fell MoM, but at a slower pace. HRC apparent supply totaled 1.834 million tons in April, down from 2.005 million tons the month prior.

Imports of cold-rolled coil (CRC), galvanized (hot dipped and electrolytic), and other metallic coat (OMC) were all down in April. CRC saw the largest decline, down 22.2% MoM, followed by Galvanized (-14.4%), and OMC (-11.7%).

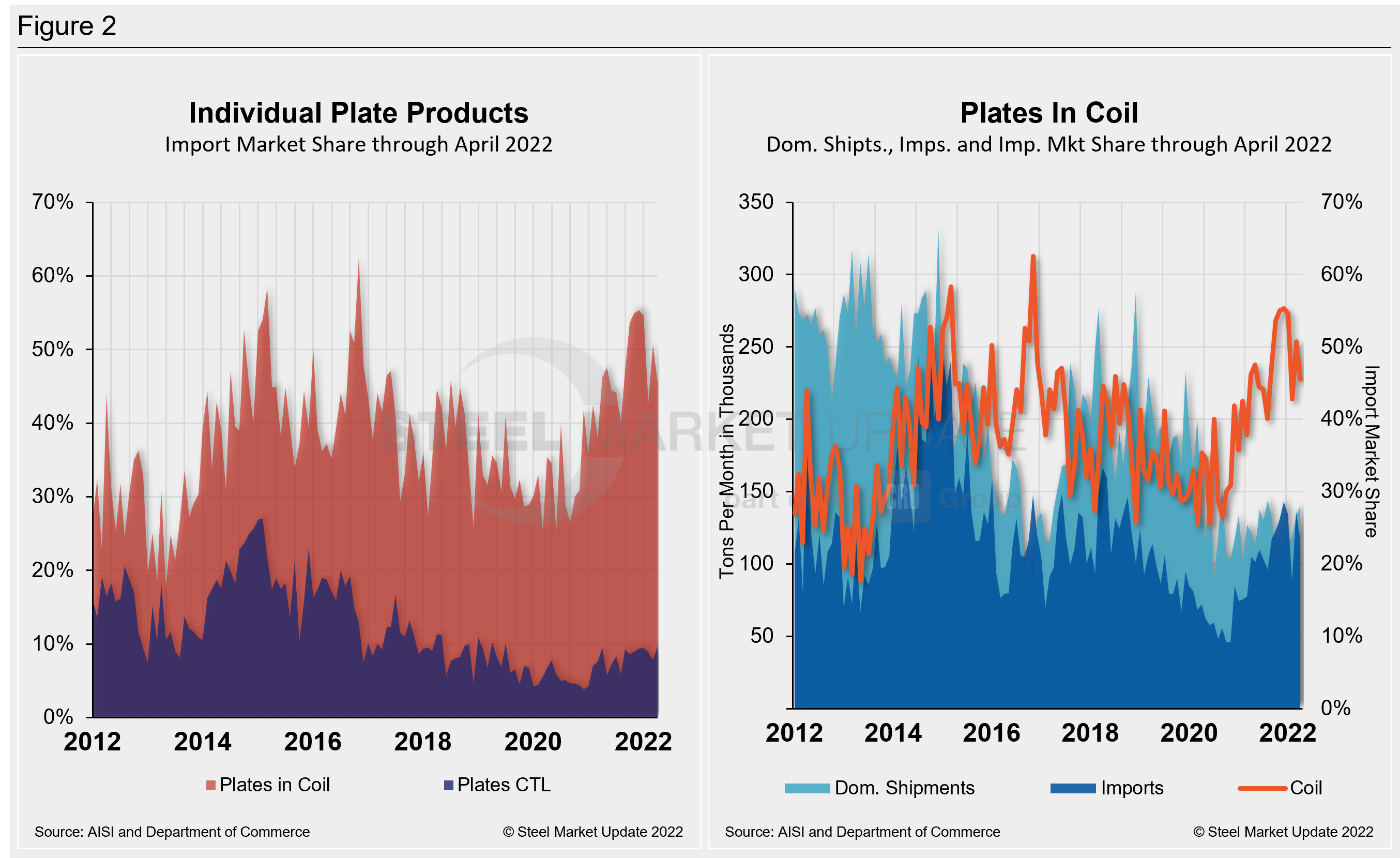

Plate products in April saw an overall decline in shipments as apparent supply dipped by 3.7% MoM. The decline was driven by a tumble of 6.5% in imports and a 2.8% decline in domestic plate shipments. April plate imports of 165,353 tons were the second-lowest total in more than six months. All told, total plate shipments, including foreign and domestic, were 755,799 tons in April, down from 784,536 tons the month prior.

The import market share for plates in coil fell to 45.4% in April, a 5.2 percentage point decrease MoM. The decline was driven by a 14.4% tumble in total imports in April, while domestic shipments rose 5.5% over the same period. Total imports of plates in coil were 116,677 ton in April, down from March’s 136,365 tons.

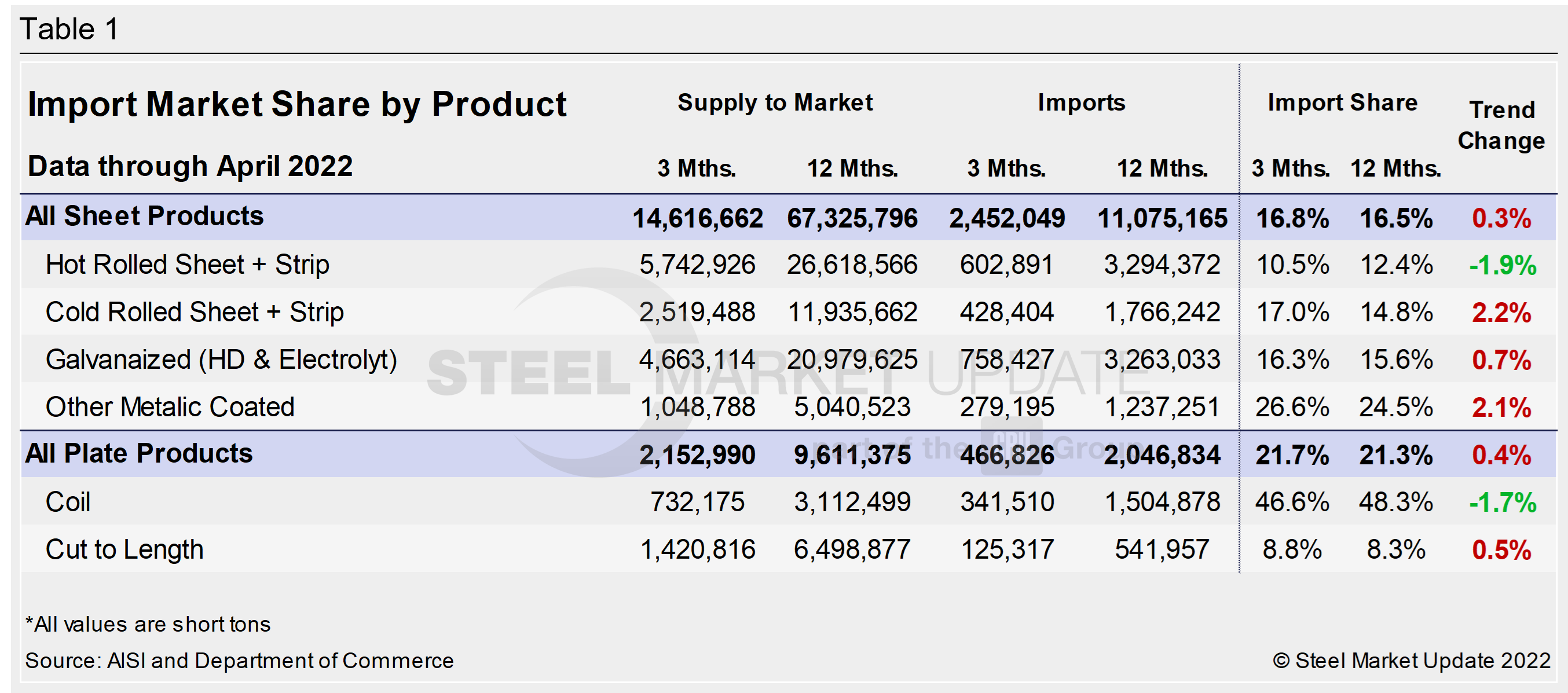

The table below displays the total supply to the market in three months and 12 months through April 2022 for sheet and plate products and six subcategories. Supply to the market is the total of domestic mill shipments plus imports. It shows imports on the same three- and 12-month basis and then calculates import market share for the two time periods for six products. Finally, it subtracts the 12-month share from the three-month share and color codes the resulting green or red according to gains or losses. If the result is positive, it means that the import share is increasing, and the code is red.

The big picture is that imports’ share of US sheet and plate sales tumbled in April following a strong surge the month prior. The big second-half jump in total imports was the result of historically and disproportionately high domestic steel prices. The influx of foreign material had been declining, coinciding with lower domestic prices. The war in Ukraine shifted that dynamic, pushing prices higher, but fundamental demand has provided support to rising prices. The rally was short-lived as prices have been tumbling quickly while foreign steel has arrived at US ports at a slower pace. The trend dynamic is especially interesting given that the global market has shifted its raw material sourcing due to sanctions in some jurisdictions on Russian material.

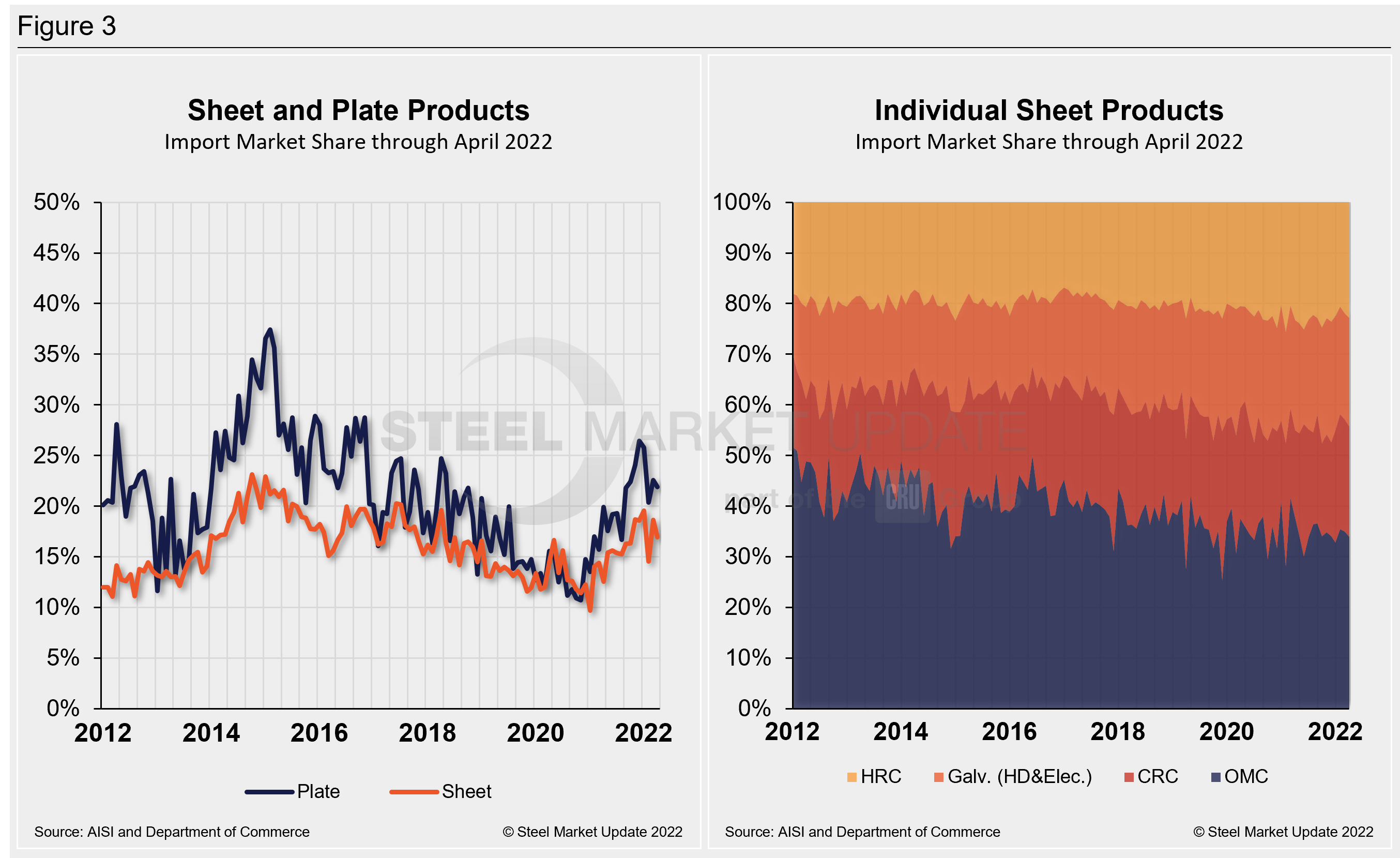

Hot-rolled and cold-rolled sheet and strip have seen a trend shift along with plate products, illustrating how import competition is impacting domestic products in three months compared to 12 months. The most notable of those subcategories is HRC and plate in coil, which have both seen a declining import market share through April.

The import market share of individual plate products as well as a breakdown of the market share for plates in coil are displayed together in Figure 2. The historical import market share of plate and sheet products, and the import market share of the four major sheet products, are shown side-by-side in Figure 3.

By David Schollaert, David@SteelMarketUpdate.com