Market Data

May 26, 2022

Steel Mill Lead Times Tick Downward, Willingness to Negotiate Rising

Written by Brett Linton

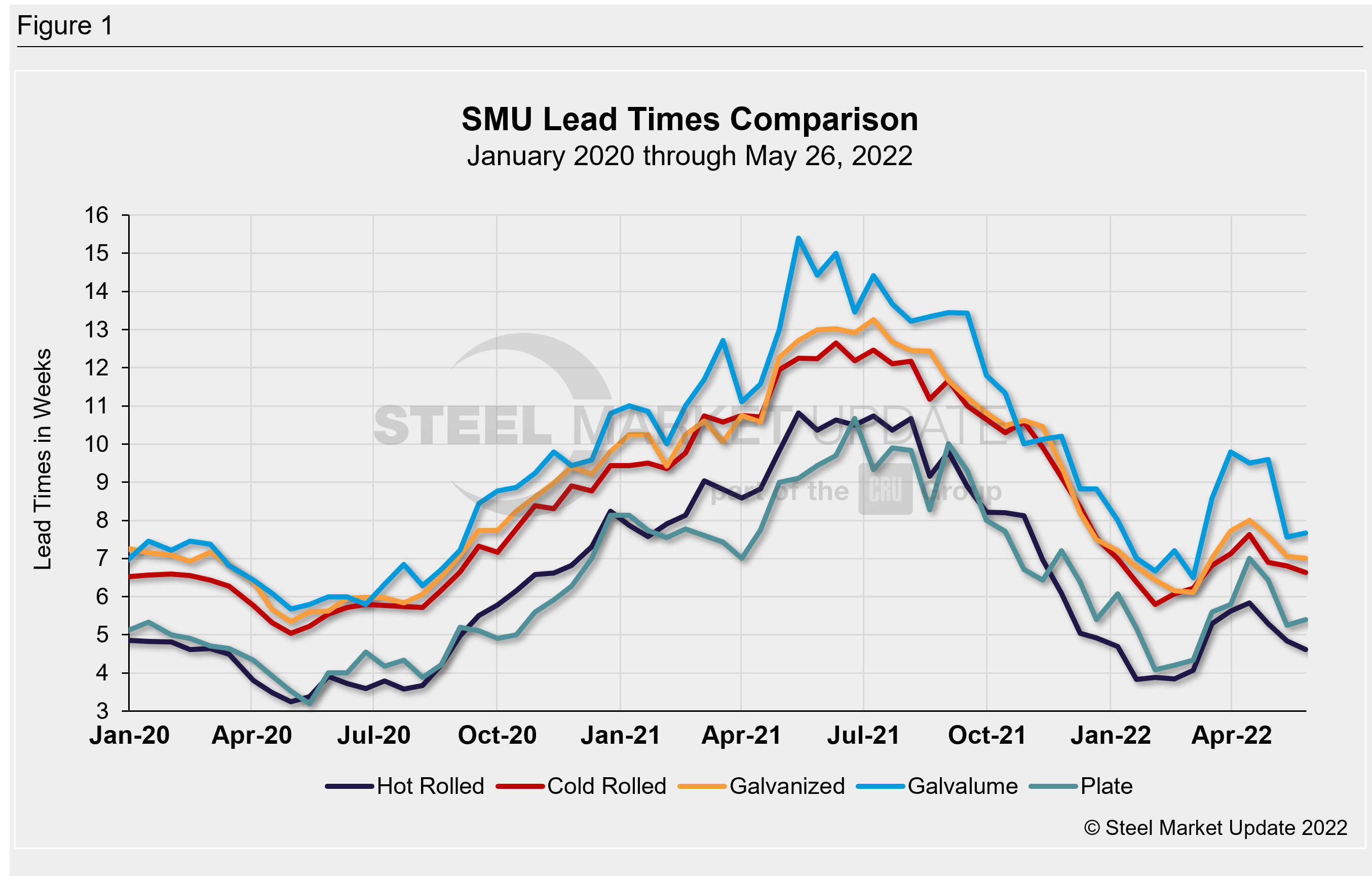

Steel Market Update’s latest check of the market indicates steel mill lead times are slowly reverting back towards historical norms for most sheet products, while Galvalume and plate lead times inched up compared to two weeks prior. Lead times are now in line with levels seen in the beginning of 2022.

Buyers surveyed this week reported mill lead times ranging from 3–8 weeks for hot rolled, 5–10 weeks for cold rolled, 5–9 weeks for galvanized, 7–9 weeks for Galvalume, and 4–7 weeks for plate.

SMU’s hot rolled lead times now average 4.6 weeks, down from 4.8 in mid-May. Cold rolled lead times eased 0.2 weeks to 6.6 weeks, while galvanized lead times declined 0.1 weeks to 7.0 weeks. The average Galvalume lead time rose 0.1 weeks to 7.7 weeks, but recall the two-week drop seen in our previous analysis. Due to the limited size of that market and our small sample size, realize that this data can be more volatile. Mill lead times for plate are now at 5.4 weeks, rising by 0.1 weeks over mid-May, but down 1.1 weeks from late April.

Approximately 56% of the executives responding to this week’s questionnaire told SMU they were seeing stable lead times, unchanged from two weeks prior and down from 70% a month ago. Roughly 41% said lead times were slipping, down from 43% in early May but up from 16% in late April. Just 3% said lead times were extending, up from 1% two weeks ago, but down from 14% one month prior. Here’s what a few of them had to say:

“Demand is soft and inventories are high.”

“Lead times are stable, but short.”

“Slipping in the short run, anticipate them to extend nd stabilize six to eight weeks out.”

“They have already shrunk drastically, and buyers will be coming off the sidelines shortly.”

“Less distributor buying activity especially from imports. None for stock. However, more domestic buying to hedge import risk means domestic mills are receiving orders, keeping lead times somewhat extended.”

“The market is heavy in inventory so the mills are getting fewer orders as new capacity comes on line.”

“Steel buyers are still ordering material they need.”

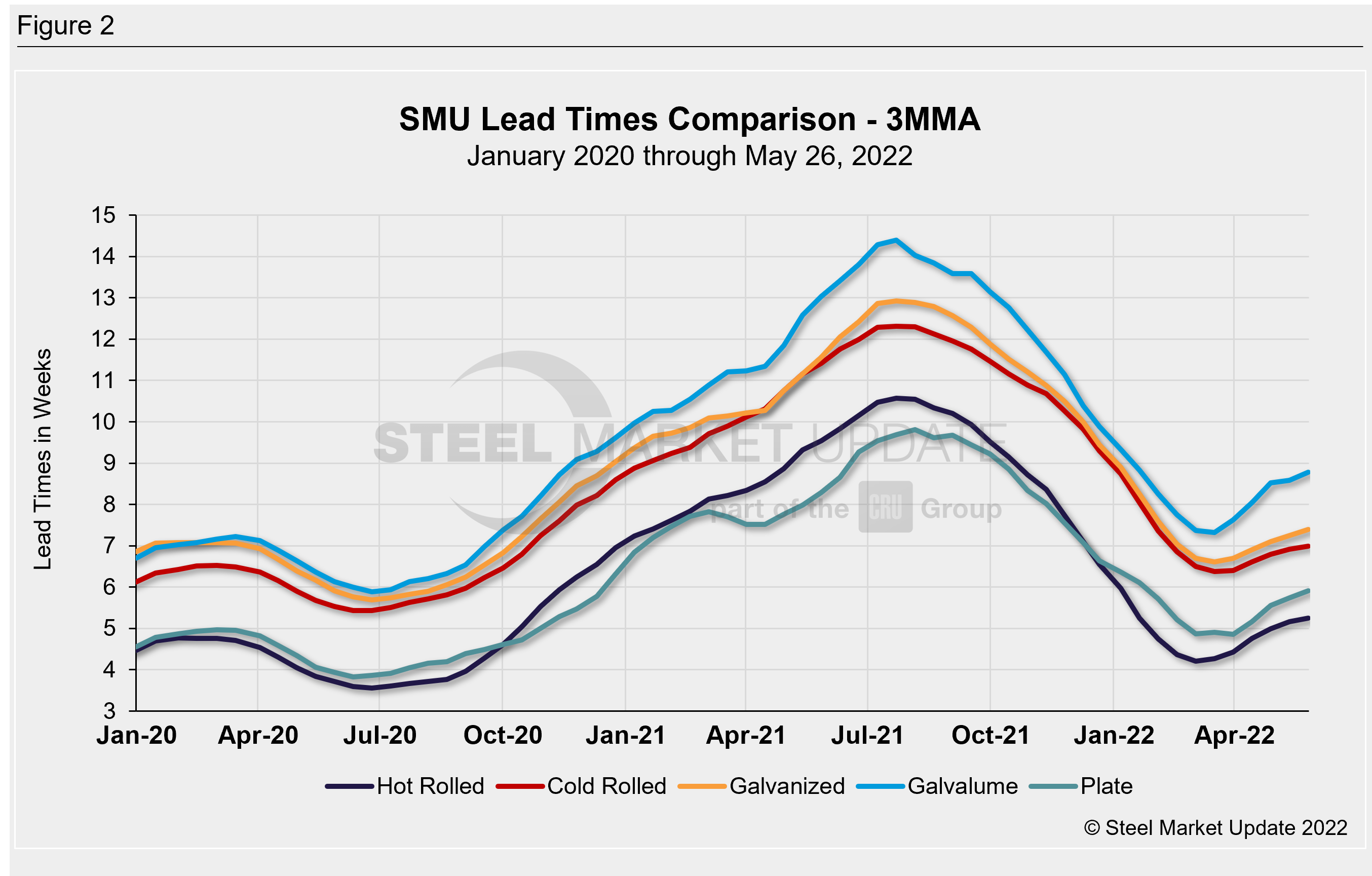

Looking at lead times on a three-month moving average can smooth out the variability in the biweekly readings. As a 3MMA, all products were flat to up 0.2 weeks compared to earlier this month. The current 3MMA for hot rolled is unchanged at 5.2 weeks, cold rolled is up 0.1 to 7.0 weeks, galvanized is up 0.2 to 7.4 weeks, Galvalume is up 0.2 to 8.8 weeks, and plate is up 0.2 to 5.9 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

Price Negotiations

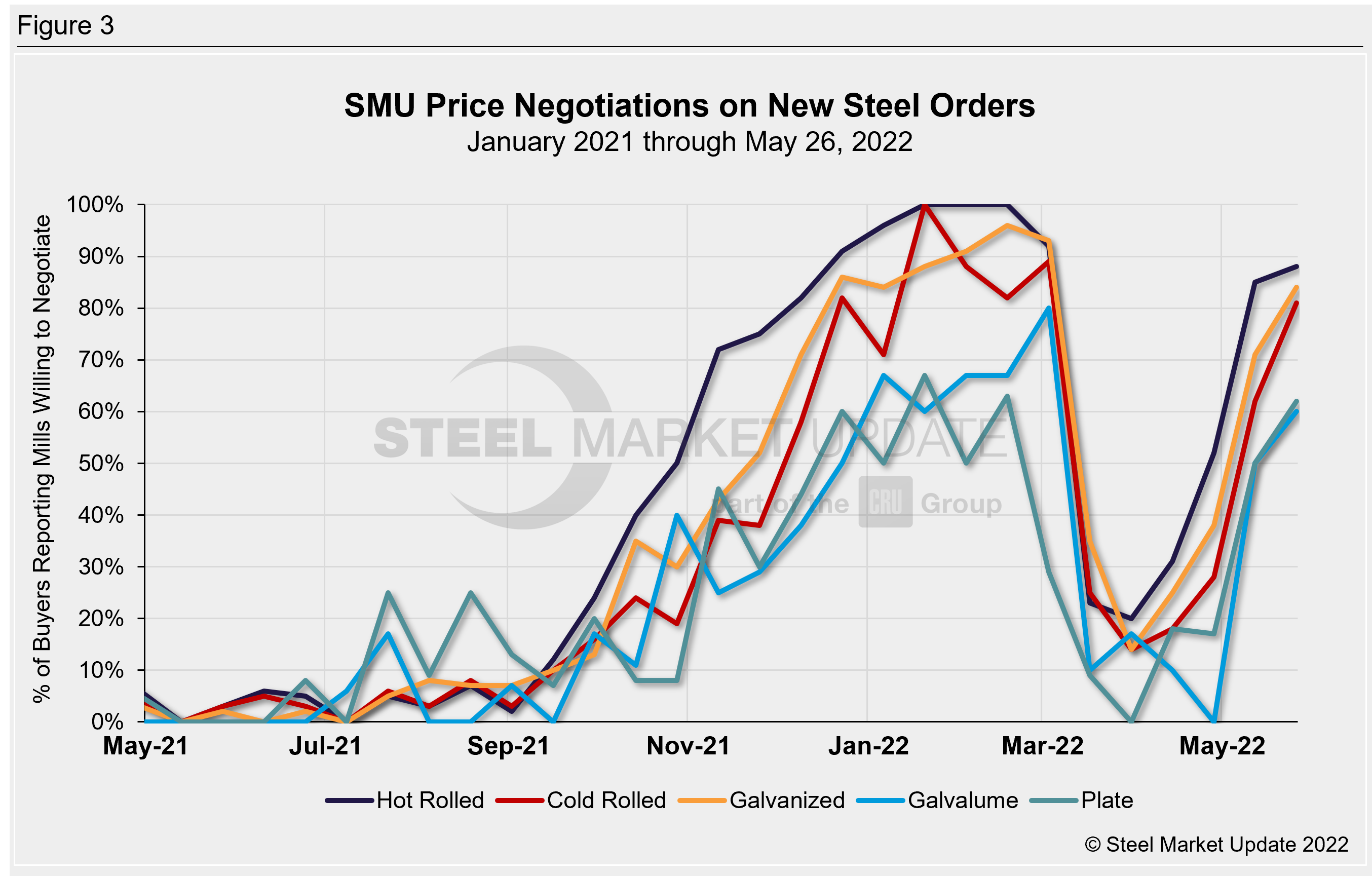

The firm grip mills held on price negotiations in March and April continues to loosen, according to steel buyers polled this week. Four out of five buyers now report that mills are willing to talk price to secure an order.

Every two weeks, SMU asks survey respondents: Are you finding domestic mills willing to negotiate spot pricing on new orders placed this week? On average, 81% of steel buyers report that mills were willing to negotiate lower prices on new orders this week, up from 70% two weeks prior and up from 35% in late April. Mills’ willingness to negotiate has grown in each of our market checks over the past ten weeks.

About 88% of hot rolled buyers surveyed this week responded that mills were willing to negotiate lower prices, up from 52% one month ago. Cold rolled and galvanized respondents tell the same story, with 81–84% of buyers reporting that mills are now negotiable, up from 28–38% in late April. Negotiations on Galvalume products are still mixed, with 60% reporting that mills are willing to negotiate, up from 50% two week prior. Negotiations were never quite as loose in the plate market, but our latest survey shows that 62% of plate buyers reported mills willing to bargain. This is up from 50% two weeks ago and up from just 17% one month prior.

SMU’s Price Momentum Indicator remains at Lower since our May 10th adjustment, indicating we expect prices to decline over the next 30–60 days.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com