Prices

May 26, 2022

Preliminary Steel Imports: April Down 12%, May Down 26%

Written by Brett Linton

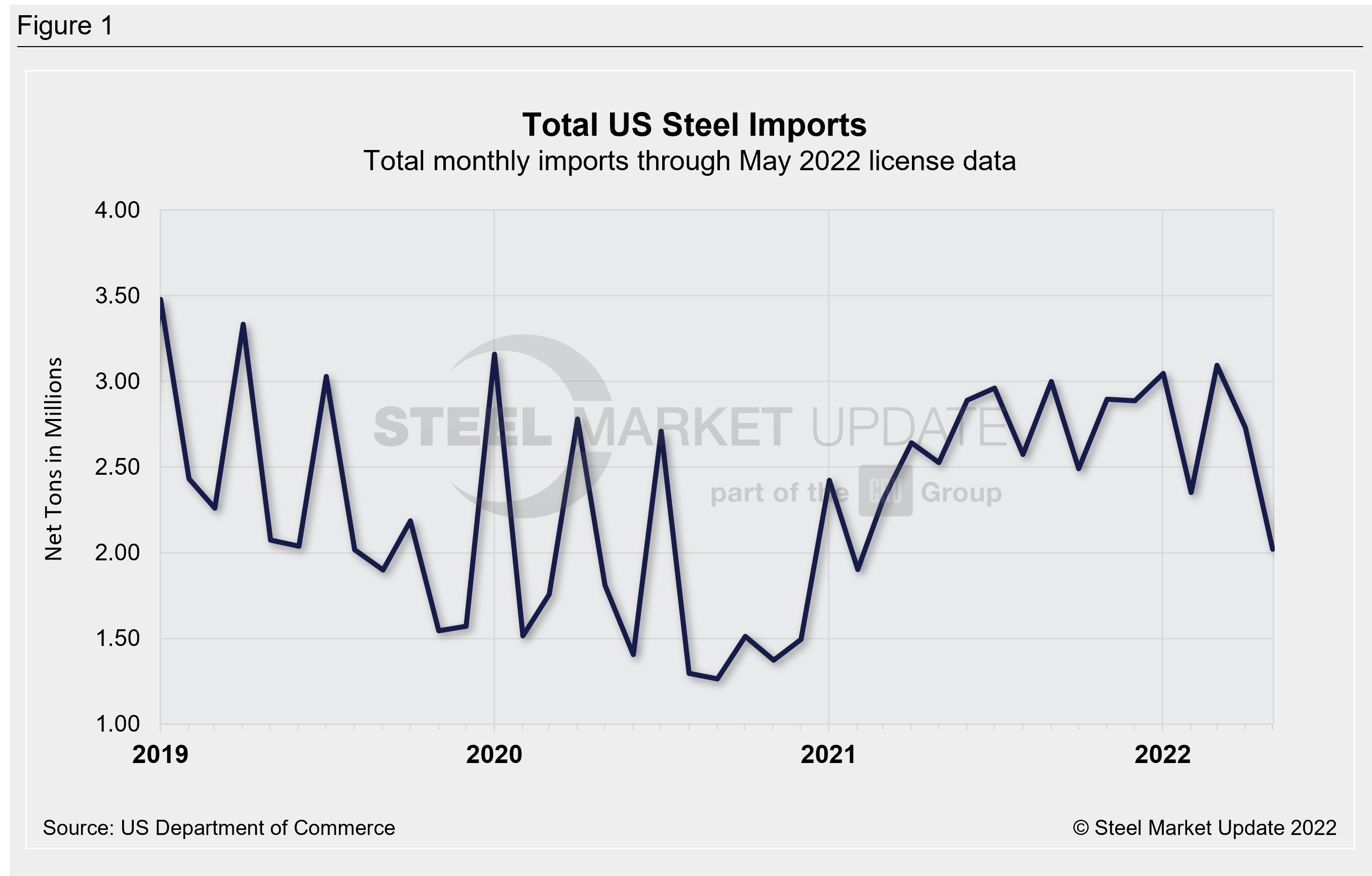

Preliminary Census data recently released shows that steel imports in April declined 12% month-over-month to 2.73 million net tons, falling from March’s 26-month high of 3.09 million tons. May import licenses through May 23 and are currently at a 15-month low of 2.02 million tons, down 26% compared to April and 35% lower than the March high.

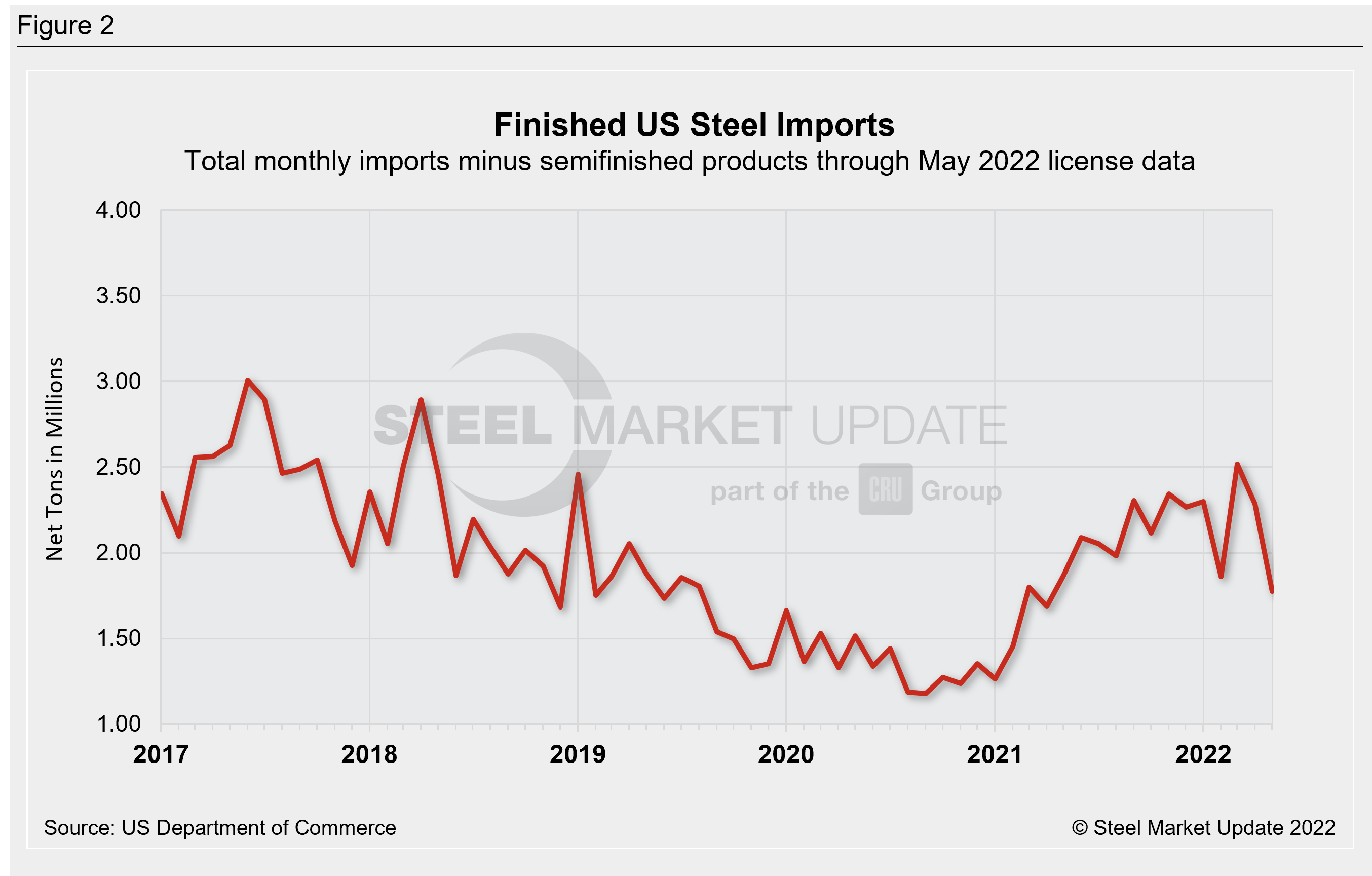

Preliminary finished steel imports were 2.28 million tons in April, down 9% from a 46-month high seen in March. License data shows May finished steel imports are down 22% over April to 1.78 million tons, potentially the lowest level seen since April 2021.

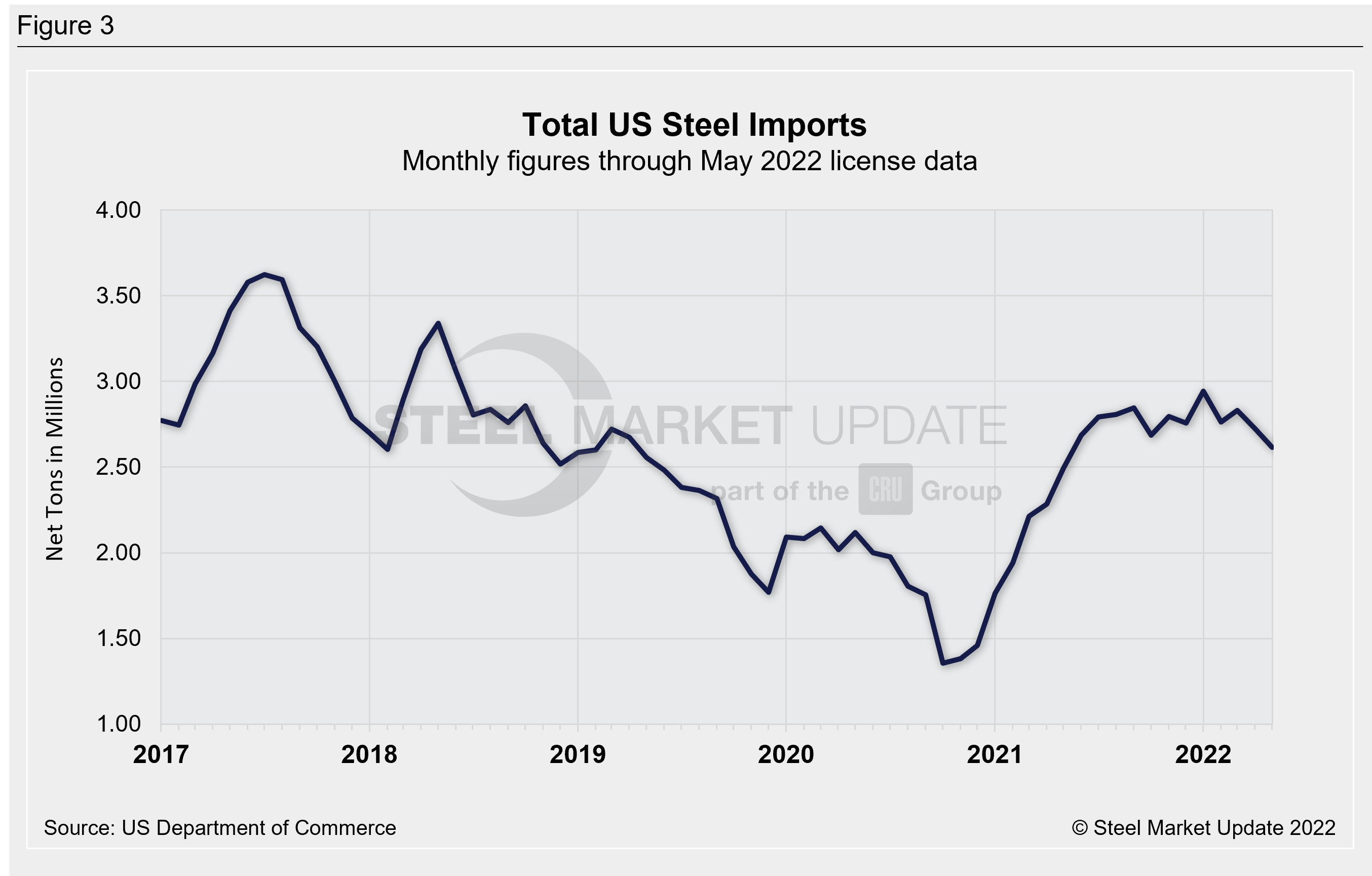

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three-month moving average (3MMA) basis in an attempt to more accurately display US steel import trends. The 3MMA through preliminary April data has fallen to a six-month low of 2.73 million tons. Although down, current import figures remain strong compared to recent years: 2021 averaged 2.63 million tons per month, 2020 averaged 1.84 million tons per month, 2019 averaged 2.32 million tons per month. Recall that the lowest 3MMA level in SMU’s recent history was October 2020, at 1.36 million tons. The latest May license data suggests that the 3MMA will decline further to 2.62 million tons, but licenses are still rolling in for the month and this figure is likely to increase in the coming weeks.

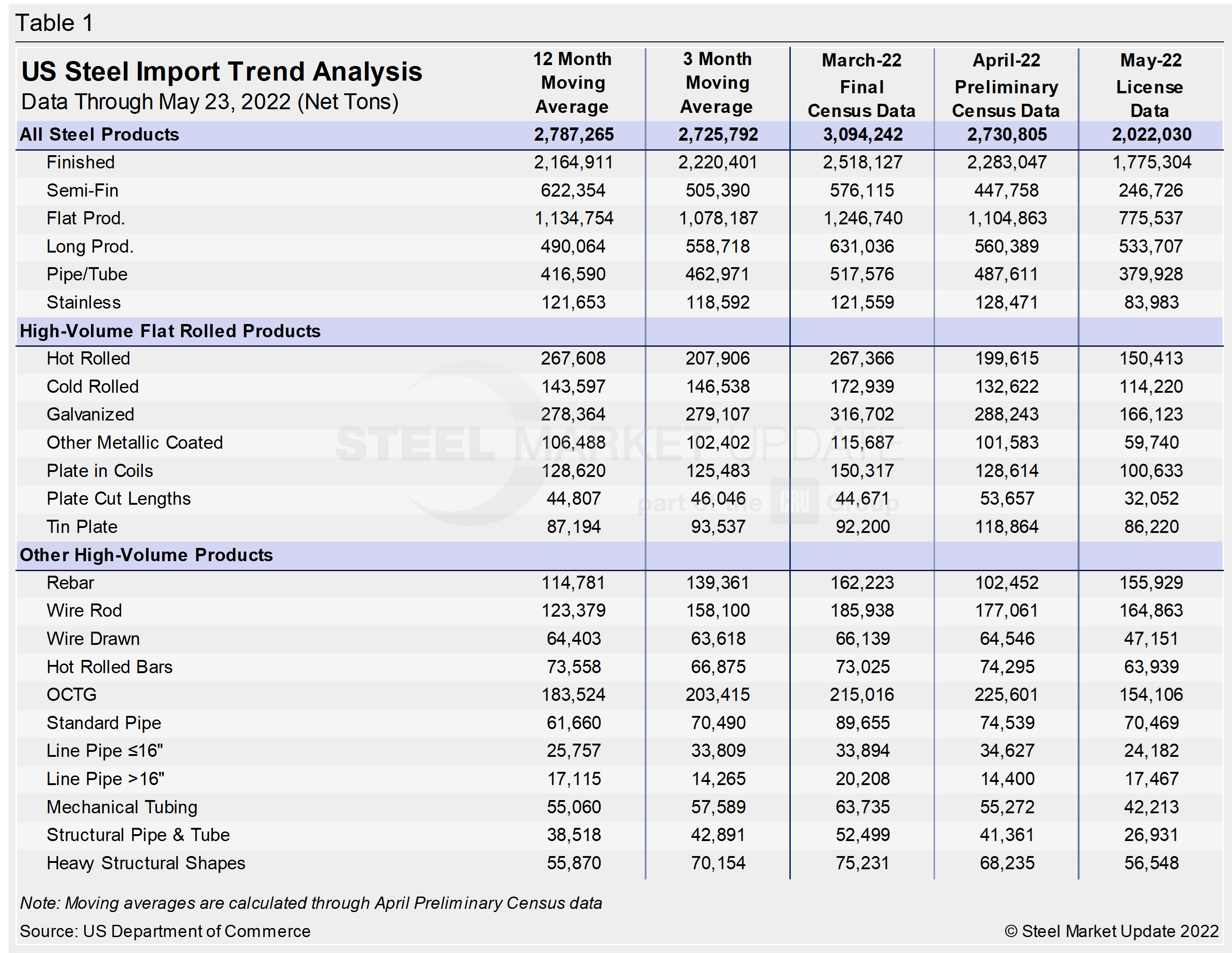

The table below displays flat-rolled product imports as well as other high-volume products, including rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on imports divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

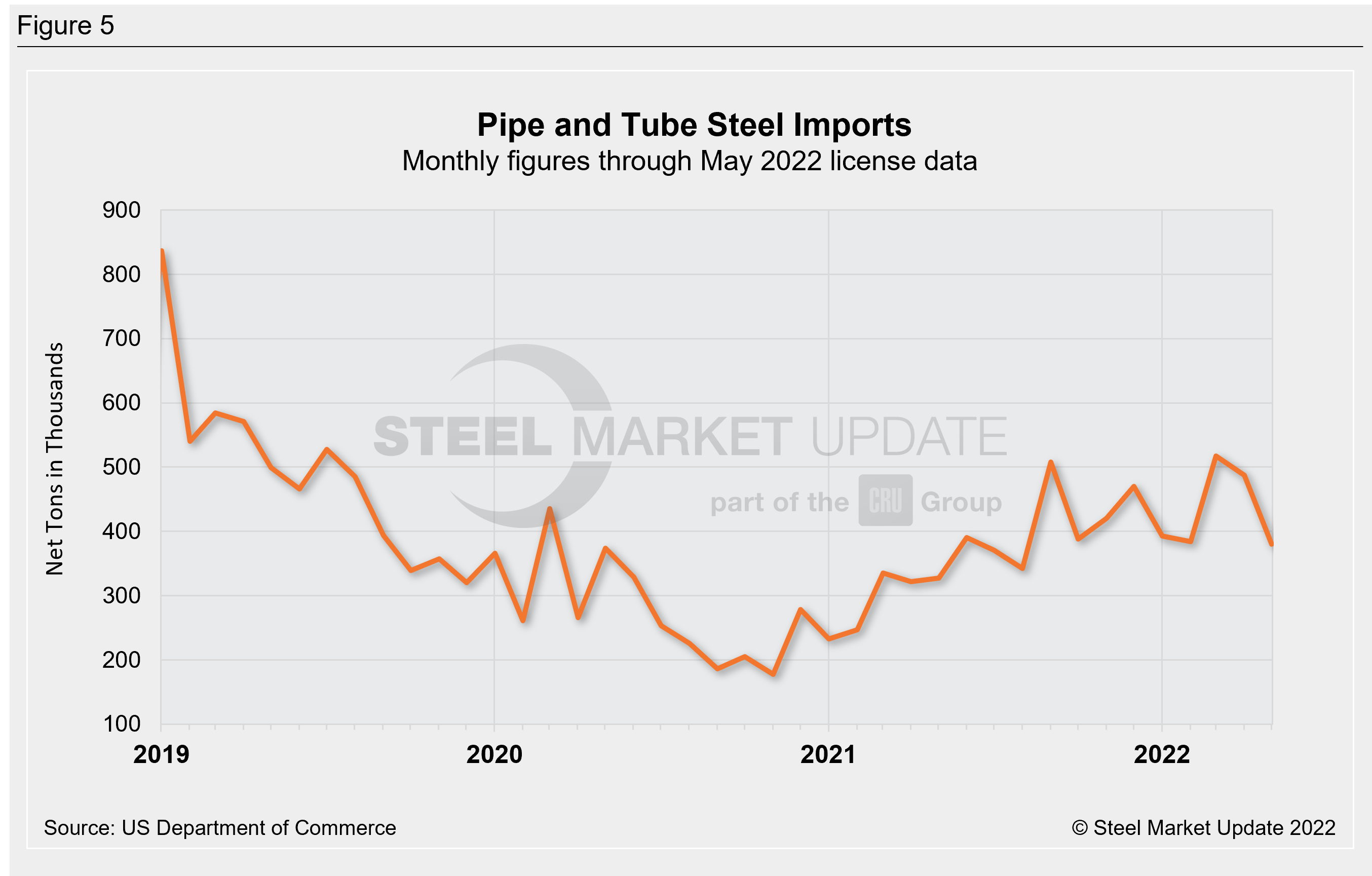

The two charts below show monthly imports grouped by product category: flat-rolled imports and pipe and tube imports. April flat rolled-imports receded to 1.10 million tons, down 11% from the month prior. May licenses show a further decline of 30%, with 776,000 tons of flat-rolled imports coming into the country. Pipe and tube imports were 488,000 tons in April, down 6% from the 2.5-year high seen in March. May pipe and tube import licenses are down an additional 22% to 390,000 tons.

We have an interactive graphing tool available on our website here. Readers can explore historical import data, in total and by product. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com