Plate

May 24, 2022

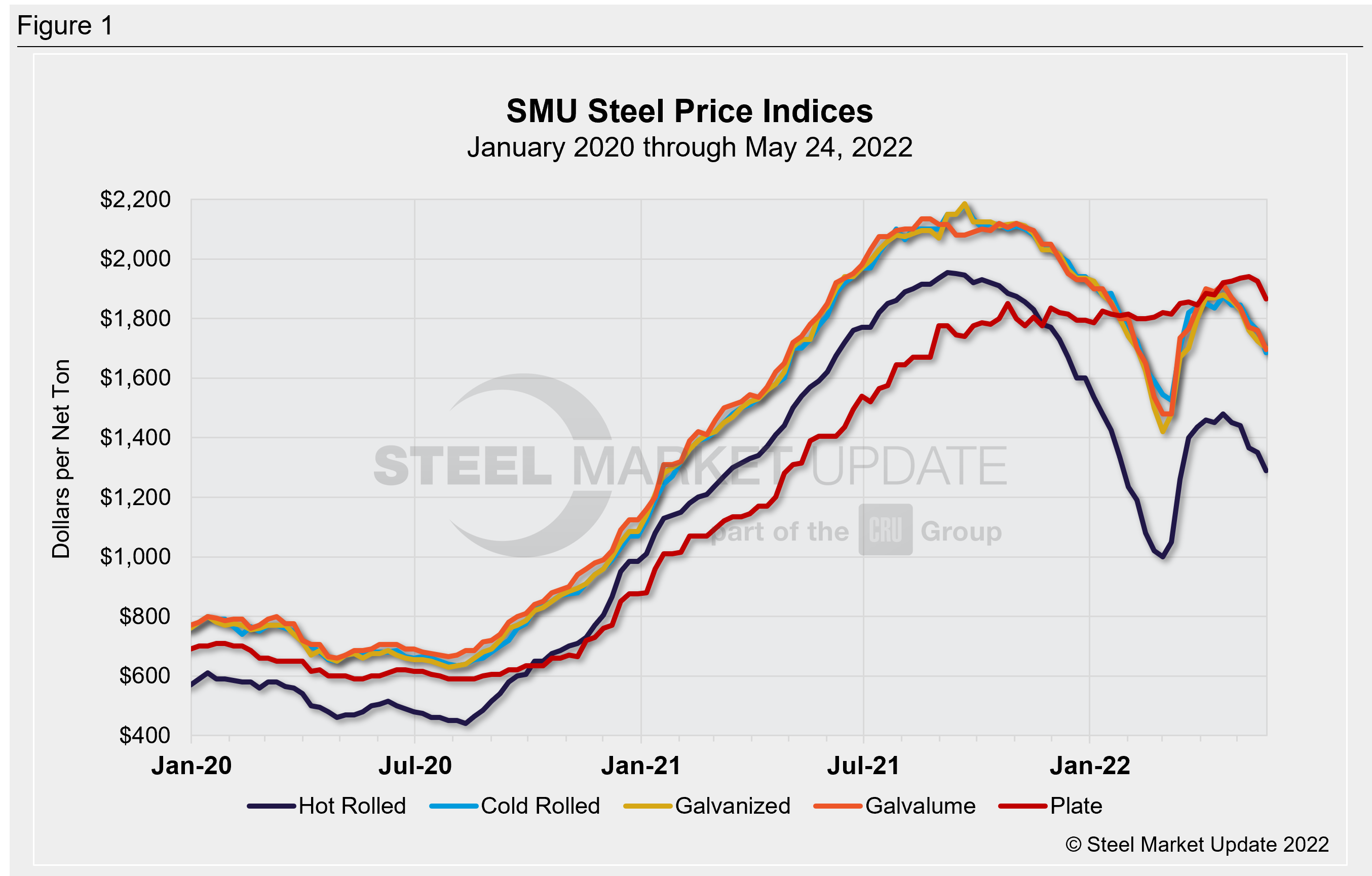

SMU Price Ranges: Sheet and Plate Down $25-75/ton

Written by Brett Linton

Flat-rolled steel prices were down again this week. Not as much as some had feared but the drops were more substantial than those hoping for a modest decline or stable pricing might have liked.

The takeaway: Hot-rolled coil is now down $190 per ton ($9.50 per cwt) over the last five weeks. In other words, we’re falling nearly as fast as we were at the end of last year.

And early expectations are that scrap will be lower again next month. Which means the floor is still moving lower too.

We’ve adjusted our plate momentum indicator to Lower for the first time since May 2020 (two years!). Recall that all sheet momentum indicators have been lower since May 10, 2022.

That switch from Neutral to Lower on plate follows Nucor’s publicly announced price decrease. It also follows chatter we had picked up on earlier about other mills quietly cutting deals.

Hot Rolled Coil: SMU price range is $1,250-$1,330 per net ton ($62.50-$66.50/cwt) with an average of $1,290 per ton ($64.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to one week ago, while the upper end declined $70 per ton. Our overall average is down $60 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 4-8 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,620-$1,750 per net ton ($81.00-$87.50/cwt) with an average of $1,685 per ton ($84.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to last week, while the upper end declined $70 per ton. Our overall average is down $75 compared to one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks*

Galvanized Coil: SMU price range is $1,650-$1,750 per net ton ($82.50-$87.50/cwt) with an average of $1,700 per ton ($85.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end declined $50 per ton. Our overall average is down $25 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,756-$1,856 per ton with an average of $1,806 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks*

Galvalume Coil: SMU price range is $1,650-$1,740 per net ton ($82.50-$87.00/cwt) with an average of $1,695 per ton ($84.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $70 per ton compared to last week, while the upper end declined $60 per ton. Our overall average is down $65 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,969-$2,059 per ton with an average of $2,014 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-9 weeks*

Plate: SMU price range is $1,800-$1,930 per net ton ($90.00-$96.50/cwt) with an average of $1,865 per ton ($93.25/cwt) FOB mill. The lower end of our range decreased $90 per ton compared to one week ago, while the upper end declined $30 per ton. Our overall average is down $60 per ton from last week. Our price momentum indicator on plate steel now points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com