Analysis

May 15, 2022

Final Thoughts

Written by Michael Cowden

We’ve been writing a lot about fob mill prices falling. That’s not happening in a vacuum. Service center resale prices are coming down as well.

That’s notable because service center resale prices, like mill lead times, are usually a reliable indicator of which way steel prices will go in the months ahead.

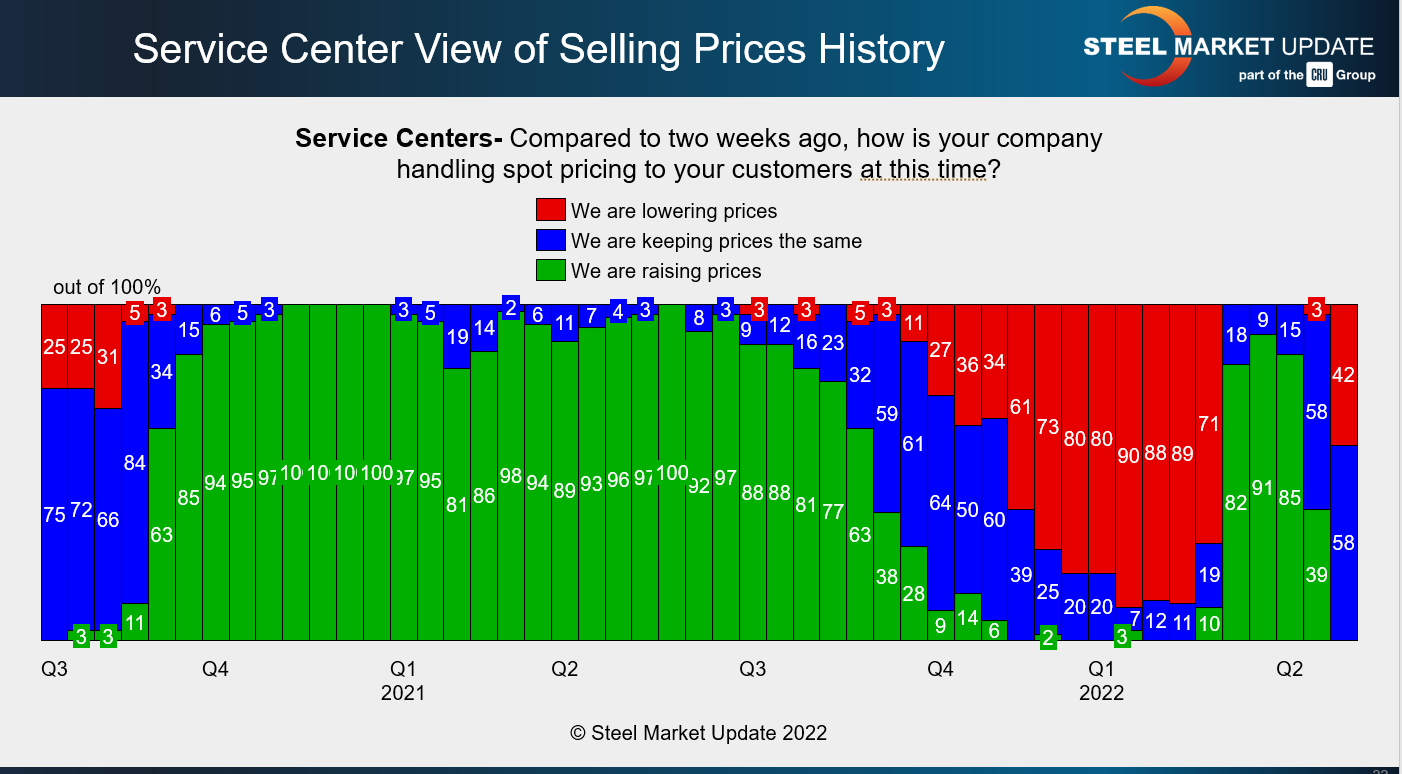

What’s also notable is how steel shifted from a seller’s market to a buyer’s market in just a month. Check out the chart below on service center resale prices from a service center perspective:

A month ago only a small percentage of service centers were lowering resale prices (the red bars). Now it’s more than 42% of those responding to our latest survey. And none – let me repeat that, none – report raising prices (the green bars).

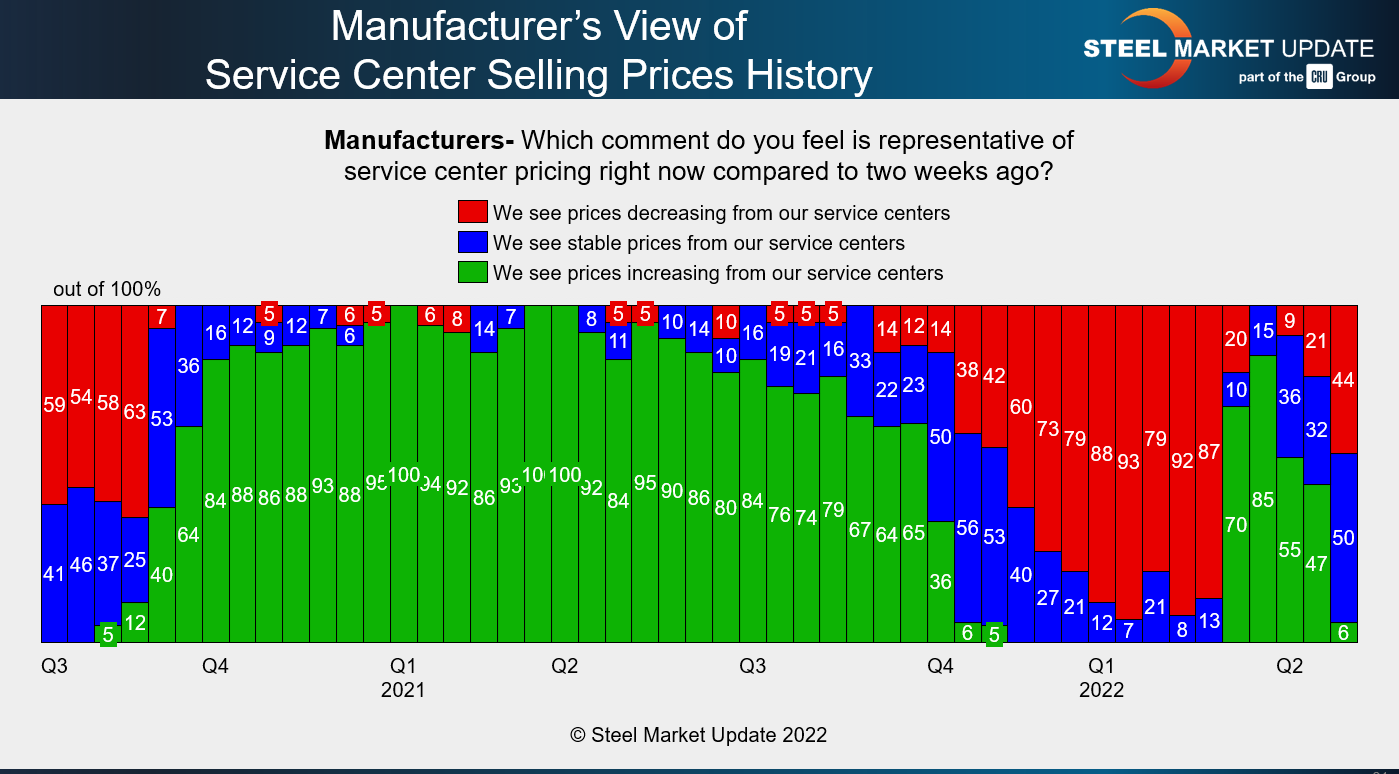

Now look at this one, which shows service center resale prices from a manufacturer’s perspective:

If you’ve been paying attention to our surveys, you know that manufacturers reported service centers lowering resale prices a couple of weeks before service centers themselves did. Maybe it was more in manufacturers interest to note lower prices and so they did so earlier? Whatever the case, neither reading is a good one if you want to see higher prices. (PSA: those charts are from our survey results, which you can find here.)

Combine lower resale prices with shorter lead mill times and mills being more willing to neogitate lower prices. What’s the question that comes to mind? For me, the questions again is how fast and how far prices will fall. In other words, we’re asking ourselves the same questions we were asking at the beginning of the year.

We learned in January and February that prices could fall fast, a lot faster than forecast. We didn’t establish quite how far they could fall. That depends on costs, and a lot is in flux now in large part because of the war in Ukraine. We’re working to answer that question for you. But if current trends hold, the market might provide an answer soon enough.

Let’s keep in mind that US prices aren’t necessarily a bad thing. From a mill perspective, it can make buyers think twice about buying imports. And lower tags can help make US manufacturers more competitive abroad. Yes, US prices are still the highest in the world, and by a lot. But if US prices continue to come down quickly, the advantage imports have over domestic material will also narrow fast.

That’s not much of a silver lining, especially given all the gloom and doom in steel (and in aluminum too). I’ve even heard some rumblings that this is the summer of 2008 (or the fall of 2014) all over again. I think a price correction is in the works. But I’m not in the extremely bearish camp that says an industry collapse is near.

And let’s not rule out the possibility of a bear trap. Because the herd mentality that tends to characterize the steel market rarely does anyone favors. I’ve seen that story I don’t know how many times in steel: Everyone gets spooked and moves to the sidelines. Then demand comes back or supply gets squeezed because of the next black swan, whether abroad (a pandemic or a war) or at home (a strike or a major unplanned outage). And then everyone is short inventory and scrambling for material, which sends prices rocketing back up.

Black swans are by definition nearly impossible predict, especially when it comes to timing. But I think a short squeeze is a lot more likely than a repeat of 2008.

Or, as one service center executive told me, “I don’t think people are buying quite as much because the price is starting to come down – so they are holding off whenever they can.”

That helps to explain lower prices and lower lead times at the mill level. And that’s not all bad because mill pricing was “too damn high” and so a correction was overdue, the service center executive said.

But he also added that he wasn’t concerned about demand. “For us, we’re still busy, we’re putting out as much volume as our structure allows.”

His concern, echoed by others, is less about steel prices than about availability of chips and other parts. And that is a harder puzzle to solve.

In the meantime, let’s hope that this remains the case: Steel price come down as the immediate panic of the war, and demand remains on stable footing.

And thanks from all of us at SMU for your business.

By Michael Cowden, Michael@SteelMarketUpdate.com