Prices

May 8, 2022

Final March Steel Imports High, April Licenses Weaker

Written by Brett Linton

Final US Department of Commerce data shows that steel imports in March rebounded 32% month-over-month to 3.09 million net tons, a 2+ year high. But April import licenses through May 4 are currently at 2.58 million tons, down 17% from March. (That said, April is still up 10% compared to February.)

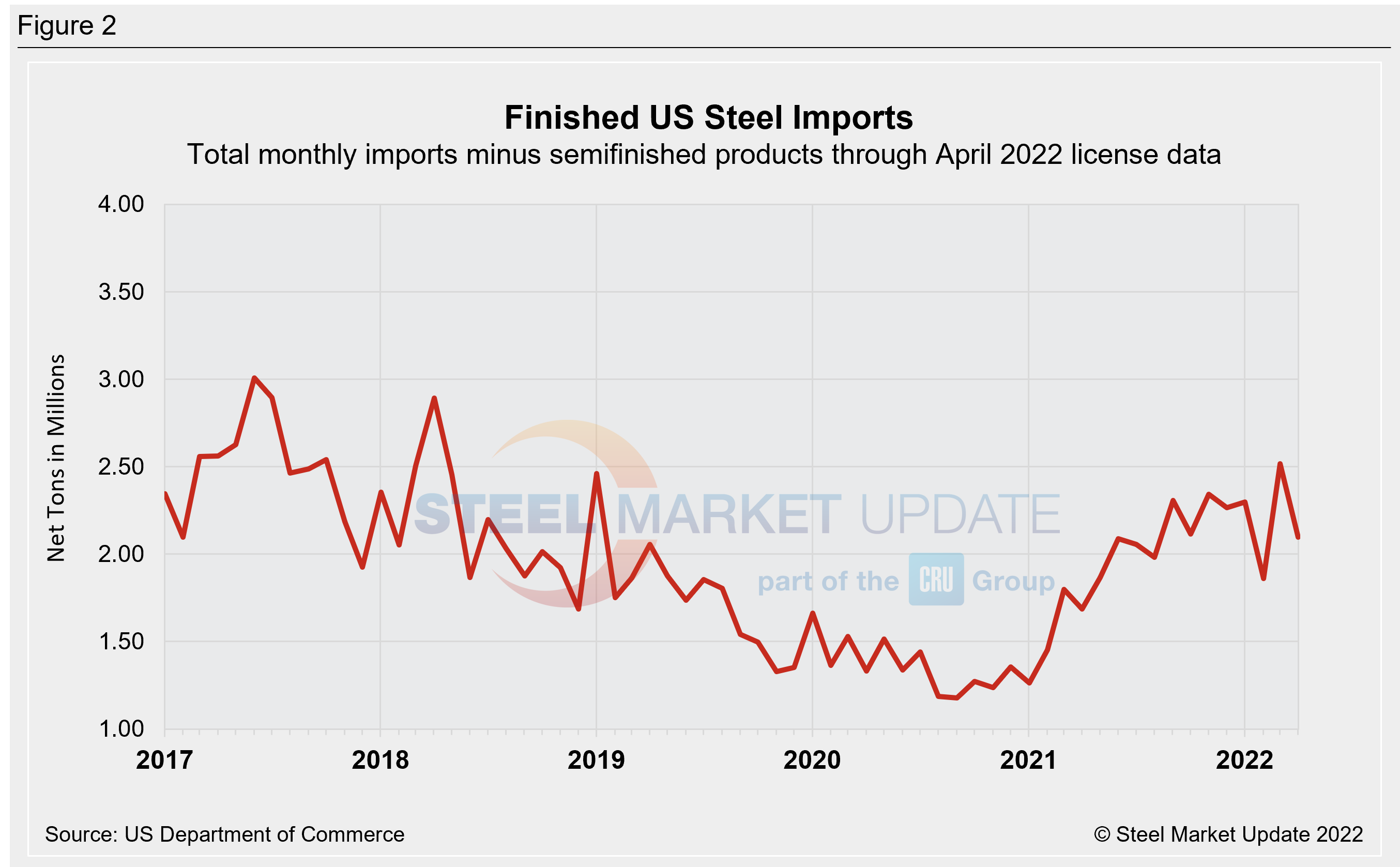

Final finished steel imports were 2.52 million tons in March, up 35% from the month prior and at the highest level seen since April 2018. License data shows April finished steel imports are down 17% over March to 2.10 million tons.

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three-month moving average (3MMA) basis in an attempt to more accurately display US steel import trends. The 3MMA through final March data is 2.83 million tons, up from February but still below January’s 42-month high. Import figures remain strong historically: 2021 averaged 2.63 million tons per month, 2020 averaged 1.84 million tons per month, 2019 averaged 2.32 million tons per month. Recall that the lowest 3MMA level in SMU’s recent history was October 2020, at 1.36 million tons. The latest April license data indicates that the 3MMA is down to 2.68 million tons, currently the lowest level seen since May 2021.

The table below displays flat rolled product imports as well as other high-volume products, including rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on imports divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

We have an interactive graphing tool available on our website here. Readers can explore historical import data, in total and by product. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com