Analysis

May 3, 2022

Final Thoughts

Written by Michael Cowden

Sheet and plate prices were flat or down modestly again this week. And it has become clearer and clearer that the market has gotten over the initial shock of the war in Ukraine.

Mill after mill lined up during earnings calls last month to say that they were no longer sourcing pig iron from Russia or Ukraine – and yet all were still producing. What seemed in March like an insurmountable obstacle was surmounted just weeks later.

In the meantime, more traditional concerns have crept back into the market. How much will scrap prices go down in May, and could that accelerate steel price declines? What will import volumes be this summer, and will domestic mills lower prices to compete with those foreign tons?

Broadly speaking, we’ve seen stable or lower prices for sheet and plate for most of April after a sharp run-up in March. Will prices correct downward this month as quickly as they shot higher following the outbreak of the war in Ukraine?

Perhaps. Most respondents to our survey this week said they expected stable or modestly lower prices in the weeks ahead. Some were more bearish:

“Stable … for the moment.”

“I would say stable. I believe that the published market numbers and mill offers overshot the actual mark 2 weeks ago. Few if any transactions at $1,500 HRC and $1,900 CRC/CTD. But there have been transactions in the current range.”

“Domestic mills are trying to hold onto the higher base pricing. But I am confident they will start taking lower priced offers.”

“Unless domestic steel demand increases significantly, the domestic mills will offer pricing competitive with imports.”

“I don’t think US steel price will stay high later this year. They are losing steam as we speak.”

While prices might be in flux, one thing hasn’t changed: deep frustration with continued port congestion, truck and labor shortages, and other supply chain issues. We asked “Are supply chain issues getting better or worse, and why?” While some respondents reported that situation on the trucking front was getting better, most said the situation was, if anything, getting worse.

Here are some of the responses we received:

“Worse, truck issues due to fuel prices and labor shortages.”

“Worse – not enough truckers.”

“They continue to plague all of our customers, competitors and vendors – very rarely is it actually steel related.”

“Staying terrible. Port congestion, high/limited inland freight and warehouse space.”

“Seems to be rinse and repeat. Same issues again and again. No real changes.”

“Not better. But randomly different.”

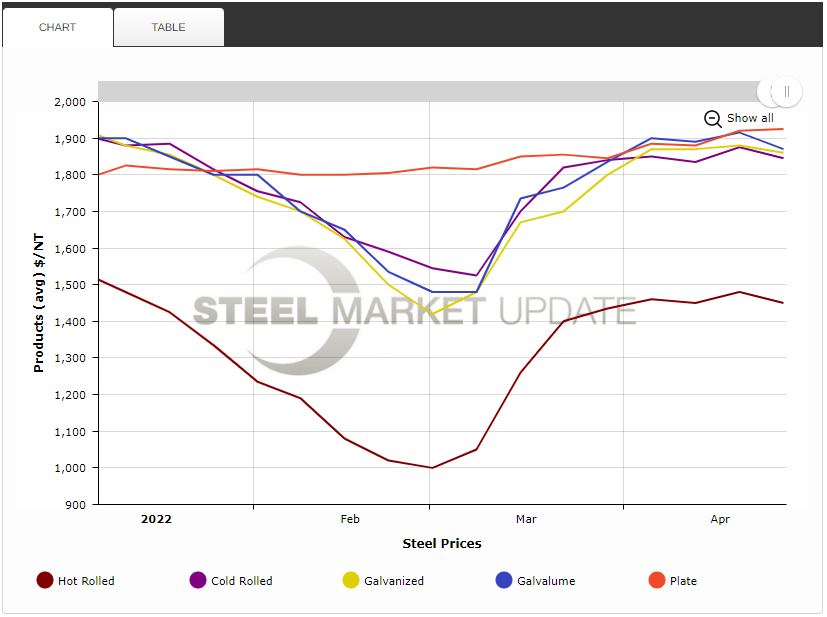

Words aside, here is what the last four months have looked like from a price perspective. You can recreate this using our interactive pricing too, which is here:

Sheet price trends make sense to me. They were falling at the beginning of the year, they reversed course on the war, and now they are slipping again.

I don’t know what to say about plate prices. Plate used to mostly follow coil, sometimes on a bit of a lag. But for a while now, plate tags have been disconnected from sheet and suspiciously stable at a high level.

I’ll leave the possible reasons for that to our readers to discern. Let’s just say I wish our increasingly volatile world could siphon off some much-needed stability from the price of domestic plate.

Steel Summit

The SMU Steel Summit Conference registrations list of companies is now available on the conference website. You can find that here. We have passed through 450 individual registrations and continue to be on pace for our goal of 1,200 attendees at this year’s event. The dates for the conference are Monday, August 22, through Wednesday, August 24. The conference will begin at 9 AM ET on Monday and conclude at 2:30 PM ET on Wednesday. The venue is the Georgia International Convention Center.

Please go to https://events.crugroup.com/smusteelsummit/home if you would like to learn more about the conference agenda, speakers, NexGen Leadership Award, costs to attend (and discounts for SMU member companies), and how to register.

Please note: Once you have registered you will receive a link that will take you to the registration page for the hotels that are part of the conference room block. These hotels are all located next to the Georgia International Convention Center in what’s known as the Gateway Center campus. Do not trust any email you receive from a non-SMU/CRU source about hotel blocks. They should not be trusted and DO NOT represent our conference.

By Michael Cowden, Michael@SteelMarketUpdate.com