Market Data

April 15, 2022

February Shipments and Supply of Steel Products

Written by David Schollaert

Total mill shipments of steel products fell for the second straight month in February to 7.655 million tons, a 6.1% decline from January’s 8.153 million tons. Apparent supply also fell in February, down 12.1% versus the prior month, falling repeatedly and unable to maintain the momentum seen during the final quarter of 2021.

This analysis is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and import-export data from the US Department of Commerce (DOC). The analysis summarizes total steel supply by product from 2008 through February 2022 and year-on-year changes.

The supply/demand differential continued to shift in January as supply topped demand, lowering shipments and pushing prices down further. Imports were also down 24.3% compared to January, as was domestic production during the period – down 7.0%. Exports provided some relief in February. They were up 4.2% over the same period.

Domestic mill utilization averaged 80.2% through February, down roughly 2% versus January’s total amid falling lead times. (Lead times at the time averaged just under four weeks.) Steel prices fell throughout the month because supply outpaced demand.

SMU’s benchmark hot-rolled coil price fell by more than $300 per net ton in February to an average of $1,131 per ton FOB mill, east of the Rockies. The downtrend for HRC gained momentum in February, and prices bottomed out around $900 per ton at the beginning of March.

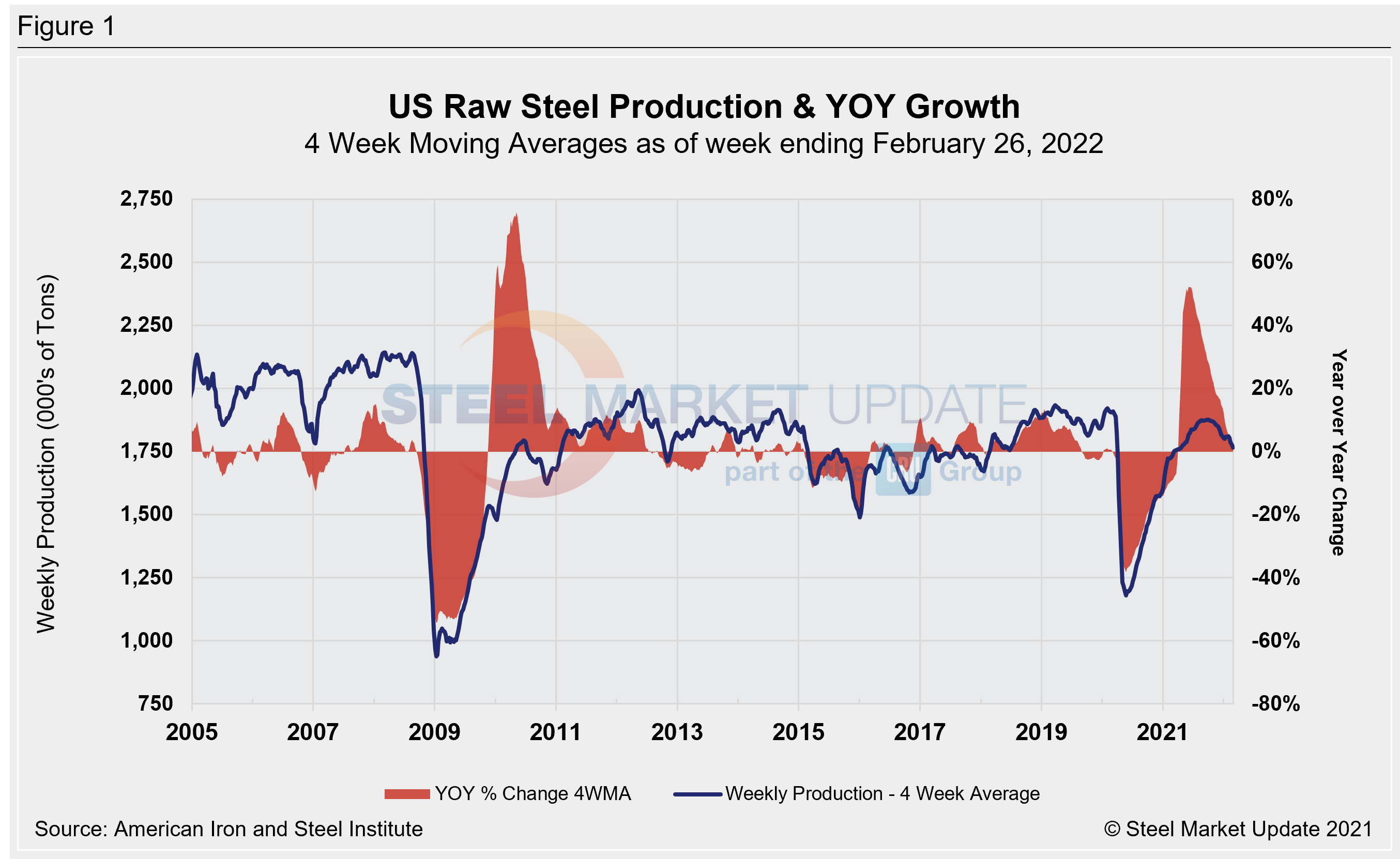

The war in Ukraine and the subsequent sanctions against Russian enterprises helped stop the fall and drive up prices. Prices, however, seem to be at an inflection point in mid-April, likely peaking at just over $1,450 per ton. Raw steel production shown below in Figure 1 is based on weekly data from the AISI displayed as four-week moving averages through Feb. 26, 2022.

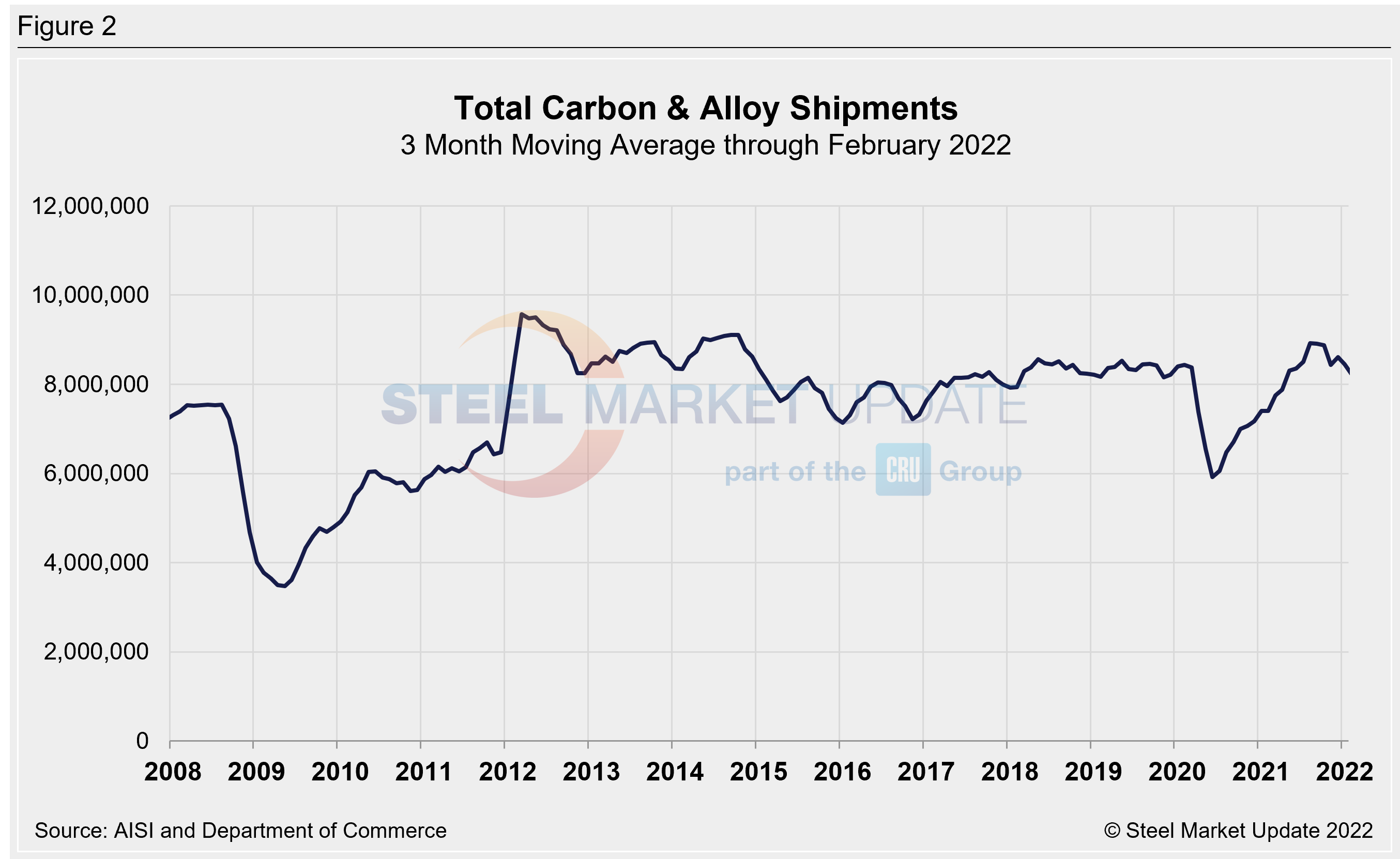

Monthly shipment data for all rolled steel products is noted in Figure 2. The trajectory of the rebound since Q2 2020 are comparable in Figures 1 and 2. Measured as a three-month moving average (3MMA) of the monthly data, February’s total was 8.219 million tons, down 2.7% versus 8.448 million tons in January. February also marked the fourth decline in five months. Despite the decrease, shipments were still up 11.0% in February versus to the year prior, when shipments were 7.404 million tons. The recovery from Covid-related shutdowns nearly two years ago was meaningful, but February’s shipments fell below the pre-pandemic period in 2020 by 2.6%.

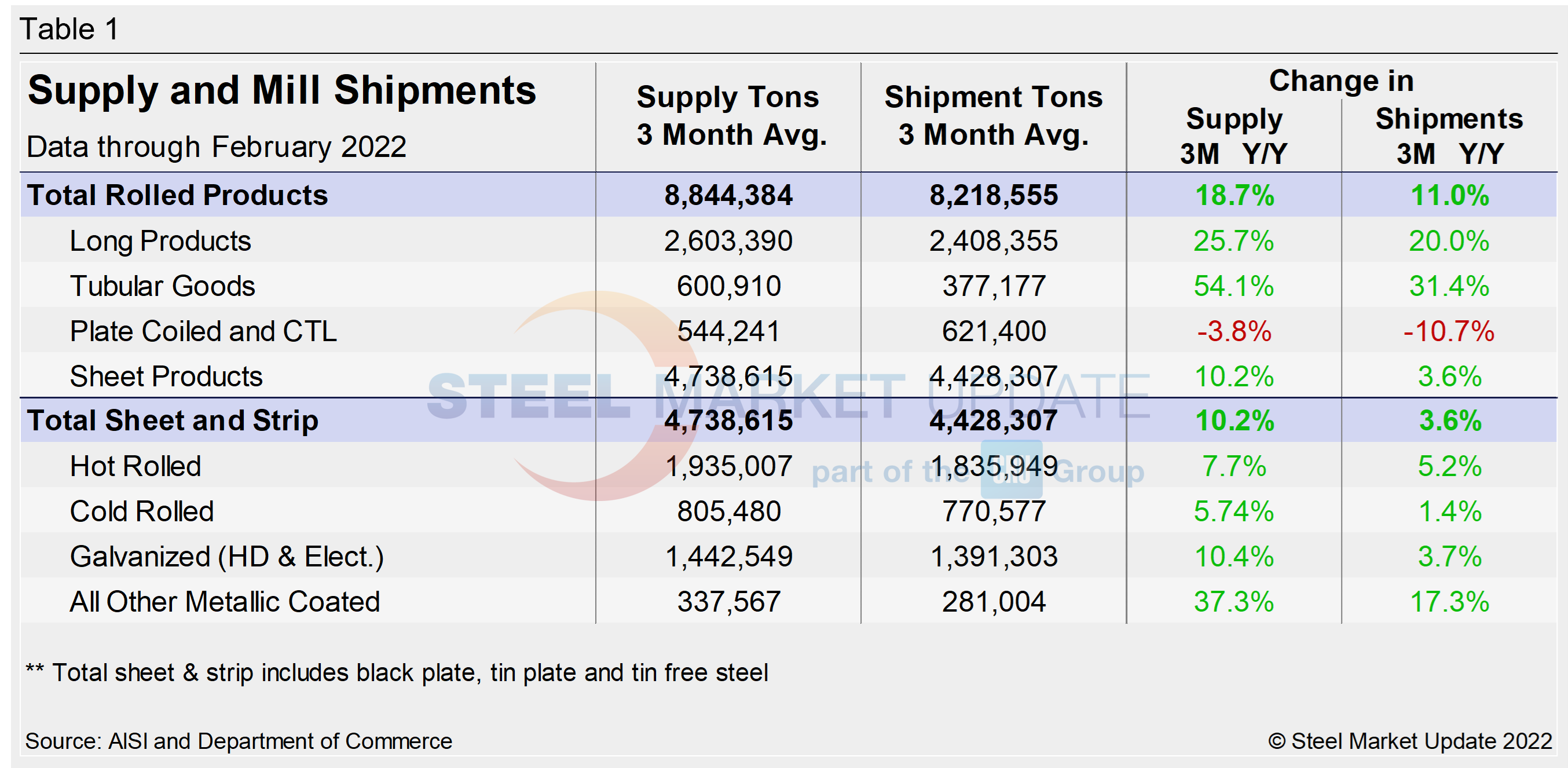

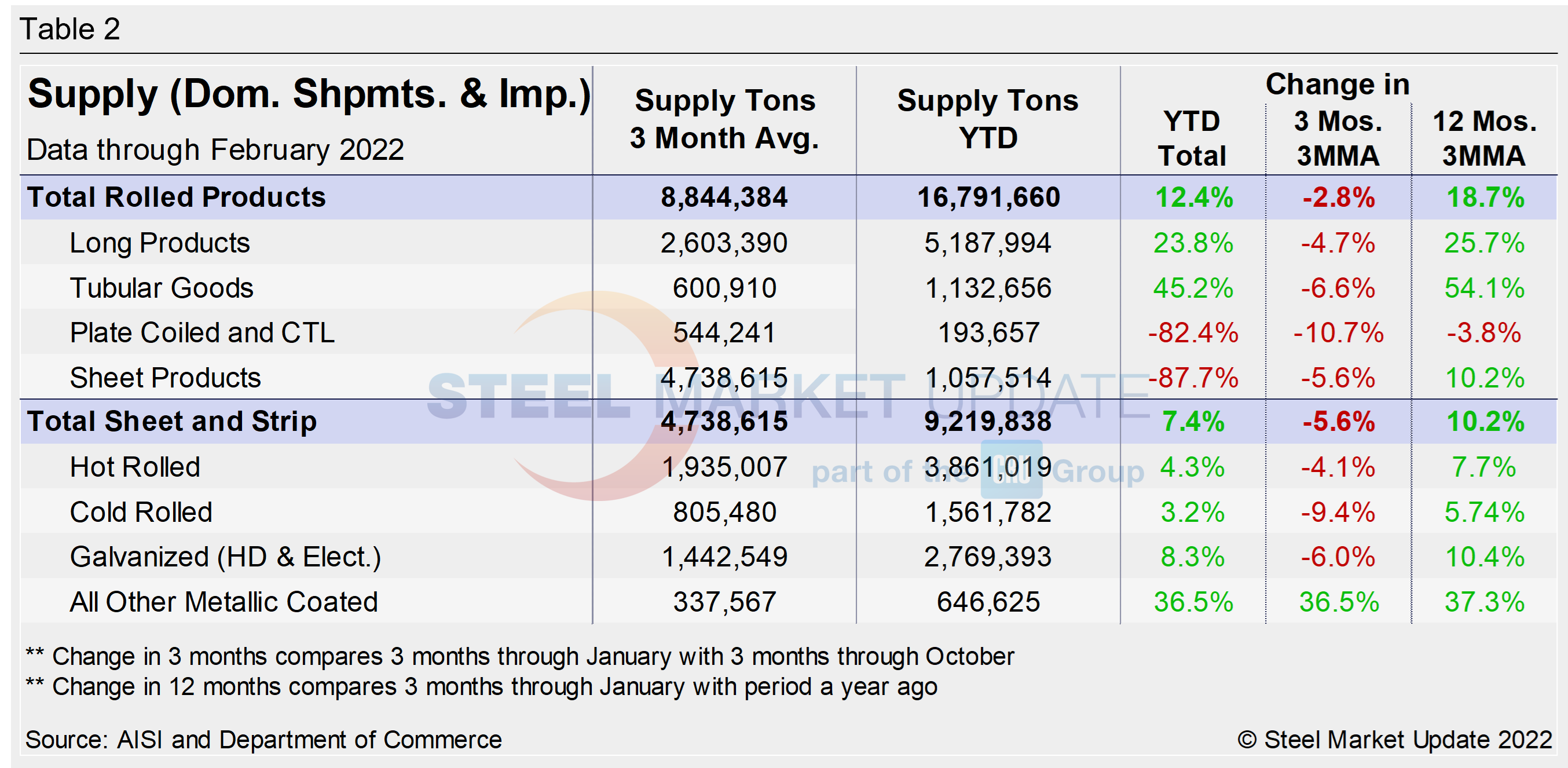

Shipment and supply details for all product groups and individual sheet products are noted in Table 1. Domestic supply (shipments and imports) is shown in Table 2. Total supply (a proxy for market demand) as a 3MMA was up year over year in February, a big turnaround from the 14.1% decline the year prior – when the market was still working its way out of disruptions in the early days of the pandemic.

Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Mill shipments were also up, a reversal from a decrease of 12.2% seen during the year-ago period in the same 3MMA comparison. The recovery has varied significantly among various products. But it should remain up due to steady domestic output, especially if foreign material continues to make its way onto US shores at current or similar rates.

Overall sheet product shipments and supply continued to increase through February, though at a slower pace. Sheet supply rose by 10.2% and shipments by 3.6% in February, a strong recovery from declines of 10% and 9.2% a year earlier. In the three months through February 2022, the average monthly supply of sheet and strip was 4.737 million tons, down from 4.957 million tons – or 4.4% below the prior month. The average monthly supply of total rolled product was down 4% to 8.844 million tons versus January’s 9.216 million tons. Total sheet and strip apparent supply is up year to date (Table 2) compared to 2021, but down 5.6% over the past three months. Total rolled product apparent supply is up also up over the same period year-ago period but trending down on a three-month moving average basis. Note that year-over-year comparisons have seasonality removed.

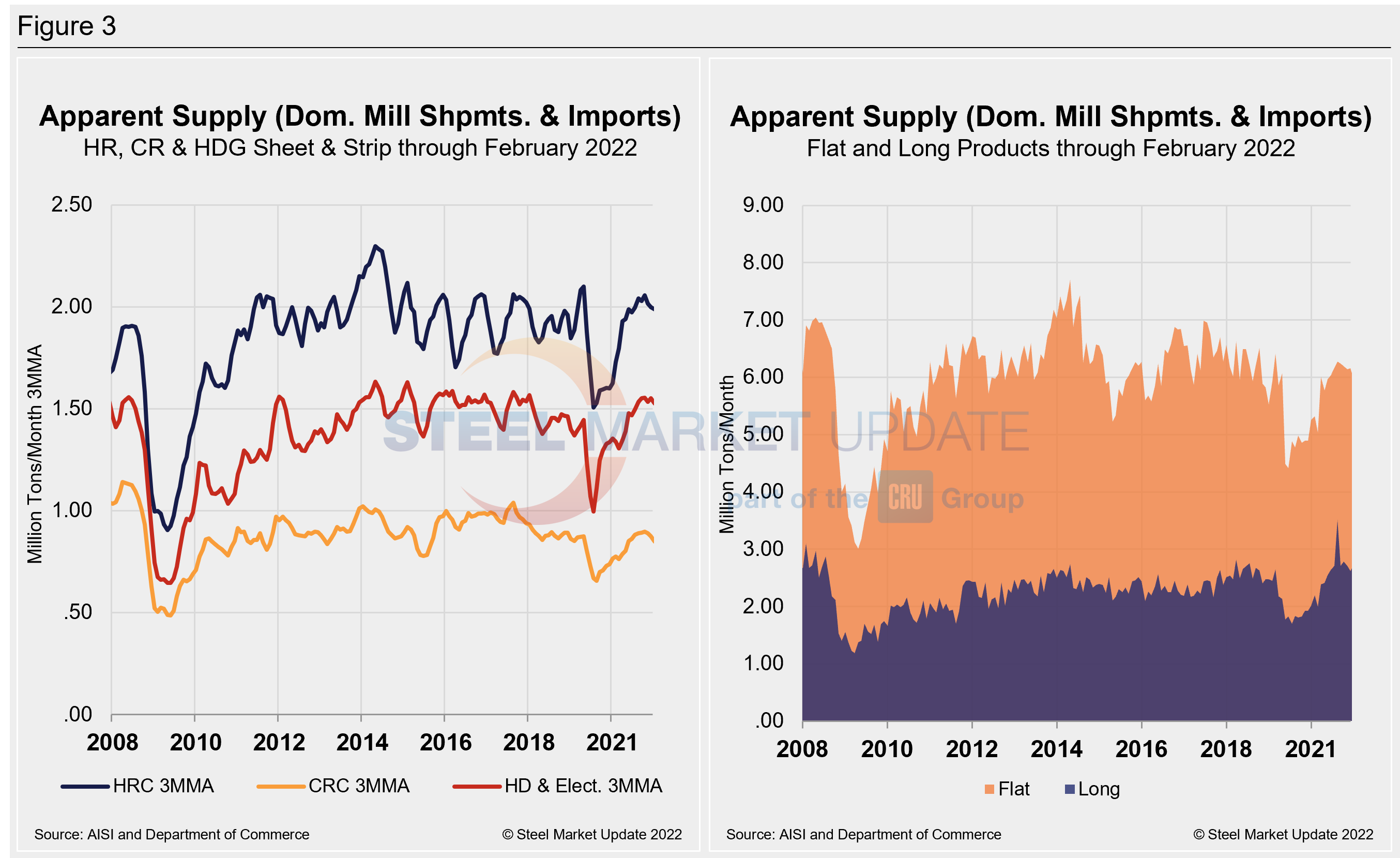

The supply picture for HRC, CRC and HDG since August 2008 as three-month moving averages versus the long-term comparison between flat and long products is shown side-by-side in Figure 3. On the left chart, all three sheet products are displayed. They have experienced some improvement since mid-2020 but are nonethless trending down. When compared to the same pre-pandemic period in 2020, only the supplies of galvanized (hot dipped and electrolytic) are presently higher at 1.8%. Hot rolled and cold rolled are down by 7.0% and 7.7%, respectively, from the same pre-pandemic period in 2020. In the right chart, note that these are monthly numbers (not 3MMAs), which show the trend difference between longs and flat products including plate.

By David Schollaert, David@SteelMarketUpdate.com