Market Data

April 14, 2022

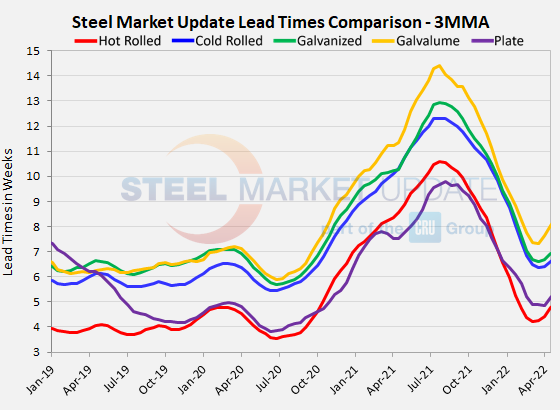

Are Steel Mill Lead Times Flattening Out?

Written by Brett Linton

Steel mill lead times appear to be steadying this week for four of the five sheet and plate products we track. They are also rising at a slower rate compared to the big gains seen in March. Steel Market Update’s latest check of the market indicates sheet lead times increased by an average of 0.2 weeks from late March, while plate lead times increased 1.2 weeks compared to two weeks prior.

Buyers surveyed this week reported mill lead times ranging from 4-8 weeks for hot rolled, 5-10 weeks for cold rolled and galvanized, 7-12 weeks for Galvalume, and 4-8 weeks for plate.

Hot rolled lead times increased by 0.2 weeks from late March to an average of 5.8 weeks at present. While gains have moderated, that is still the highest HRC lead time in four and a half months, according to our interactive pricing tool. Cold rolled lead times now average 7.6 weeks, rising half a week from our previous survey. Galvanized lead times rose 0.3 weeks to 8 weeks, territory not seen since December. The average Galvalume lead time fell by 0.3 weeks to 9.5 weeks. Mill lead times for plate are now at 7 weeks, up 1.2 weeks from SMU’s previous check of the market.

Almost half of the executives responding to this week’s questionnaire told SMU they thought lead times would remain stable. Most of the rest said lead times were extending. Just 9% responded that lead times would decline. Here’s what a few of them had to say:

“Lead times are moving out but not radically.”

“Both prices in the last week and lead times are slightly increasing; neither significantly.”

“The lead times are definitely extending, just not at the same pace as pricing. Important, as a leading indicator, that they continue to extend though.”

“Arguably they have already started to peel back from the initial run up, expect buyers to start to ease off on getting orders placed if they feel prices are peaking.”

“Mill lead times are short, but they are limiting spot offers to keep prices elevated.”

“Port congestions, lesser availability from imports, and stable demand will push lead times further.”

Looking at lead times on a three-month moving average can smooth out the variability in the biweekly readings. As a 3MMA, all products showed an increase this week, rising an average rate of 0.3 weeks over the last week of March. The current 3MMA for hot rolled is 4.8 weeks, cold rolled is 6.6 weeks, galvanized is 6.9 weeks, Galvalume is 8.0 weeks, and plate is 5.2 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com