Plate

April 12, 2022

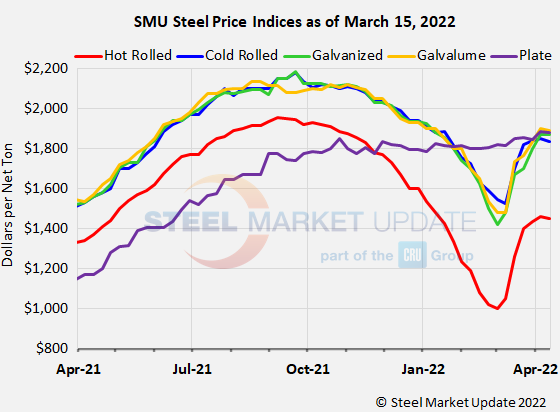

SMU Price Ranges & Indices: Sheet and Plate Run Out of Steam

Written by Brett Linton

Sheet prices were flat or fell modestly across this board this week for the first time since late February.

Case in point: SMU’s average hot-rolled coil price slipped to $1,450 per ton, down $10 per ton from last week. The decline, while negligible in absolute terms, marks the first time HRC prices have not risen since early March – when they shot upward on Russia’s invasion of Ukraine.

Market participants reported increasing resistance to mills trying to fetch $1,500 per ton for hot-rolled coil and $1,900 for cold-rolled and coated products. The reasons given were various: Some noted that US prices had stalled out because of lower prices in Asia and increasing concerns about weakness in Europe as well.

Others flagged scrap losing momentum and noted that US buyers had gotten over the initial shock of the war. And, unlike last year when prices shot up, buyers have enough inventory to buy only as needed instead of rushing to secure material at what could prove to be high prices.

With prices down or flat – our galvanized price, for example, was unchanged – SMU has shifted all our pricing momentum indicators to neutral. We will keep them there until the market establishes a clear upward or downward trajectory again.

Hot Rolled Coil: SMU price range is $1,380-$1,520 per net ton ($69.00-$76.00/cwt) with an average of $1,450 per ton ($72.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $10 per ton from last week. Our price momentum indicator on hot rolled steel now points to Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 5-7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday).

Cold Rolled Coil: SMU price range is $1,770-$1,900 per net ton ($88.50-$95.00/cwt) with an average of $1,835 per ton ($91.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $15 per ton from one week ago. Our price momentum indicator on cold rolled steel now points to Neutral until the market establishes a clear direction

Cold Rolled Lead Times: 6-10 weeks*

Galvanized Coil: SMU price range is $1,830-$1,910 per net ton ($91.50-$95.50/cwt) with an average of $1,870 per ton ($93.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end decreased $30 per ton. Our overall average is unchanged from last week. Our price momentum indicator on galvanized steel now points to Neutral until the market establishes a clear direction

Galvanized .060” G90 Benchmark: SMU price range is $1,927-$2,007 per ton with an average of $1,967 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-10 weeks*

Galvalume Coil: SMU price range is $1,830-$1,950 per net ton ($91.50-$97.50/cwt) with an average of $1,890 per ton ($94.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to last week, while the upper end decreased $50 per ton. Our overall average is down $10 per ton from one week ago. Our price momentum indicator on Galvalume steel now points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,121-$2,241 per ton with an average of $2,181 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks*

Plate: SMU price range is $1,850-$1,910 per net ton ($92.50-$95.50/cwt) with an average of $1,880 per ton ($94.00/cwt) FOB mill. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $5 per ton from last week. Our price momentum indicator on plate steel now points to Neutral until the market establishes a clear direction

Plate Lead Times: 4-8 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.