Prices

March 29, 2022

SMU Price Ranges & Indices: HRC Prices Gains Slow as Outlooks Diverge

Written by Brett Linton

Sheet prices continue to rise with new, higher offers from some domestic mills: as much as $1,500 per ton for hot-rolled coil and $1,900 per ton for cold-rolled and coated product.

Despite those higher pricing levels, gains on the hot-rolled side have moderated. SMU’s benchmark hot-rolled coil price now stands at $1,435 per ton ($71.75 per cwt), up $35 per ton from last week. That marks the lowest week-over-week increase of the month and breaks two consecutive weeks of triple-digit gains.

More modest increases for HRC were offset by big gains for coated products (up $70-100 per ton). Some sources fretted that US prices could peak and fall along with world prices. They cited a severe Covid-19 outbreak in China and the war in Ukraine potentially pushing Europe into recession. But others said they saw no signs of anything but higher prices in the short term on strong demand as well as continued increases in pig iron and scrap costs.

One the plate side, prices remained roughly stable as they have been for most of the year. Although some market participants said plate tags could move higher next month if certain producers enforce higher raw material surcharges.

Hot Rolled Coil: SMU price range is $1,370-$1,500 per net ton ($68.50-$75.00/cwt) with an average of $1,435 per ton ($71.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $50 per ton. Our overall average is up $35 per ton from last week. Our price momentum on hot rolled steel continues to point toward Higher prices over the next 30 days.

Hot Rolled Lead Times: 5-8 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday).

Cold Rolled Coil: SMU price range is $1,780-$1,900 per net ton ($89.00-$95.00/cwt) with an average of $1,840 per ton ($92.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel continues to point toward Higher prices over the next 30 days.

Cold Rolled Lead Times: 6-10 weeks*

Galvanized Coil: SMU price range is $1,700-$1,900 per net ton ($85.00-$95.00/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $100 per ton compared to one week ago. Our overall average is up $100 per ton from last week. Our price momentum on galvanized steel continues to point toward Higher prices over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,797-$1,997 per ton with an average of $1,897 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks*

Galvalume Coil: SMU price range is $1,750-$1,920 per net ton ($87.50-$96.00/cwt) with an average of $1,835 per ton ($91.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $90 per ton compared to last week, while the upper end increased $50 per ton. Our overall average is up $70 per ton from one week ago. Our price momentum on Galvalume steel continues to point toward Higher prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,041-$2,211 per ton with an average of $2,126 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-10 weeks*

Plate: SMU price range is $1,830-$1,860 per net ton ($91.50-$93.00/cwt) with an average of $1,845 per ton ($92.25/cwt) FOB mill. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $10 per ton from last week. Our price momentum on plate steel continues to point toward Higher prices over the next 30 days.

Plate Lead Times: 4-10 weeks*

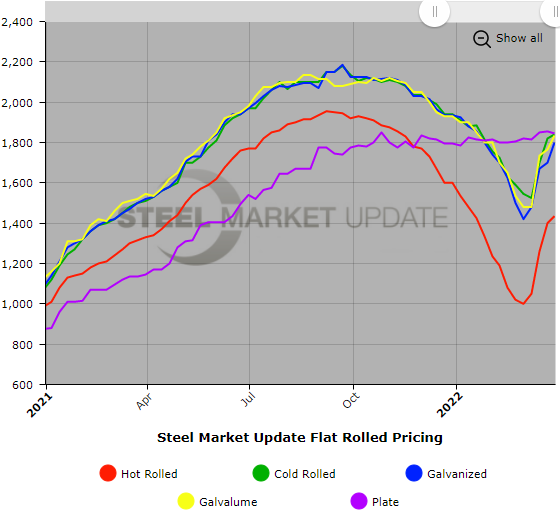

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.